Auto insurance comparison is crucial for securing the best coverage at the most affordable price. Navigating the complexities of insurance policies can be daunting, but understanding the key factors influencing premiums and leveraging online comparison tools can significantly simplify the process. This guide will equip you with the knowledge and strategies to effectively compare auto insurance options, ensuring you find a policy that perfectly suits your needs and budget.

We’ll explore how comparison websites function, delve into the factors that determine your premiums (like driving history and vehicle type), and dissect the different coverage options available. We’ll also provide practical tips for negotiating lower rates and spotting hidden fees, ultimately empowering you to make an informed decision. From understanding liability and collision coverage to leveraging technology to find the best deal, we’ll cover it all.

Understanding Auto Insurance Comparison Websites

Finding the best auto insurance can feel like navigating a maze. Luckily, comparison websites simplify the process by bringing multiple insurers together in one place. These sites offer a convenient way to compare quotes, features, and coverage options, helping you make an informed decision.

Typical Features of Auto Insurance Comparison Websites

Most major comparison websites share a core set of features designed to streamline the insurance shopping experience. These typically include a simple quote request form requiring basic information like your location, driving history, and the type of vehicle you own. After submitting this information, the site searches its database of partnered insurers and returns a list of tailored quotes.

Beyond quote generation, many sites provide detailed policy comparisons, allowing you to analyze coverage details, deductibles, and premiums side-by-side. Customer reviews and ratings can also be incorporated to provide further insight into insurer reputation and customer satisfaction. Some sites offer additional resources such as educational materials explaining insurance terminology and coverage options.

Comparison of User Interfaces Across Popular Websites, Auto insurance comparison

The user experience can significantly impact how effectively you use a comparison website. Let’s look at three popular examples: The Zebra, NerdWallet, and Policygenius. While all aim to simplify the process, their approaches differ in design and functionality.

| Website Name | Ease of Use | Number of Providers Listed | Additional Features |

|---|---|---|---|

| The Zebra | Generally intuitive and visually appealing, with clear navigation. | A wide range, often boasting hundreds of insurers. | Detailed policy comparisons, customer reviews, and educational resources. Strong emphasis on visual aids and interactive tools. |

| NerdWallet | Clean and straightforward design. Might require more careful reading of fine print compared to The Zebra. | A substantial number of providers, though perhaps slightly fewer than The Zebra. | Detailed articles and guides on various insurance topics, alongside the core comparison tools. Focus on financial literacy and broader personal finance advice. |

| Policygenius | User-friendly, but perhaps slightly less visually engaging than The Zebra. Strong focus on clear policy explanations. | A good selection of providers, with a possible emphasis on larger, more established insurers. | A strong emphasis on personalized advice and assistance from licensed agents. May offer more direct communication with insurers. |

Data Collection Methods Employed by Comparison Websites

These websites gather data in several ways to provide accurate quotes and comparisons. Firstly, they collect information directly from users through their quote request forms. This includes personal details, driving history, vehicle information, and desired coverage levels. Secondly, they maintain partnerships with numerous insurance providers, receiving real-time data on available policies and pricing. This data is typically transmitted through secure APIs (Application Programming Interfaces), ensuring data privacy and accuracy.

Finally, some sites supplement this data with publicly available information, such as insurer ratings and customer reviews, to offer a more comprehensive view of each provider. The exact methods and data points collected may vary between websites, so reviewing each site’s privacy policy is recommended.

Factors Influencing Auto Insurance Premiums

Getting the best auto insurance rate isn’t just about luck; it’s about understanding the factors that insurance companies consider. Your premium isn’t arbitrarily chosen; it’s a calculation based on your risk profile, as assessed by the insurer. This involves a complex interplay of various elements, some within your control and others not.

Driving History’s Impact on Premiums

Your driving record is a significant factor in determining your insurance premium. Insurance companies meticulously track your history, looking for any evidence of risky behavior. A clean driving record, meaning no accidents or traffic violations, will generally translate to lower premiums. Conversely, a history of accidents or violations, especially serious ones like DUIs, will significantly increase your premiums.

For example, an accident-free driver for five years might receive a significantly lower rate than someone with two at-fault accidents and multiple speeding tickets in the same period. The impact of a single at-fault accident can raise premiums by 20-40%, while multiple incidents can lead to even steeper increases or even policy cancellation.

Vehicle Type and Associated Risk

The type of vehicle you drive also plays a crucial role in determining your insurance premium. Certain vehicles are statistically more prone to accidents or theft, leading to higher insurance costs. Insurance companies categorize vehicles based on their safety features, repair costs, and theft rates.

- Sports Cars: Often associated with higher speeds and riskier driving, resulting in higher premiums due to increased accident potential and higher repair costs.

- Luxury Vehicles: Higher repair costs and greater likelihood of theft contribute to higher premiums. The replacement cost of parts is significantly higher compared to standard vehicles.

- SUVs and Trucks: Generally fall somewhere in the middle, with premiums varying depending on size and safety features. Larger vehicles can cause more damage in accidents, impacting premiums.

- Compact Cars: Often associated with lower premiums due to lower repair costs and generally lower accident severity.

Location’s Influence on Premiums

Your location significantly impacts your auto insurance premium. Insurance companies consider the crime rate, accident frequency, and the cost of repairs in your area. Areas with high rates of theft or accidents will generally have higher insurance premiums. For instance, someone living in a densely populated urban area with high traffic congestion and a higher crime rate might pay more than someone residing in a rural area with lower traffic and crime rates.

The cost of repairs also varies geographically; parts and labor are more expensive in some areas than others, directly affecting insurance costs.

Policy Coverage Options and Comparisons

Choosing the right auto insurance policy involves understanding the different coverage options available. This section will break down the key types of coverage – liability, collision, and comprehensive – explaining their differences and providing examples of when they’re most beneficial. Remember, the specific details and costs will vary depending on your location, driving history, and the insurer.Liability coverage protects you financially if you cause an accident that injures someone or damages their property.

It covers the medical bills and property repairs of the other party involved. Collision coverage, on the other hand, pays for damage toyour* vehicle, regardless of who caused the accident. Finally, comprehensive coverage protects your vehicle against damage from non-collision events, such as theft, vandalism, or weather-related incidents.

Liability Coverage Explained

Liability coverage is usually divided into bodily injury liability and property damage liability. Bodily injury liability covers medical expenses, lost wages, and pain and suffering for anyone injured in an accident you caused. Property damage liability covers repairs or replacement costs for the other person’s vehicle or property damaged in the accident. For example, if you rear-end another car causing $5,000 in damages and $10,000 in medical bills for the other driver, your liability coverage would pay for these costs, up to your policy limits.

Insufficient liability coverage could leave you personally responsible for the remaining costs.

Collision Coverage Explained

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. This means even if you caused the accident, or if the other driver was at fault but uninsured, your collision coverage will help cover the costs. For instance, if a deer runs into your car causing $3,000 in damage, your collision coverage will cover the repair costs (minus your deductible).

Without collision coverage, you’d be responsible for the entire repair bill.

Comprehensive Coverage Explained

Comprehensive coverage goes beyond accidents, protecting your vehicle against a wide range of non-collision events. This includes damage from fire, theft, vandalism, hail, floods, and even hitting an animal. Imagine your car is broken into and your stereo is stolen; comprehensive coverage would help cover the replacement cost. Similarly, if a tree falls on your car during a storm, comprehensive coverage would step in to help with the repairs.

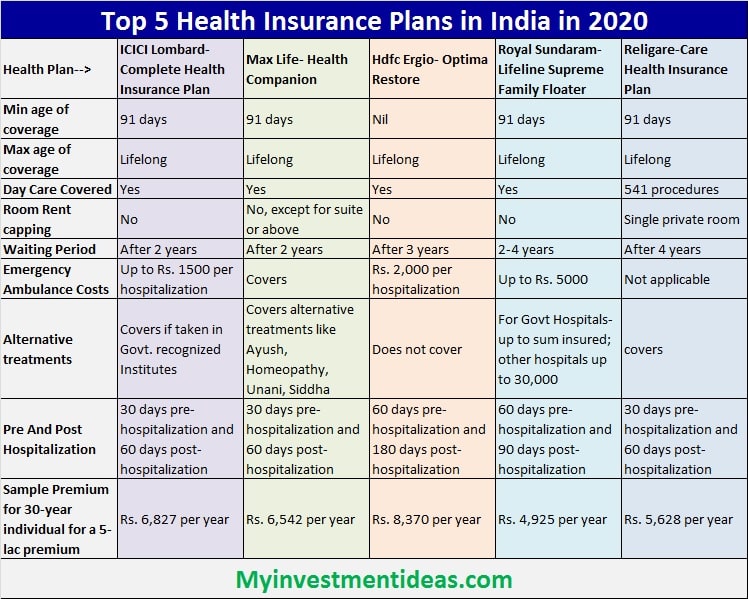

Comparative Table of Coverage Levels and Costs

This table provides a sample comparison. Actual costs will vary greatly depending on several factors, including your location, driving history, vehicle type, and the insurance company.

| Coverage Type | Coverage Level | Example Cost (Annual) | Description |

|---|---|---|---|

| Liability | 25/50/25 | $500 | $25,000 per person/$50,000 per accident bodily injury; $25,000 property damage |

| Liability | 100/300/100 | $750 | $100,000 per person/$300,000 per accident bodily injury; $100,000 property damage |

| Collision | $500 Deductible | $400 | Covers damage to your vehicle in an accident, after your deductible |

| Comprehensive | $500 Deductible | $300 | Covers damage to your vehicle from non-collision events, after your deductible |

Finding the Best Deal

Landing the best auto insurance deal involves more than just clicking through comparison websites. It requires a strategic approach, combining smart comparison techniques with effective negotiation strategies. Remember, the lowest quote isn’t always the best deal; you need to ensure the coverage adequately protects you.Finding the lowest premium often involves a bit of legwork and a willingness to negotiate.

Don’t be afraid to shop around and use the information you gather to leverage better deals from insurers. The key is to be informed and proactive.

Negotiating Lower Premiums

Effective negotiation starts with understanding your leverage. Armed with multiple competitive quotes, you can approach your current insurer or a new one with a stronger position. Highlight the lower premiums you’ve found elsewhere, emphasizing the comparable coverage. Be polite but firm, explaining your willingness to switch unless a comparable offer is presented. For example, if you’ve received a quote that’s $200 cheaper annually, mention this specifically.

Many insurers would rather retain a customer than lose them to a competitor. Remember to document all your interactions and offers received.

Tips for Effective Quote Comparison

Comparing insurance quotes effectively requires a systematic approach. Don’t just focus on the headline price; delve into the details.

- Compare Apples to Apples: Ensure all quotes are for the same coverage levels and deductibles. A lower premium with less coverage is a false economy.

- Check Deductibles: Higher deductibles generally mean lower premiums, but you need to be comfortable paying that amount out-of-pocket in case of an accident.

- Understand Coverage Limits: Pay close attention to liability limits, uninsured/underinsured motorist coverage, and comprehensive/collision coverage limits. Insufficient coverage can leave you financially exposed.

- Read the Fine Print: Carefully review the policy documents to understand exclusions and limitations. Some policies may have restrictions on certain types of vehicles or driving situations.

- Use Multiple Comparison Websites: Don’t rely on just one website. Different sites may partner with different insurers, offering you a broader range of choices.

Identifying Hidden Fees and Limitations

Hidden fees and policy limitations can significantly impact the true cost of your insurance. Scrutinize the policy documents for the following:

- Administrative Fees: Some insurers charge administrative fees for various services, which can add up over time.

- Policy Fees: Be aware of any fees associated with issuing or renewing your policy.

- Usage-Based Fees: Some insurers utilize telematics to monitor your driving habits. While this can sometimes lead to discounts, excessive monitoring fees might offset any savings.

- Geographic Restrictions: Certain policies may have limitations on where you can drive your vehicle.

- Coverage Exclusions: Carefully review what is

-not* covered by the policy. For instance, some policies may exclude coverage for specific types of damage or accidents.

Illustrative Examples of Policy Comparisons

Let’s look at some real-world examples to illustrate how auto insurance quotes can vary dramatically depending on individual circumstances. Understanding these differences is key to finding the best policy for your needs.

We’ll compare quotes for two fictional drivers with different profiles to highlight the factors influencing premium costs.

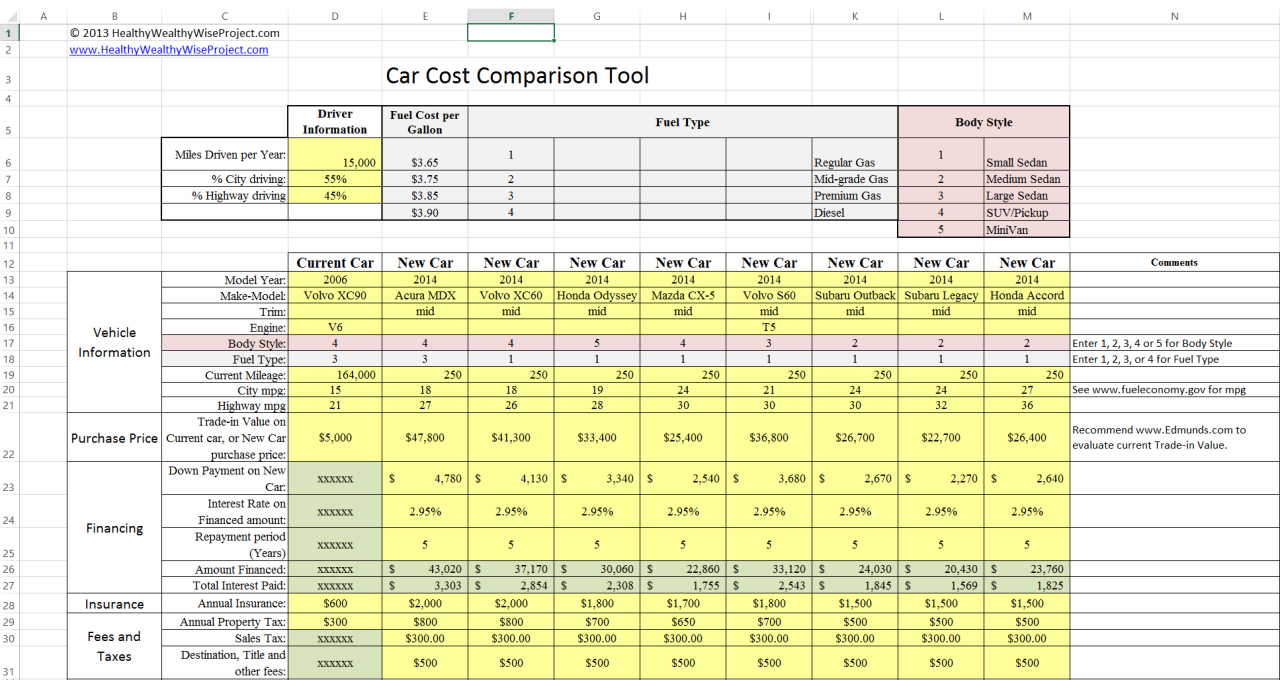

Fictional Driver Profiles and Quote Comparisons

Here’s a comparison of insurance quotes for two drivers, showcasing how different factors impact the final price.

| Driver | Age | Driving History | Vehicle | Annual Premium (Example Company A) | Annual Premium (Example Company B) |

|---|---|---|---|---|---|

| Sarah | 25 | Clean driving record, no accidents or tickets in the past 5 years | 2018 Honda Civic | $800 | $950 |

| John | 40 | One at-fault accident in the past 3 years, one speeding ticket | 2022 Ford F-150 | $1,500 | $1,800 |

As you can see, Sarah, with her clean driving record and smaller, less expensive vehicle, receives significantly lower premiums than John, who has a less favorable driving history and drives a larger, more expensive truck. Note that these are just example premiums and actual quotes will vary based on many factors and location.

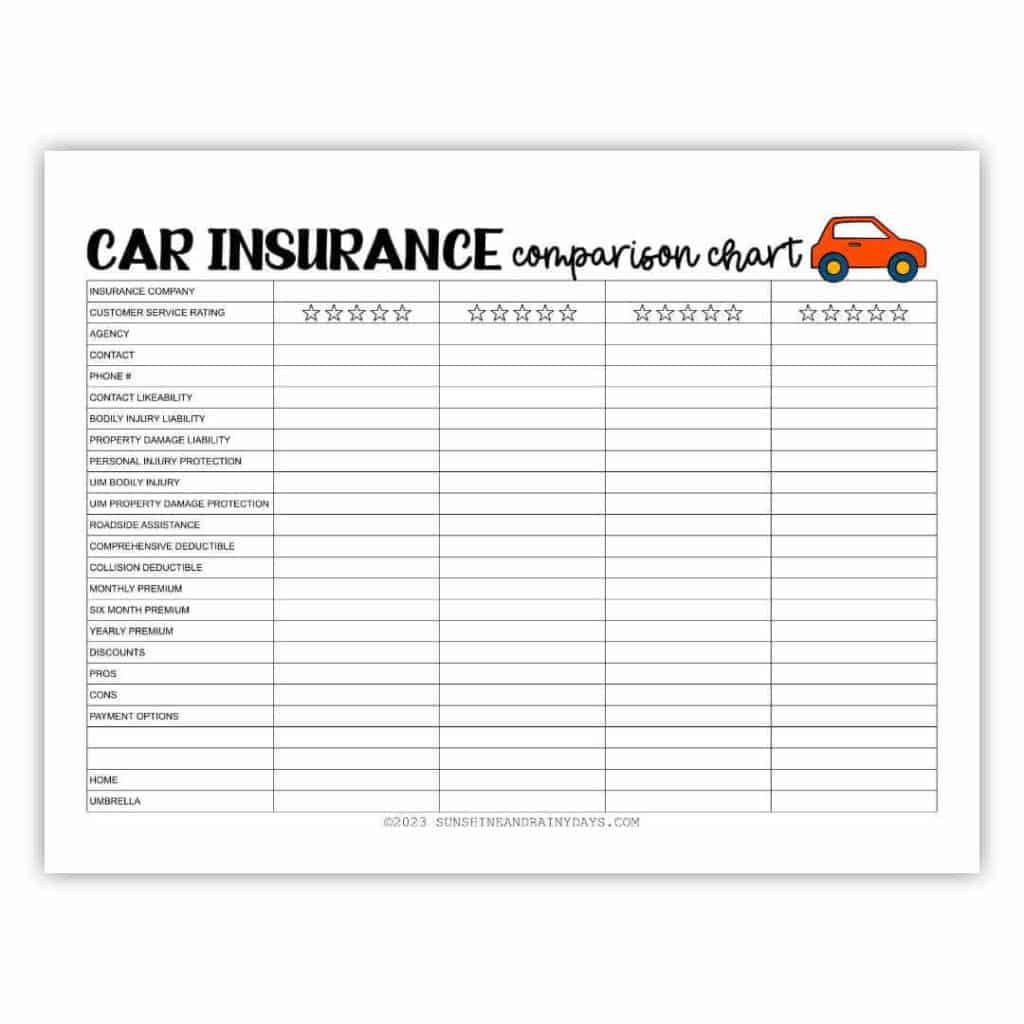

Ideal Comparison Chart Visual Elements

A clear and effective comparison chart is crucial for easy understanding. Visual elements play a vital role in this process.

An ideal chart would use a clean and uncluttered design. A simple color scheme, perhaps using two contrasting but easily distinguishable colors for each insurer, would improve readability. For example, Company A could be represented by a light blue, and Company B by a light green. Font sizes should be large enough to be easily read, with bold headings to highlight key information.

Data should be presented in a clear and concise manner, using tables with well-defined columns and rows. Consider using visual cues like bar graphs to visually represent the differences in premiums for a quick comparison. The use of clear labels and concise explanations alongside the data is also essential.

Importance of Reading the Fine Print

Before committing to any auto insurance policy, meticulously reviewing the fine print is paramount. This often-overlooked step can save you from unexpected costs and frustrations later on.

Pay close attention to details such as deductibles, coverage limits, exclusions, and any additional fees or surcharges. Understanding the specific terms and conditions of each policy will allow you to make an informed decision and choose the plan that best aligns with your needs and budget. Don’t hesitate to contact the insurance company directly if anything is unclear.

A little extra time spent on this crucial step can save you significant money and headaches down the road. Remember, the cheapest policy isn’t always the best if it lacks essential coverage.

The Role of Technology in Auto Insurance Comparisons

Technology has revolutionized how we compare auto insurance, moving from tedious manual searches to streamlined online platforms. This shift has significantly impacted both consumer experience and the insurance industry itself, introducing new efficiencies and challenges. The use of sophisticated algorithms and vast datasets allows for faster, more accurate, and personalized comparisons, ultimately benefiting consumers.AI and machine learning are increasingly important in the auto insurance industry, influencing everything from risk assessment to customer service.

These technologies analyze massive datasets to identify patterns and predict future outcomes, leading to more accurate pricing and personalized policy recommendations. This sophisticated analysis goes beyond simple demographic data, considering driving behavior, vehicle type, and even credit scores to build a more comprehensive risk profile.

AI and Machine Learning in Auto Insurance

AI and machine learning algorithms are used to analyze vast amounts of data to predict the likelihood of accidents and claims. This enables insurers to offer more accurate and competitive premiums, rewarding safe drivers with lower rates and adjusting premiums based on real-time risk factors. For example, telematics data from in-car devices can track driving habits, providing insurers with insights into braking patterns, speed, and mileage, all of which contribute to a more nuanced risk assessment.

This leads to more tailored pricing models, benefiting both insurers and consumers. Furthermore, AI-powered chatbots are being deployed to handle routine customer inquiries, freeing up human agents to focus on more complex issues.

Benefits and Drawbacks of Online Comparison Tools

Online comparison tools offer significant benefits, including convenience, speed, and access to a wide range of options. Consumers can quickly compare quotes from multiple insurers, saving time and effort. However, drawbacks exist. The information presented may not always be completely comprehensive, and some tools might prioritize insurers who pay them referral fees, potentially biasing the results. Furthermore, the complexity of insurance policies can make it difficult for consumers to fully understand the nuances of different coverage options through an online comparison alone.

Careful reading of the policy details remains crucial.

Customer Service Across Comparison Platforms

The level of customer service varies considerably among different comparison platforms. Some platforms offer extensive support through phone, email, and live chat, providing assistance with understanding quotes, selecting coverage, and filing claims. Others may rely primarily on automated systems, potentially leaving consumers feeling frustrated if they encounter difficulties. Platforms with robust customer service often invest in well-trained agents who can provide personalized guidance and address complex questions.

Conversely, platforms with limited support may leave consumers to navigate the process independently, which can be challenging for those unfamiliar with insurance terminology and processes. Therefore, researching the customer service capabilities of a platform before using it is highly recommended.

Wrap-Up

Finding the right auto insurance policy shouldn’t feel like navigating a minefield. By understanding the factors influencing premiums, utilizing online comparison tools effectively, and carefully reviewing policy details, you can confidently secure a policy that offers comprehensive protection without breaking the bank. Remember, taking the time to compare quotes and understand your coverage options is an investment in your financial well-being and peace of mind.

Armed with the right knowledge, you can confidently navigate the world of auto insurance and find the perfect fit for your needs.

Quick FAQs: Auto Insurance Comparison

How often should I compare auto insurance quotes?

At least annually, or whenever your circumstances change (new car, move, driving record changes).

What is uninsured/underinsured motorist coverage?

It protects you if you’re hit by an uninsured or underinsured driver. It covers your medical bills and vehicle damage.

Can I bundle my auto and homeowners insurance?

Yes, many insurers offer discounts for bundling policies, saving you money.

What is a deductible?

The amount you pay out-of-pocket before your insurance coverage kicks in.

What if I have a lapse in coverage?

This can significantly increase your premiums, making it harder to find affordable insurance.