Dental insurance plans are more than just a financial safety net; they’re a gateway to better oral health. Understanding the nuances of different plans—PPOs, HMOs, and EPOs—is crucial for making informed decisions about your dental care. This guide navigates the complexities of coverage, costs, and choosing the right plan to fit your specific needs and budget, ensuring you get the smile you deserve without breaking the bank.

We’ll explore the various types of plans, outlining their advantages and disadvantages to help you determine which best suits your lifestyle and dental requirements. From understanding coverage details and limitations to navigating the process of filing claims, we’ll demystify the world of dental insurance, empowering you to make confident choices.

Types of Dental Insurance Plans

Choosing the right dental insurance plan can feel overwhelming, but understanding the key differences between the main types will help you make an informed decision. This section will break down the three most common types: PPO, HMO, and EPO plans, highlighting their features, costs, and network access. This information should help you determine which plan best suits your needs and budget.

PPO, HMO, and EPO Dental Plan Differences, Dental insurance plans

PPO (Preferred Provider Organization), HMO (Health Maintenance Organization), and EPO (Exclusive Provider Organization) plans all offer coverage for dental care, but they differ significantly in how they structure that coverage and how you access it. Understanding these differences is crucial for selecting a plan that aligns with your dental needs and spending habits.

Dental Plan Comparison

Here’s a comparison table summarizing the key differences between PPO, HMO, and EPO dental plans:

| Plan Type | Coverage Details | Cost | Network Access |

|---|---|---|---|

| PPO | Offers the most flexibility. You can see any dentist, but you’ll pay less if you choose an in-network dentist. Coverage percentages vary depending on the dentist and services. | Generally higher premiums than HMOs, but potentially lower out-of-pocket costs if you stick to in-network providers. | Broad network of dentists; you can see out-of-network dentists, but at a higher cost. |

| HMO | Typically requires you to choose a primary care dentist (PCD) from the plan’s network. Referrals may be needed to see specialists. | Generally lower premiums than PPOs. | Limited to dentists within the plan’s network. Seeing out-of-network dentists is usually not covered. |

| EPO | Similar to HMOs in that you must use in-network dentists. Referrals might be needed for specialists. | Premiums are generally similar to HMOs. | Strictly limited to dentists within the plan’s network. Out-of-network care is not covered. |

PPO Plan Advantages and Disadvantages

PPO plans offer greater flexibility in choosing dentists. The advantage is the freedom to select a dentist you trust, even if they’re out-of-network, although at a higher cost. The disadvantage is that premiums tend to be higher than HMO or EPO plans.

HMO Plan Advantages and Disadvantages

HMO plans usually have lower premiums. The advantage is cost-effectiveness for those who are comfortable with a limited network of dentists. The disadvantage is the restricted choice of dentists and the potential need for referrals to specialists.

EPO Plan Advantages and Disadvantages

EPO plans combine aspects of both PPO and HMO plans. They offer lower premiums like HMOs but require in-network care, similar to HMOs. The advantage is a balance between cost and network access; the disadvantage is the lack of out-of-network coverage.

Situations Favoring Specific Plan Types

A PPO plan might be preferable for someone who values choice and has a preferred dentist outside a typical network, even if it means higher premiums. An HMO plan is ideal for budget-conscious individuals who are comfortable with a smaller network of dentists. An EPO plan might be a good compromise for someone seeking lower premiums but still needing access to in-network specialists.

For example, a family with a long-standing relationship with a specific dentist would likely benefit from a PPO plan, while a young, healthy individual on a tight budget might prefer an HMO plan.

Coverage Details and Limitations

Understanding what your dental insurance plan covers and doesn’t cover is crucial for managing dental expenses effectively. This section clarifies common aspects of dental insurance coverage, helping you navigate your plan’s specifics. Remember, policies vary, so always refer to your individual plan documents for the most accurate information.

Dental insurance plans typically cover a range of preventative, basic, and sometimes major dental services. However, there are almost always limitations and exclusions to be aware of. Knowing these beforehand can prevent unexpected costs.

Commonly Covered Dental Procedures

Most dental insurance plans include coverage for routine preventative care, designed to keep your teeth and gums healthy. This usually includes checkups, cleanings, and x-rays. Many plans also cover basic restorative procedures like fillings for cavities and extractions of damaged teeth. Some plans even extend to more extensive treatments, such as root canals, crowns, and bridges, though often with higher out-of-pocket costs or limitations on the number of procedures covered annually.

Common Exclusions and Limitations

While dental insurance provides valuable coverage, it’s important to understand what is typically

-not* covered. Cosmetic procedures, such as teeth whitening or veneers, are rarely included in standard plans. Orthodontic treatment (braces) often has significant limitations, with lengthy waiting periods and potentially high co-pays. Implants, while sometimes partially covered, usually require substantial out-of-pocket expenses. Pre-existing conditions, like extensive gum disease diagnosed before the policy started, may also have limited or no coverage.

Additionally, many plans have annual maximums, meaning a total amount they will pay out per year. Once that limit is reached, you’re responsible for all further costs.

Waiting Periods for Dental Services

Waiting periods are common in dental insurance plans, especially for major procedures. These periods, typically ranging from a few months to a year, prevent immediate use of coverage for expensive treatments after signing up. Preventative services like cleanings often have shorter or no waiting periods, while major restorative or orthodontic work usually has a longer waiting period. This is a standard practice to control costs and prevent immediate claims for extensive work.

Typical Coverage Percentages for Various Procedures

Coverage percentages vary widely between insurance providers and plans. However, the following is a general guideline illustrating typical coverage levels for different procedures. These percentages represent the portion the insurance company pays, with the remaining percentage being your responsibility (copay, coinsurance, or deductible).

- Cleanings and X-rays: 80-100%

- Fillings: 70-80%

- Extractions: 70-80%

- Root Canals: 50-70%

- Crowns: 50-70%

- Orthodontics: 50% (often with annual maximums)

Note: These are average percentages and can vary significantly. Always check your specific plan’s details for accurate coverage information.

Cost and Premiums

Understanding the cost of dental insurance is crucial for making informed decisions. Premiums vary widely depending on several factors, and it’s important to weigh the monthly cost against the potential savings on dental procedures. This section will break down the cost aspects of dental insurance plans, providing a clearer picture of what to expect.

Average Monthly Premiums by Age Group

Dental insurance premiums are often influenced by age. Younger individuals generally pay less due to lower statistical risk of needing extensive dental work. However, this is a generalization, and specific rates depend heavily on the insurer, plan type, and location. For illustrative purposes, let’s consider a hypothetical scenario: A 25-year-old might pay an average of $30-$50 per month for a basic plan, while a 55-year-old could pay $70-$120 for a similar plan, reflecting the increased likelihood of needing more extensive care.

These are rough estimates; actual premiums will vary significantly.

Cost-Effectiveness of Dental Insurance Over Time

Let’s imagine Sarah, a 30-year-old, needs a crown. Without insurance, this procedure could cost $1,000-$1,500. With a dental plan, her out-of-pocket expense might be significantly less, perhaps only her copay and deductible. Over five years, if Sarah requires routine cleanings and fillings, her total cost without insurance could easily exceed $2,000. With insurance, however, her premiums and out-of-pocket costs combined could be substantially lower, making the insurance a cost-effective choice.

This scenario highlights the long-term value of preventative care coverage provided by many dental plans.

Annual Out-of-Pocket Maximums

The annual out-of-pocket maximum represents the most you’ll pay for covered services in a year. Once this limit is reached, the insurance typically covers 100% of covered expenses for the remainder of the year. This is a critical factor in choosing a plan.

| Plan Name | Annual Out-of-Pocket Maximum |

|---|---|

| Plan A (Basic) | $1,000 |

| Plan B (Standard) | $1,500 |

| Plan C (Premium) | $2,500 |

Note: These are hypothetical examples. Actual out-of-pocket maximums vary widely.

Factors Influencing Premium Costs

Several factors influence the cost of dental insurance premiums. These include the individual’s age, location, the type of plan chosen (basic, standard, premium), the insurer, and the specific benefits included in the plan. For instance, plans with comprehensive coverage, including orthodontics, typically carry higher premiums than basic plans offering only preventative care. Geographic location also plays a role, as costs of dental services and administrative expenses vary across regions.

The insurer’s own risk assessment and administrative costs also contribute to the final premium.

Finding and Choosing a Plan

Picking the right dental insurance plan can feel overwhelming, but a systematic approach makes the process manageable. This section Artikels steps to effectively research and compare plans, ensuring you find one that best suits your individual needs and budget.Choosing a dental insurance plan is a personal decision heavily influenced by your specific dental health requirements and financial situation. Factors like the frequency of your dental visits, the type of dental care you anticipate needing, and your overall budget all play a crucial role in determining the most suitable plan.

Researching and Comparing Dental Insurance Plans

A methodical approach is key to finding the best dental insurance plan. Start by identifying dental insurance providers in your area or those offering nationwide coverage. Then, obtain detailed information on each plan’s coverage, including specifics on preventative care, basic treatments, and major procedures. Compare the annual maximum benefit, waiting periods, and any exclusions. Use online comparison tools or contact providers directly to get quotes.

Pay close attention to the details of each plan’s coverage, as these can vary significantly. For example, one plan might cover 80% of cleanings, while another covers only 50%.

Considering Individual Dental Needs

Your personal dental history and anticipated future needs are critical factors. If you have existing dental issues requiring extensive treatment, you’ll need a plan with a high annual maximum benefit and comprehensive coverage. Conversely, if you generally maintain excellent oral hygiene and only require routine checkups, a plan with a lower annual maximum might suffice. Consider any pre-existing conditions that might affect your choice.

For instance, if you have extensive restorative work already planned, a plan with shorter waiting periods for major procedures would be advantageous. If you anticipate needing orthodontics, look for plans that include orthodontic coverage, keeping in mind that this often comes with separate waiting periods and limitations.

Understanding the Terms and Conditions of a Dental Insurance Policy

Before committing to a plan, meticulously review the policy’s terms and conditions. Pay particular attention to the following: the annual maximum benefit (the total amount the plan will pay out each year), the deductible (the amount you pay out-of-pocket before the insurance coverage kicks in), co-insurance (your share of the costs after meeting your deductible), and waiting periods (the time you must wait before certain services are covered).

Look for any exclusions, which are services or procedures not covered by the plan. Understanding these terms will help you accurately assess the plan’s true cost and value. For example, a plan with a low premium might have a high deductible and limited annual maximum, making it less cost-effective in the long run if you require significant dental care.

Resources for Finding Affordable Dental Insurance Options

Several resources can assist in locating affordable dental insurance options. Your employer may offer group dental insurance plans, often at lower premiums than individual plans. Check with your state’s insurance marketplace or a licensed insurance broker for a range of available plans and compare their costs and benefits. Some non-profit organizations also offer dental insurance programs for low-income individuals and families.

Online comparison websites can be helpful tools to browse and compare plans from various providers. Finally, consider community dental clinics, which may offer affordable or sliding-scale dental care, even without insurance. Remember that even with insurance, budgeting for your out-of-pocket expenses (deductibles, co-pays, and any uncovered services) is crucial.

Dental Insurance and Specific Needs

Choosing a dental insurance plan often requires considering individual circumstances beyond basic coverage. Factors like orthodontic needs, pre-existing conditions, and the age of family members significantly impact the suitability of a particular plan. Understanding these nuances is crucial for making an informed decision.

Orthodontic Treatment Coverage

Orthodontic coverage varies greatly between dental insurance plans. Some plans offer comprehensive coverage for braces and other orthodontic treatments, often with a maximum lifetime benefit. This maximum benefit might be a fixed dollar amount or a percentage of the total cost. Other plans may offer limited coverage, requiring substantial out-of-pocket expenses. For example, a plan might cover 50% of the cost of braces up to $1,500, meaning a $3,000 treatment would leave the patient with a $1,500 bill.

It’s vital to carefully review the plan’s specific details regarding orthodontic coverage, including waiting periods (the time you must wait before coverage begins), and the types of orthodontic treatments covered. Some plans might exclude certain procedures, such as Invisalign.

Dental Insurance Coverage for Pre-existing Conditions

Pre-existing dental conditions, like cavities or gum disease, are often handled differently depending on the insurance plan. Some plans might have waiting periods before they’ll cover treatment for pre-existing conditions. Others might exclude coverage entirely for specific pre-existing conditions. For example, a plan might not cover root canal treatment for a tooth with a pre-existing cavity if that cavity was present before the policy’s effective date.

It is crucial to disclose any pre-existing conditions during the application process to avoid unexpected costs and denial of claims. Reviewing the plan’s policy document regarding pre-existing conditions is essential.

Dental Insurance Coverage Differences: Children vs. Adults

Children’s dental plans often differ from adult plans in terms of coverage and benefits. Pediatric dental plans typically focus on preventative care, such as regular checkups and cleanings, and often include coverage for sealants and fluoride treatments, crucial for children’s developing teeth. Adult plans may emphasize restorative care, such as fillings and crowns, more heavily. Some plans offer broader coverage for orthodontics for children than for adults.

The cost of children’s dental plans is also typically lower than adult plans due to their lower risk profile. Families should consider the specific needs of each family member when choosing a plan.

Determining if a Plan Meets Family Needs

Choosing a dental insurance plan for a family requires careful consideration of several factors. First, assess the dental needs of each family member. Do any family members require orthodontic treatment, or have pre-existing conditions? Next, compare the coverage provided by different plans. Consider the annual maximum benefit, the co-pay amounts, and the percentage of costs covered for various procedures.

Finally, calculate the total cost of the plan, including premiums and expected out-of-pocket expenses. A family with several children needing extensive dental work may find a plan with a higher premium but comprehensive coverage more cost-effective in the long run compared to a low-premium plan with limited benefits. Creating a budget and projecting potential dental expenses will help in making an informed decision.

Maintaining Dental Insurance Coverage

Keeping your dental insurance active and maximizing its benefits requires understanding the claims process, the importance of preventative care, and how to avoid common pitfalls. This section will equip you with the knowledge to navigate your dental insurance effectively and ensure you receive the most value from your plan.

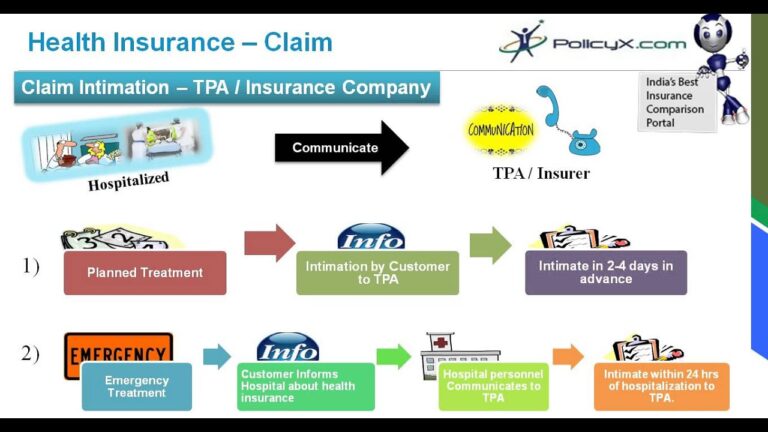

Filing a Dental Insurance Claim

Submitting a claim involves several steps. First, you’ll need to receive treatment from a dentist within your plan’s network, if applicable. Your dentist will then complete a claim form, detailing the services rendered and their associated costs. This form, often electronic, is sent to your insurance provider. You may also need to submit a copy of the explanation of benefits (EOB) from your dentist.

The insurance company will process the claim, reviewing the covered services and applying your plan’s coverage percentages. You’ll then receive a payment directly from the insurance company, or your dentist will adjust the balance based on the reimbursement. Remember to keep copies of all claim forms and correspondence for your records.

Preventative Dental Care and Coverage

Preventative dental care, such as regular checkups and cleanings, is crucial for maintaining good oral health and, often, maintaining your dental insurance coverage. Many plans offer significant coverage, sometimes even fully covering these preventative services. This is because preventative care is far less expensive than treating significant dental problems later. For example, a simple cavity filling is far cheaper than a root canal or crown.

By investing in preventative care, you are not only protecting your teeth but also maximizing your insurance benefits and avoiding potentially costly treatments down the line. Regular checkups allow dentists to identify and address minor issues before they escalate into major, and more expensive, problems.

Avoiding Common Dental Insurance Mistakes

Several common mistakes can jeopardize your coverage or lead to unexpected out-of-pocket costs. Failing to use in-network dentists, if your plan requires it, is a significant one. In-network dentists have pre-negotiated rates with your insurance company, ensuring lower costs for you. Another common mistake is neglecting to understand your policy’s limitations and coverage percentages. Carefully review your policy document to understand what is and isn’t covered, including deductibles, annual maximums, and waiting periods.

Finally, always keep thorough records of your dental visits, claims, and payments. This documentation is invaluable if you ever encounter a billing discrepancy or need to appeal a claim decision.

Frequently Asked Questions About Dental Insurance Maintenance

Understanding your policy is paramount to successful dental insurance maintenance. Here are answers to common questions:

- What happens if I change dentists? If you switch dentists, you’ll need to inform your new dentist of your insurance information and ensure they’re in-network if required. You may need to provide updated information to your insurance provider as well.

- How do I appeal a claim denial? Your insurance policy will Artikel the appeals process. Typically, this involves submitting a written appeal with supporting documentation, such as medical records, within a specified timeframe.

- What if my insurance changes? Notify your dentist of any changes to your insurance coverage immediately. This ensures smooth billing and prevents unexpected costs. You might need to update your information with your new provider as well.

- Can I use my dental insurance for cosmetic procedures? Most dental insurance plans don’t cover cosmetic procedures like teeth whitening. However, check your specific policy for details.

Illustrative Example: A Family’s Dental Insurance Needs

The Miller family—John, Mary, and their two children, 8-year-old Lily and 15-year-old Tom—needed dental insurance. John, a self-employed contractor, was concerned about the rising costs of dental care and wanted a plan that offered comprehensive coverage for his family. Mary, a teacher, had employer-sponsored insurance, but it didn’t cover the whole family. They researched different dental insurance plans to find the best fit for their needs and budget.They considered several factors.

Lily needed regular checkups and preventative care, while Tom was entering a phase requiring more orthodontic attention. John and Mary both needed routine cleanings and potential fillings. They also looked at the waiting periods for major procedures, the annual maximum payout, and the network of dentists available within their area. They compared plans from several providers, focusing on the balance between premium costs and the extent of coverage.

Plan Selection Process and Cost Implications

The Millers initially considered a basic plan with a low monthly premium. However, they quickly realized that this plan’s limited coverage would likely leave them with substantial out-of-pocket expenses for Tom’s potential orthodontic treatment. A more comprehensive plan, while having a higher monthly premium, offered significantly better coverage for major procedures like orthodontics and offered lower co-pays for routine care.

They also found that a family plan offered better value than purchasing individual plans for each member. After careful comparison of several plans, they chose a mid-range plan that balanced cost and coverage adequately. This plan offered comprehensive coverage for preventative care, routine cleanings, and basic procedures, with a reasonable co-pay for more complex treatments like fillings or root canals.

Orthodontic coverage was also included, though with a longer waiting period.

Visual Representation of Dental Expenses

Imagine two bar graphs side-by-side. The left graph represents their dental expenses without insurance. The bars show significant costs for Tom’s orthodontic treatment, which reached approximately $5,000 over the year, along with costs for routine cleanings and fillings for the entire family, totaling another $2,000. This resulted in a total annual dental expense of approximately $7,000. The right graph, representing expenses with insurance, shows considerably shorter bars.

The orthodontic treatment cost is reduced to about $2,000 after co-pays and reimbursements. The cost of routine care is also significantly reduced to around $500 due to co-pays and preventative care coverage. The total annual dental expense with insurance is approximately $2,500, representing a savings of $4,500 compared to the uninsured scenario. This demonstrates the substantial financial benefit of having dental insurance.

Summary: Dental Insurance Plans

Choosing the right dental insurance plan can feel overwhelming, but armed with the right information, the process becomes significantly easier. Remember to carefully consider your individual dental needs, compare plans thoroughly, and understand the terms and conditions before making a commitment. By taking a proactive approach and understanding your options, you can secure affordable, comprehensive dental care that protects your oral health for years to come.

A healthy smile is an investment in your overall well-being, and choosing the right dental insurance plan is the first step towards achieving it.

Essential FAQs

What’s the difference between a deductible and a copay?

A deductible is the amount you pay out-of-pocket before your insurance begins to cover expenses. A copay is a fixed amount you pay each time you visit the dentist, even after meeting your deductible.

Can I change my dental insurance plan during the year?

It depends on your plan and your employer’s policy. Some plans allow changes during open enrollment periods, while others have stricter rules. Check your policy details or contact your insurance provider.

What happens if I need a procedure not covered by my plan?

You’ll be responsible for the full cost of the procedure. It’s a good idea to check your plan’s coverage details before undergoing any major dental work.

How do I file a claim with my dental insurance provider?

The process varies by provider, but generally involves submitting a claim form with supporting documentation from your dentist. Your insurance provider’s website or member handbook will Artikel the specific steps.

What if I lose my dental insurance coverage?

You might be able to find coverage through the marketplace, your state’s dental association, or community health clinics. Investigate options quickly to avoid gaps in coverage.