Insurance agency management software is revolutionizing how insurance agencies operate. No longer are agents bogged down in paperwork and manual processes; instead, they’re empowered to focus on what truly matters: building client relationships and growing their business. This software integrates crucial functions, automating tasks, providing real-time data, and enhancing communication – all leading to increased efficiency and profitability.

This comprehensive guide explores the core functionalities, benefits, implementation, costs, security considerations, and future trends of insurance agency management software. We’ll delve into various software types, comparing features and pricing models to help you make informed decisions for your agency. We’ll also address common concerns and provide practical advice for successful implementation and ongoing success.

Defining Insurance Agency Management Software

Insurance agency management software (IAMS) is a crucial tool for streamlining operations and boosting efficiency in the insurance industry. It’s designed to automate many of the manual tasks involved in running an insurance agency, allowing agents to focus on client relationships and sales. Think of it as a central hub for all your agency’s activities, from client management to policy administration.

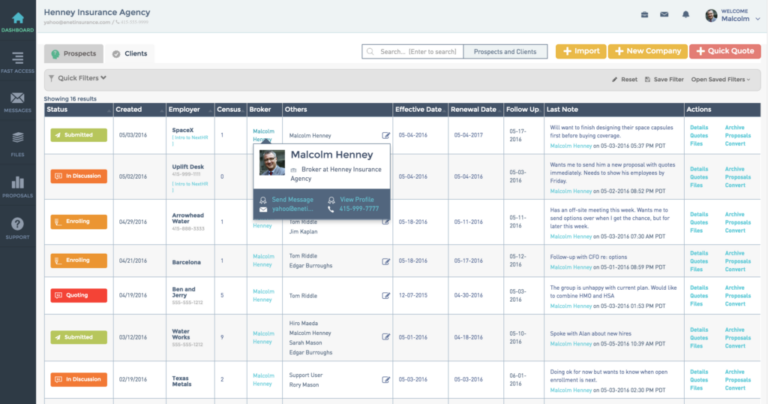

Core functionalities typically include client relationship management (CRM), policy administration, commission tracking, reporting and analytics, and communication tools. These features work together to create a more organized and productive workflow, ultimately leading to improved profitability and client satisfaction.

Types of Insurance Agencies Benefiting from IAMS

A wide range of insurance agencies can significantly benefit from implementing IAMS. This includes independent agencies, captive agencies, and even smaller agencies with limited staff. Independent agencies, which represent multiple insurance carriers, benefit from IAMS’s ability to manage policies across different carriers in one place. Captive agencies, representing a single carrier, find value in the enhanced reporting and client management features.

Even small agencies can leverage IAMS to automate tasks, reducing administrative overhead and freeing up time for client interactions.

Comparison of Cloud-Based and On-Premise Software

The choice between cloud-based and on-premise IAMS solutions depends heavily on the specific needs and resources of the agency. Cloud-based software offers scalability, accessibility from anywhere with an internet connection, and often lower upfront costs. However, it relies on a stable internet connection and may involve ongoing subscription fees. On-premise software, installed directly on the agency’s servers, offers greater control and security but requires significant upfront investment in hardware and IT infrastructure, as well as ongoing maintenance.

Comparison of Leading Insurance Agency Management Software Solutions

Choosing the right software can be challenging. Here’s a comparison of three leading solutions (Note: Pricing and features are subject to change and may vary based on specific plans and add-ons):

| Software | Pricing Model | Key Features | Notes |

|---|---|---|---|

| AgencyBloc | Subscription-based, tiered pricing | CRM, policy management, client communication tools, reporting & analytics | Strong focus on user experience and ease of use. |

| Vertafore AMS360 | Subscription-based, tiered pricing | Comprehensive suite of features, including CRM, policy management, accounting integration, and advanced reporting | A more established and feature-rich solution, potentially more complex to learn. |

| Applied Epic | Subscription-based, tiered pricing | Wide range of functionalities for large agencies, including sophisticated workflow automation and integration capabilities. | Often preferred by larger agencies due to its extensive capabilities. |

Key Features and Benefits

Let’s be honest, running an insurance agency is a juggling act. You’re dealing with clients, policies, paperwork, and regulations – all while trying to grow your business. The right insurance agency management software can be the difference between feeling overwhelmed and feeling in control. It streamlines operations, boosts efficiency, and ultimately, helps you focus on what matters most: building strong client relationships and achieving your business goals.Choosing the right software means selecting features that directly address your agency’s pain points and help you operate more smoothly.

This leads to increased profitability and allows you to scale your business effectively.

Top Five Efficiency-Boosting Features

The following features are essential for maximizing efficiency within an insurance agency. These are not simply nice-to-haves; they’re game-changers. Implementing them will significantly reduce administrative overhead and allow your team to focus on strategic initiatives.

- Policy Management: A robust policy management system allows for easy creation, modification, and renewal of policies. This eliminates manual data entry, reduces errors, and ensures compliance.

- Client Relationship Management (CRM): A CRM integrates all client interactions into a single platform, providing a 360-degree view of each client’s needs and history. This facilitates personalized service and strengthens client relationships.

- Automated Workflows: Automating tasks like email reminders, payment processing, and report generation frees up valuable time for more strategic activities.

- Reporting and Analytics: Real-time dashboards provide key performance indicators (KPIs) at a glance, allowing for data-driven decision-making and proactive adjustments to business strategies.

- Communication Tools: Integrated communication tools, including email, SMS, and even video conferencing, ensure seamless and efficient interaction with clients and partners.

Automation’s Impact on Client Management and Administrative Tasks

Automation is not just about saving time; it’s about improving accuracy and consistency. Automating repetitive tasks like data entry, generating reports, and sending reminders eliminates human error and ensures that all processes are completed efficiently and accurately. For example, automated email reminders for upcoming policy renewals reduce the risk of missed payments and policy lapses, improving client retention. Automated payment processing streamlines cash flow and reduces the time spent on manual reconciliation.

The result is a more efficient, reliable, and less stressful workflow.

Real-Time Data and Reporting’s Influence on Agency Performance

Access to real-time data provides immediate insights into agency performance. Instead of waiting weeks for reports, you can monitor key metrics like sales conversion rates, client acquisition costs, and policy renewal rates in real time. This allows for quick identification of trends, problems, and opportunities. For instance, if a sudden drop in policy renewals is detected, immediate action can be taken to address the issue, preventing further losses.

This data-driven approach enhances decision-making and ensures the agency stays ahead of the curve.

Integrated Communication Tools and Enhanced Client Relationships

Effective communication is crucial for building strong client relationships. Integrated communication tools allow for seamless interaction with clients through various channels. For example, automated email sequences can welcome new clients, provide policy updates, and answer frequently asked questions. SMS reminders can be sent for appointments or policy deadlines. The ability to quickly access a client’s complete history allows for personalized and efficient communication, fostering trust and loyalty.

A quick response to a client’s inquiry via integrated chat, for instance, can dramatically improve satisfaction and loyalty.

Workflow Improvement Flowchart

Imagine a flowchart with three distinct columns: “Before Software,” “After Software,” and “Improvements.” Before Software: This column depicts a messy, multi-step process involving manual data entry, paper shuffling, phone calls, and email chains for each task (policy creation, client communication, reporting). After Software: This column shows a streamlined, automated process. The same tasks are shown, but now they are integrated within the software.

For example, policy creation involves a single data entry point, automated workflows handle communication and reminders, and real-time dashboards provide instant reporting. Improvements: This column highlights the efficiency gains, such as reduced processing time, decreased errors, improved accuracy, and better communication. Quantifiable metrics could be included (e.g., “Reduced processing time by 50%,” “Error rate decreased by 75%”). The visual contrast between the “Before” and “After” columns clearly demonstrates the software’s positive impact.

Implementation and Integration

Successfully implementing insurance agency management software requires careful planning and execution. A smooth transition minimizes disruption to daily operations and maximizes the software’s benefits. This involves a strategic approach encompassing data migration, staff training, and ongoing support.The integration process blends the new software with your existing systems, creating a unified workflow. This synergy streamlines operations and improves data consistency across your agency.

A phased approach, starting with a pilot program, can be a valuable strategy for minimizing risks and maximizing efficiency.

Best Practices for Successful Implementation

Prioritize thorough planning. This includes defining clear goals, assigning roles and responsibilities, and establishing a realistic timeline. Engage key stakeholders early and often to ensure buy-in and address concerns proactively. Consider a phased rollout, starting with a pilot group to test functionality and identify potential issues before a full-scale deployment. Regular progress reviews help maintain momentum and address challenges promptly.

Document every step of the process for future reference and troubleshooting.

Integrating with Existing Agency Systems

Integrating the new software with existing systems like CRM and accounting platforms requires careful consideration of data formats and APIs. This often involves working with IT specialists and software vendors to ensure seamless data exchange. For example, automating the transfer of client data from a CRM to the insurance management system eliminates duplicate data entry and reduces the risk of errors.

Similarly, integrating with accounting software can automate billing and payment processes, improving efficiency and accuracy. API-driven integration is often the most efficient method, providing real-time data synchronization.

Data Migration from Legacy Systems

Data migration from older systems is a crucial step. Begin by thoroughly cleaning and validating your existing data to ensure accuracy and consistency. Develop a detailed migration plan outlining the steps involved, including data transformation, validation, and testing. Use specialized data migration tools to automate the process and minimize manual intervention. Implement a robust data validation process to detect and correct any inconsistencies before migrating the data.

Conduct thorough testing after migration to ensure data integrity and system functionality. For instance, a staged migration, moving data in batches, allows for easier error correction and reduces the overall risk.

Training Requirements for Agency Staff

Comprehensive training is essential for effective software adoption. Develop a multi-faceted training program that includes online tutorials, hands-on workshops, and ongoing support. Tailor the training to different roles and skill levels within the agency. Provide clear documentation and readily available support resources. Consider using a blended learning approach combining online modules with in-person training sessions.

Regular refresher courses can ensure staff remains proficient in using the software’s features. Feedback mechanisms, such as surveys and focus groups, help refine the training program based on staff needs.

Ongoing Support and Maintenance

Post-implementation support is critical for long-term success. Establish a service level agreement (SLA) with the software vendor outlining response times and support options. Proactive maintenance, such as regular software updates and system backups, prevents unexpected downtime and data loss. Regularly review system performance and identify areas for improvement. Utilize the vendor’s support resources, such as knowledge bases and online forums, for quick solutions to common problems.

Investing in ongoing training and support ensures the agency maximizes the software’s value and keeps pace with updates and new features.

Cost and ROI

Investing in insurance agency management software is a significant decision, but one that can yield substantial returns. Understanding the various cost models and how to assess the return on investment (ROI) is crucial for making an informed choice. This section will break down the different pricing structures, key factors to consider for cost-effectiveness, and provide a framework for calculating your potential ROI.

Pricing Models for Insurance Agency Management Software

Insurance agency management software typically operates under two main pricing models: subscription-based and one-time purchase. Subscription models involve recurring monthly or annual fees, often tiered based on features and user numbers. This provides predictable budgeting and access to ongoing updates and support. One-time purchases involve a larger upfront cost, but eliminate recurring fees. However, this usually means you’re locked into a specific version of the software without automatic updates or ongoing support.

The best model depends on your agency’s size, budget, and long-term needs. Larger agencies with consistent growth might find subscription models more manageable, while smaller agencies with limited budgets might prefer a one-time purchase, although they may need to factor in upgrade costs later.

Factors Affecting Cost-Effectiveness

Several factors influence the cost-effectiveness of different software solutions. These include the software’s features and functionalities, the level of support provided, implementation costs (including training and data migration), integration capabilities with existing systems, and the ongoing maintenance and support fees. Consider whether the software offers features that directly address your agency’s pain points and improve efficiency. A seemingly cheaper option with limited functionality might ultimately prove more expensive in the long run due to lost productivity or inefficiencies.

Cost-Benefit Analysis Template

A thorough cost-benefit analysis is essential for evaluating the ROI of insurance agency management software. The following template can guide this process:

| Cost Factors | Estimated Cost |

|---|---|

| Software License (One-time or Subscription) | |

| Implementation Costs (Training, Data Migration) | |

| Ongoing Maintenance & Support | |

| Hardware/Infrastructure Upgrades (if needed) | |

| Total Costs |

| Benefit Factors | Estimated Benefit (Annualized) |

|---|---|

| Reduced Operational Costs (e.g., labor, paper) | |

| Increased Efficiency and Productivity | |

| Improved Client Retention | |

| Increased Sales/Revenue | |

| Reduced Errors and Claims Processing Time | |

| Total Benefits (Annual) |

Quantifiable Benefits and ROI Calculation

Quantifiable benefits are key to demonstrating ROI. For example, reduced operational costs might be calculated by estimating the time saved per task multiplied by employee hourly rates. Increased revenue can be projected based on improved sales conversion rates or increased client base. Let’s say implementing the software saves 10 hours of administrative work per week at $50/hour, resulting in an annual saving of $26,000 ($50/hour

- 10 hours/week

- 52 weeks/year). If the software costs $10,000 annually, the net benefit is $16,000.

To calculate the payback period, divide the initial investment by the annual net benefit:

Payback Period = Initial Investment / Annual Net Benefit

In this example: Payback Period = $10,000 / $16,000 = 0.625 years (approximately 7.5 months).

Security and Compliance: Insurance Agency Management Software

Protecting sensitive client data is paramount for any insurance agency, and the software you use plays a crucial role in this. A robust security and compliance framework is not just a good idea; it’s a necessity to maintain client trust, avoid hefty fines, and ensure the long-term success of your agency. This section details the essential security measures and compliance standards your agency management software must meet.

Data Encryption and Access Controls

Data encryption is the cornerstone of data security. It transforms sensitive information into an unreadable format, rendering it useless to unauthorized individuals. Strong encryption algorithms, like AES-256, should be employed to protect data both in transit (while being transmitted over networks) and at rest (while stored on servers or devices). Access controls, implemented through role-based permissions, further strengthen security by limiting access to sensitive data based on an individual’s job function.

For example, a claims adjuster should have access to claim files but not necessarily to policyholder financial information. This granular control prevents unauthorized access and reduces the risk of data breaches.

Industry Regulations and Compliance

Compliance with relevant industry regulations is non-negotiable. The Health Insurance Portability and Accountability Act (HIPAA) in the US, for example, mandates strict security and privacy measures for protected health information (PHI). Similarly, the General Data Protection Regulation (GDPR) in Europe establishes stringent rules for processing personal data. Failure to comply with these regulations can result in significant financial penalties and reputational damage.

Your agency management software must be designed and configured to meet the specific requirements of all applicable regulations. This includes features like data subject access requests (DSAR) functionality for GDPR compliance.

Data Backup and Disaster Recovery

Data loss can cripple an insurance agency. A comprehensive data backup and disaster recovery plan is essential to mitigate this risk. Regular backups should be performed, ideally to multiple locations (on-site and off-site) using different methods (e.g., cloud storage, tape backups). The software should facilitate automated backups and provide tools to verify the integrity of backups. A disaster recovery plan should Artikel procedures for restoring data and systems in the event of a natural disaster, cyberattack, or other unforeseen event.

This plan should include a detailed recovery time objective (RTO) and recovery point objective (RPO) – specifying the maximum tolerable downtime and data loss, respectively. For instance, a plan might aim for an RTO of 4 hours and an RPO of 24 hours.

Security Measures for Protecting Sensitive Client Data

Multiple layers of security are necessary to protect client data. This includes robust firewalls to prevent unauthorized access from external networks, intrusion detection and prevention systems (IDPS) to monitor for malicious activity, and regular security audits and penetration testing to identify and address vulnerabilities. Employee training on security best practices is also critical, as human error remains a major source of security breaches.

Multi-factor authentication (MFA) should be mandatory for all users to add an extra layer of protection against unauthorized access. Regular software updates are essential to patch security vulnerabilities as they are discovered.

Security and Compliance Checklist for Insurance Agency Management Software

Before selecting an insurance agency management software solution, use this checklist to assess its security and compliance posture:

- Does the software utilize strong encryption (e.g., AES-256) for data in transit and at rest?

- Does the software offer granular access controls based on roles and responsibilities?

- Is the software compliant with all applicable regulations (e.g., HIPAA, GDPR, CCPA)?

- Does the software support regular automated data backups to multiple locations?

- Does the vendor have a documented disaster recovery plan with defined RTO and RPO?

- Does the software incorporate multi-factor authentication (MFA)?

- Does the vendor conduct regular security audits and penetration testing?

- Does the vendor provide ongoing security updates and patches?

- Does the vendor offer comprehensive employee training on security best practices?

Future Trends

The insurance industry is undergoing a rapid digital transformation, and insurance agency management software is at the forefront of this change. Future trends are driven by technological advancements and evolving client expectations, leading to increasingly sophisticated and integrated systems. This section explores the key trends shaping the future of this crucial software.

Artificial Intelligence and Machine Learning in Agency Operations

AI and ML are poised to revolutionize insurance agency operations. These technologies can automate tasks such as lead generation, policy processing, and claims management, freeing up agents to focus on building client relationships and providing personalized service. For example, AI-powered chatbots can handle routine inquiries, while ML algorithms can analyze vast datasets to identify high-risk clients or predict future claims.

This leads to improved efficiency, reduced operational costs, and better risk management. The implementation of predictive modeling, powered by ML, allows for more accurate pricing and risk assessment, ultimately benefiting both the agency and the client.

Innovative Features Emerging in Insurance Agency Management Software

Several innovative features are expected to become commonplace in the coming years. These include advanced analytics dashboards providing real-time insights into agency performance, integrated CRM systems for seamless client management, and personalized client portals offering 24/7 access to policy information and services. Furthermore, the integration of blockchain technology could enhance security and transparency in policy management, while advanced automation features could streamline workflows and reduce manual errors.

Consider, for example, the potential of automated document processing, where AI reads and classifies policy documents, drastically reducing processing time.

The Role of Cloud Computing and Mobile Accessibility

Cloud computing is becoming the standard for insurance agency management software, offering scalability, accessibility, and cost-effectiveness. Agencies can access their data and applications from anywhere with an internet connection, improving collaboration and flexibility. Mobile accessibility is also crucial, allowing agents to manage their business and communicate with clients on the go. This trend empowers agents to respond quickly to client needs and operate more efficiently, regardless of their location.

The adoption of cloud-based solutions by major insurance providers is a strong indicator of this trend’s momentum.

Infographic: The Evolution of Insurance Agency Management Software (Next 5 Years)

The infographic would be a timeline showing the evolution of insurance agency management software over the next five years.* Year 1 (Present): Depicted as a basic computer screen with icons representing core functionalities (e.g., policy management, client database). Label: “Current State: Primarily focused on core functions, limited integration.”

Year 2

The screen expands to include more integrated icons (e.g., CRM, reporting). Label: “Increased Integration: Better data flow between modules, improved reporting.”

Year 3

The screen shows a mobile device alongside the computer, with icons for mobile access and AI features (e.g., chatbot). Label: “Mobile-First Approach: Enhanced mobile accessibility, introduction of AI-powered tools.”

Year 4

The computer screen displays advanced analytics dashboards and predictive modeling icons. Label: “Data-Driven Decisions: Real-time insights and predictive analytics.”

Year 5

The entire system is depicted in a cloud environment, with icons representing enhanced security and blockchain integration. Label: “Secure and Scalable Cloud Platform: Blockchain integration for enhanced security and transparency.”The overall visual style would be clean and modern, using a consistent color scheme to represent the progression of technology. The timeline format clearly illustrates the incremental advancements and the shift towards more sophisticated and integrated systems.

End of Discussion

Ultimately, investing in the right insurance agency management software is a strategic move that positions your agency for long-term growth and success. By streamlining operations, improving client service, and gaining valuable insights into performance, you can unlock new levels of efficiency and profitability. The key is careful planning, thorough research, and a commitment to leveraging the technology to its full potential.

Don’t get left behind – embrace the future of insurance agency management.

General Inquiries

What types of agencies benefit most from this software?

Agencies of all sizes, from small independent firms to large national brokers, can benefit. The software scales to meet the needs of different agency structures and workflows.

Is cloud-based software always better than on-premise?

It depends on your agency’s specific needs and IT infrastructure. Cloud-based offers flexibility and accessibility, while on-premise provides more control but requires dedicated IT resources.

How long does it typically take to implement the software?

Implementation time varies, depending on agency size, data migration complexity, and staff training needs. Expect a timeline ranging from a few weeks to several months.

What kind of training is required for my staff?

Most vendors offer training programs, ranging from online tutorials to in-person workshops. The extent of training will depend on the software’s complexity and your staff’s technical skills.

What happens if my software experiences a security breach?

Reputable vendors employ robust security measures, but a comprehensive data backup and disaster recovery plan is crucial. This should be part of your due diligence when choosing a vendor.