Navigating the insurance claim process can feel like traversing a minefield, but understanding the steps involved can significantly improve your chances of a successful outcome. From car accidents to home disasters, knowing what to expect and how to prepare your documentation is crucial. This guide breaks down the entire process, offering practical advice and insights to empower you throughout your claim journey.

We’ll cover everything from gathering the necessary evidence and communicating effectively with adjusters to appealing denied claims and understanding your rights as a policyholder. We’ll also explore how technology is transforming the claims landscape and offer real-world case studies to illustrate both successful and unsuccessful claims, highlighting key lessons learned. Prepare to become a more informed and confident advocate for yourself.

Understanding the Insurance Claim Process

Filing an insurance claim can feel daunting, but understanding the process can make it significantly less stressful. This guide breaks down the typical steps, highlights differences between claim types, and walks you through a common scenario. Remember, each insurance company has its own specific procedures, so always refer to your policy and contact your insurer directly for clarification.

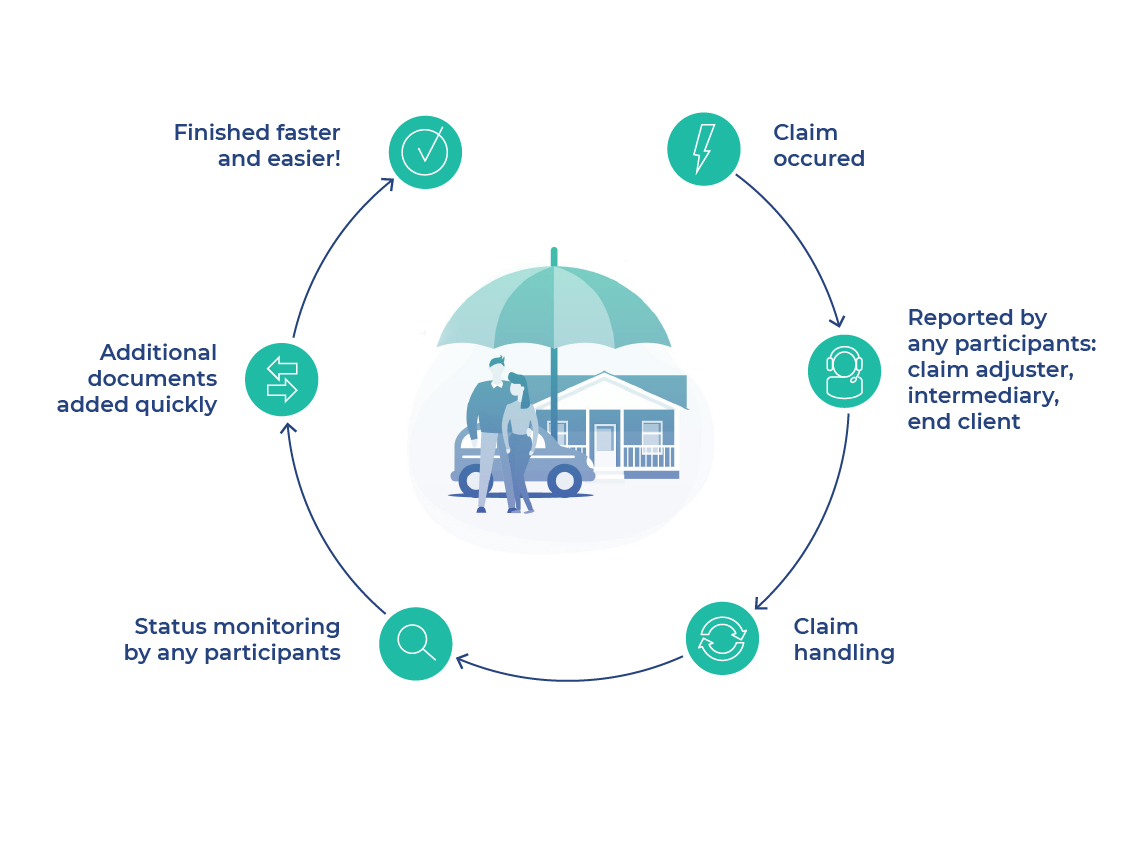

The core process generally involves reporting the incident, gathering necessary documentation, submitting your claim, and then waiting for a decision from the insurance company. This can involve multiple interactions and may take time depending on the complexity of the claim and the insurer’s workload.

Types of Insurance Claims

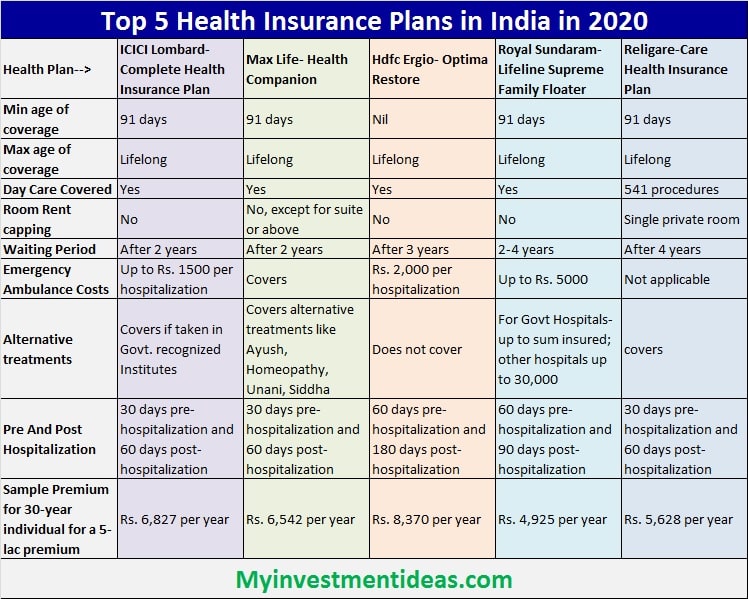

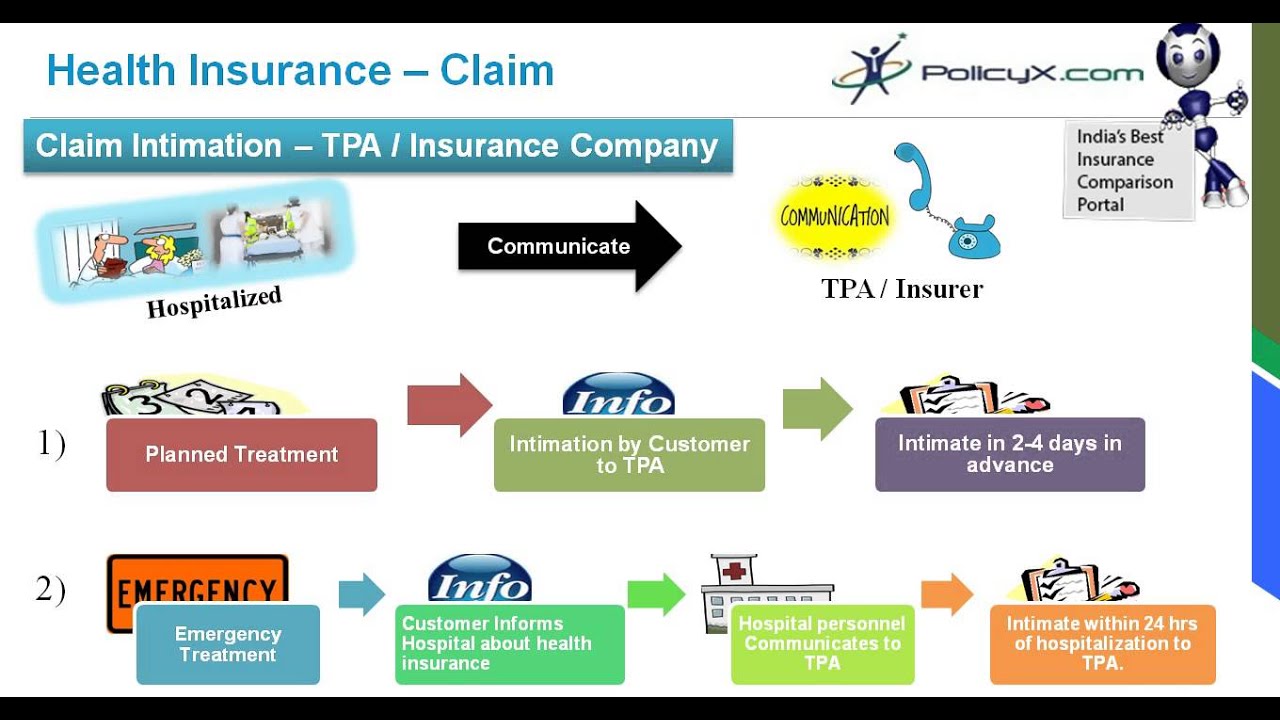

Different types of insurance claims have varying processes. Auto insurance claims typically involve accidents, theft, or damage to your vehicle. Home insurance claims usually cover damage to your property from events like fire, theft, or natural disasters. Health insurance claims cover medical expenses, requiring documentation from healthcare providers. Each type necessitates specific documentation and processes.

For instance, an auto claim requires police reports and repair estimates, while a home claim may need photos of the damage and contractor estimates. Health insurance often involves pre-authorization and submitting bills from doctors and hospitals.

Step-by-Step Guide: Car Accident Claim

Let’s say you’ve been in a car accident. Here’s a step-by-step guide:

- Ensure Safety: Check on yourself and others involved. Call emergency services if needed.

- Document the Scene: Take photos of the damage to all vehicles, the accident location, and any visible injuries. Note down the date, time, and location.

- Exchange Information: Get the names, addresses, phone numbers, insurance information, and driver’s license numbers of all involved parties and witnesses.

- Report to the Police: File a police report, especially if there are injuries or significant damage.

- Contact Your Insurer: Report the accident to your insurance company as soon as possible. Follow their instructions for filing a claim.

- Obtain Repairs Estimates: Get at least two estimates from reputable repair shops for the vehicle damage.

- Submit Your Claim: Submit all necessary documentation to your insurance company, including the police report, photos, repair estimates, and medical bills (if applicable).

- Review the Settlement: Once your insurer has reviewed your claim, they will offer a settlement. Review carefully and negotiate if necessary.

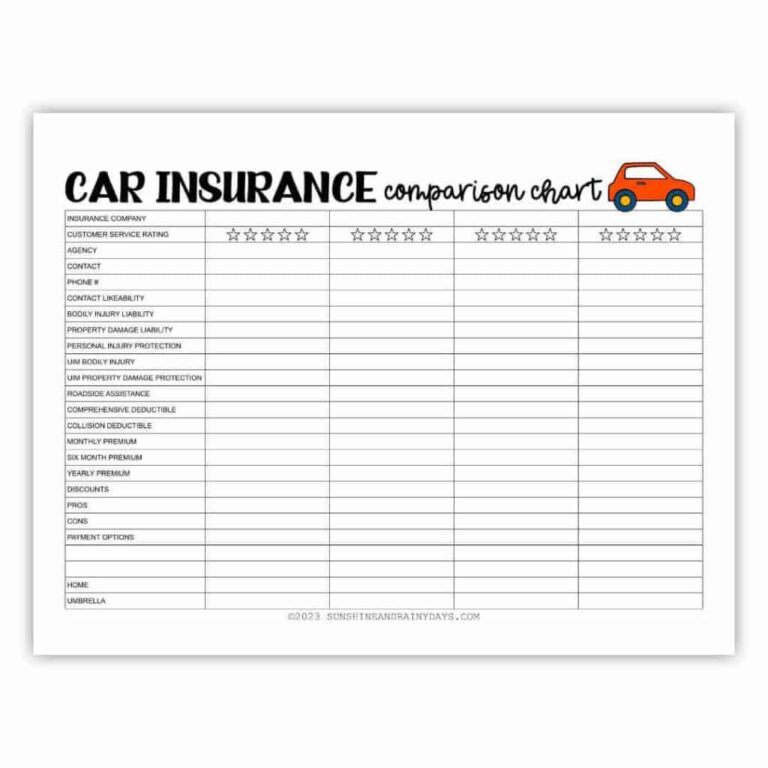

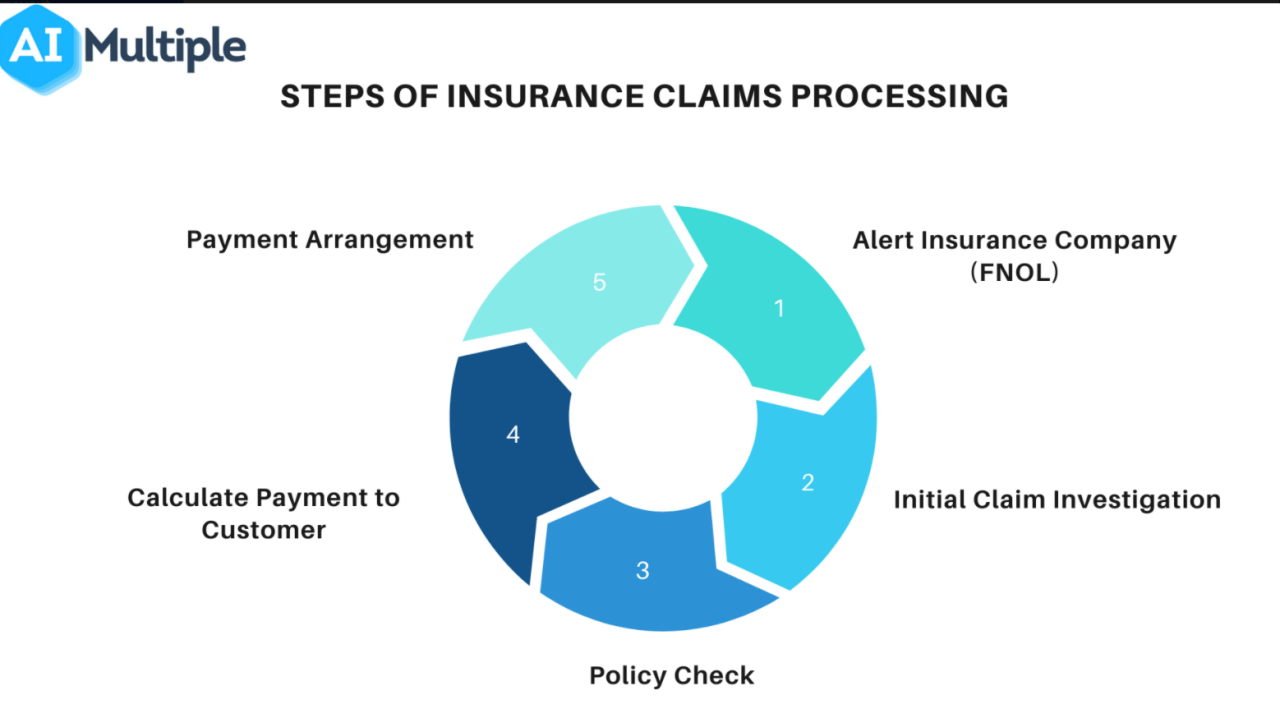

Insurance Claim Process Flowchart

The following flowchart visually represents a simplified version of the claim process. The specific steps and their order might vary depending on the type of claim and your insurance provider.

| Step | Action | Documentation | Timeline |

|---|---|---|---|

| 1 | Incident Occurs | N/A | Immediate |

| 2 | Report Incident | Police report (if applicable), photos, witness statements | Within 24-48 hours |

| 3 | Claim Filed | Claim form, supporting documentation | Within a few days of incident |

| 4 | Investigation | Insurance adjuster review | Several days to weeks |

| 5 | Claim Assessment | Damage assessment, medical records (if applicable) | Several days to weeks |

| 6 | Settlement Offered | Settlement offer letter | Several weeks to months |

| 7 | Settlement Accepted/Negotiated | Signed agreement | Within a set timeframe |

Documentation and Evidence Required: Insurance Claim Process

Getting your insurance claim approved hinges on providing the right documentation. A complete and accurate submission significantly increases your chances of a swift and successful outcome. Failing to provide necessary information can lead to delays or even claim denial. Let’s look at what you’ll need.

The specific documents required will vary depending on the type of claim. However, some documents are almost universally needed. Think of it like building a case; the stronger your evidence, the better your chances of winning.

Required Documents for Different Claim Types

This checklist Artikels the common documents needed for various claim types. Remember to always refer to your specific insurance policy for detailed requirements.

- Auto Accident Claims: Police report (if applicable), photos of vehicle damage, medical bills, repair estimates, witness statements, rental car receipts.

- Homeowners Claims (Damage): Photos and videos of the damage, contractor estimates for repairs, receipts for temporary housing (if applicable), police report (if applicable), documentation of the cause of damage.

- Homeowners Claims (Theft): Police report, inventory list of stolen items with purchase receipts or appraisals, photos of the scene, any security system logs.

- Health Insurance Claims: Medical bills, explanation of benefits (EOB) from your provider, doctor’s notes, diagnostic test results, prescriptions.

- Travel Insurance Claims: Flight itineraries, hotel confirmations, medical bills (if applicable), police report (if applicable), photos or videos of any incidents or damaged property, receipts for any expenses incurred due to the covered event.

Acceptable and Unacceptable Forms of Evidence

Providing the right kind of evidence is crucial. Some forms of evidence are more readily accepted than others. Consider this a guide to ensure your submission is strong.

- Acceptable Evidence: Original documents (or certified copies), digital photos and videos (high-resolution, clearly showing the damage or incident), official reports (police, medical, etc.), invoices and receipts, sworn statements from witnesses.

- Unacceptable Evidence: Photocopies without certification, blurry or unclear photos/videos, hearsay, unverified claims without supporting documentation, self-created documents without official stamps or signatures.

Importance of Accurate and Complete Documentation

Accuracy and completeness are paramount. Inaccurate or incomplete information can lead to delays, claim denials, or even legal issues. Take your time to gather all necessary information and double-check for accuracy before submitting your claim. Think of it as presenting your case to a judge – you want to present the most compelling and accurate evidence possible.

Providing false or misleading information is a serious offense and can have significant consequences.

Dealing with Insurance Adjusters

Navigating the insurance claim process often involves interacting with insurance adjusters, individuals responsible for investigating your claim and determining the payout. Effective communication and a clear understanding of their role are crucial for a fair and timely settlement. This section will equip you with the knowledge and strategies to successfully interact with adjusters and negotiate a fair settlement.

Effective Communication Strategies

Clear and concise communication is key when dealing with insurance adjusters. Maintain a professional and respectful tone in all interactions, whether written or verbal. Document every interaction, including dates, times, and the key points discussed. Provide accurate and complete information promptly, and always follow up on any requests for additional documentation in a timely manner. If you disagree with an adjuster’s assessment, clearly and respectfully explain your reasoning, supporting your claims with evidence.

Remember to be patient; the claims process can take time. Avoid emotional outbursts or aggressive language, as this can hinder the process and damage your credibility.

Negotiating Fair Settlements

Negotiating a fair settlement requires preparation and a clear understanding of your policy coverage and the extent of your losses. Gather all relevant documentation, including repair estimates, medical bills, and receipts for any expenses incurred due to the incident. Know your policy inside and out. Before engaging in negotiations, research comparable settlements for similar claims to understand the typical range of payouts.

Present your case clearly and logically, emphasizing the facts and supporting them with evidence. Be prepared to compromise, but don’t settle for less than what you believe is fair. If negotiations fail to reach a satisfactory outcome, consider seeking legal counsel.

Common Tactics Used by Insurance Adjusters

Insurance adjusters are trained professionals who often employ certain strategies during the claims process. They may attempt to minimize the value of your claim by questioning the extent of your damages or the cause of the incident. They may also delay the process by requesting additional documentation or information. Some adjusters may offer a low initial settlement hoping you’ll accept it quickly.

Understanding these tactics allows you to prepare a strong case and avoid being pressured into an unfair settlement. Always carefully review any settlement offer before accepting it.

Different Types of Adjusters

Several types of adjusters handle insurance claims. Staff adjusters are employed directly by insurance companies and handle a large volume of claims. Independent adjusters are self-employed and contracted by insurance companies to investigate and settle claims, often in specific geographic areas or for specialized types of claims. Public adjusters represent the policyholder and work to maximize the claim settlement.

Understanding these different roles can help you anticipate their approaches and prepare accordingly. For example, a public adjuster might be beneficial if you’re facing a complex or high-value claim.

Common Claim Denials and Appeals

Getting your insurance claim denied can be frustrating, but understanding the reasons behind denials and the appeals process can significantly improve your chances of a successful outcome. This section Artikels common reasons for denial, the appeals process itself, and strategies for building a strong appeal.

Insurance companies have specific criteria for approving claims. Failing to meet these criteria, even inadvertently, is the most frequent cause of denial. This often stems from issues with documentation, policy interpretation, or the specifics of the incident itself.

Frequent Reasons for Claim Denials

Several common reasons contribute to claim denials. Understanding these helps you proactively avoid issues and strengthens your position during an appeal.

- Lack of Proper Documentation: Insufficient or missing paperwork is a major reason for denial. This includes incomplete forms, missing receipts, or a lack of supporting medical records.

- Policy Exclusions: Many policies exclude specific events or circumstances. Failing to understand these exclusions can lead to denial, even if the damage seems covered at first glance. For example, flood damage might not be covered under a standard homeowner’s policy.

- Failure to Meet Policy Requirements: Policies often have specific requirements, such as timely reporting of incidents or cooperation with investigations. Non-compliance can lead to denial.

- Pre-existing Conditions: In health insurance, pre-existing conditions may not be fully covered until a specific waiting period has passed. Claims related to these conditions before the waiting period might be denied.

- Fraud or Misrepresentation: Providing false information on a claim form, or exaggerating the extent of damages, is a serious offense that will result in denial and potentially legal consequences.

The Appeals Process for Denied Claims

Most insurance companies have a formal appeals process. This process usually involves submitting additional documentation and providing a clear explanation of why you believe the claim should be approved. It’s crucial to understand the specific steps Artikeld in your policy.

The appeals process typically involves several stages, starting with an initial review of the denial, followed by a formal appeal to a higher authority within the insurance company. In some cases, an external review or arbitration may be necessary.

Examples of Successful Appeals and Strategies Used

Successful appeals often involve meticulous documentation and a clear, concise presentation of the case. They emphasize the policy’s coverage, the validity of the claim, and the inaccuracies in the initial denial.

- Example 1: A homeowner’s claim for wind damage was initially denied due to missing photos. The homeowner successfully appealed by providing additional evidence from a neighbor who witnessed the storm’s impact and took photos of the damage.

- Example 2: A car accident claim was initially denied due to a perceived discrepancy in witness statements. The claimant successfully appealed by providing a detailed timeline of events, supported by police reports and medical records, clarifying the discrepancies and demonstrating the validity of their claim.

Building a Strong Appeal

A well-prepared appeal significantly increases your chances of success. The following steps are crucial:

- Carefully Review the Denial Letter: Understand the specific reasons for the denial. Address each point directly and thoroughly in your appeal.

- Gather All Relevant Documentation: This includes photos, receipts, medical records, police reports, witness statements, and any other supporting evidence.

- Write a Clear and Concise Letter: Explain the situation calmly and professionally. Clearly state why you believe the denial is incorrect and provide supporting evidence for your claims.

- Follow the Appeals Process Precisely: Adhere to the deadlines and procedures Artikeld in your policy or denial letter. Keep copies of all correspondence.

- Maintain Professionalism: Avoid emotional outbursts or accusatory language. Maintain a respectful and professional tone throughout the process.

- Consider Legal Counsel: If your appeal is unsuccessful, and the amount is significant, consulting with an attorney specializing in insurance law may be beneficial.

Timeframes and Delays in the Claim Process

Navigating the insurance claim process can feel like a marathon, not a sprint. Understanding the typical timelines and potential delays is crucial for managing expectations and proactively addressing any issues. Knowing what to expect and how to handle potential roadblocks can significantly ease the stress of filing a claim.

Insurance claim processing times vary wildly depending on the type of claim, the complexity of the situation, and the efficiency of both the insurance company and the claimant. Simple claims, with clear documentation and straightforward circumstances, generally process much faster than those involving significant damage, multiple parties, or disputes over liability. Delays can be incredibly frustrating, but understanding the common causes can help you stay proactive and potentially prevent them.

Typical Processing Times for Different Claim Types

The speed at which your claim is processed depends heavily on its nature. Auto claims, for instance, often have a quicker turnaround than homeowners’ claims due to standardized procedures and readily available evidence (accident reports, police statements). Conversely, complex claims involving significant property damage or liability disputes may take considerably longer. Health insurance claims can also vary greatly depending on the provider’s network, the type of procedure, and the required documentation.

Factors That Can Cause Delays in Claim Processing, Insurance claim process

Several factors can significantly lengthen the claim process. Incomplete or inaccurate documentation is a major culprit. Missing forms, unclear photos, or inconsistent statements can lead to requests for additional information, delaying the process. Difficulties in verifying information, such as confirming the value of damaged property or the extent of injuries, can also create significant delays. Disputes over liability, particularly in auto accidents or property damage claims, can also prolong the process significantly.

For example, a disagreement on who was at fault in a car accident might necessitate a lengthy investigation before the claim can proceed. Finally, high claim volumes, especially during peak seasons or after major events like hurricanes, can cause significant backlogs and increased processing times.

Strategies for Expediting the Claim Process

Being proactive can significantly shorten the claim process. Submitting a complete and accurate claim package from the outset is paramount. This includes all necessary forms, detailed descriptions of the incident, and comprehensive supporting documentation such as photos, videos, receipts, and police reports. Promptly responding to any requests for additional information from the insurance adjuster is also crucial.

Maintaining clear and consistent communication with your adjuster can prevent misunderstandings and delays. If you encounter delays, don’t hesitate to follow up and inquire about the status of your claim. Keep records of all communication, including dates, times, and the names of the individuals you’ve spoken with.

Average Processing Times for Various Claim Types

| Claim Type | Average Processing Time | Factors Affecting Processing Time |

|---|---|---|

| Auto Claim (Minor Damage) | 2-4 weeks | Severity of damage, availability of police report |

| Auto Claim (Significant Damage) | 4-8 weeks | Complexity of repairs, vehicle availability for assessment |

| Homeowners Claim (Minor Damage) | 4-6 weeks | Extent of damage, availability of contractors |

| Homeowners Claim (Significant Damage) | 8-12 weeks or more | Extensive damage, need for structural engineers, potential for litigation |

| Health Insurance Claim (Routine) | 1-3 weeks | Provider participation in network, claim submission method |

| Health Insurance Claim (Complex) | 4-8 weeks or more | Pre-authorization requirements, appeals process |

The Role of Technology in Claim Processing

Technology has revolutionized the insurance claim process, dramatically increasing efficiency and improving the overall customer experience. From initial reporting to final settlement, digital tools are streamlining workflows and reducing processing times, leading to faster payouts and greater satisfaction for policyholders.The impact of technology on claim processing efficiency is undeniable. Automated systems handle routine tasks like data entry and initial assessment, freeing up adjusters to focus on more complex claims.

This automation significantly reduces processing time and minimizes human error, leading to quicker and more accurate claim resolutions. Real-time data analysis helps identify potential fraud and streamline investigations, further improving efficiency.

Online Portals and Mobile Apps in Claim Management

Online portals and mobile apps offer policyholders convenient ways to manage their claims. These platforms allow for 24/7 access to claim status, the ability to submit supporting documentation electronically, and direct communication with adjusters. Features like photo upload capabilities for damage assessment and real-time tracking of claim progress enhance transparency and improve communication throughout the process. For example, a policyholder can use a mobile app to submit a claim for a car accident, upload photos of the damage, and receive updates on the adjuster’s progress, all from their smartphone.

This contrasts sharply with the traditional method of mailing in paperwork and waiting for phone calls or letters, which could take weeks or even months.

Comparison of Traditional and Digital Claim Processes

Traditional claim processes relied heavily on paper-based documentation, manual data entry, and physical mail. This resulted in significant delays, increased administrative costs, and a higher potential for errors. In contrast, digital claim processes leverage technology to automate many steps, reducing processing time and improving accuracy. For example, a traditional car accident claim might involve filling out a paper form, mailing it to the insurance company, waiting for an adjuster to visit the damaged vehicle, and then receiving a check in the mail.

A digital process would allow the policyholder to submit a claim online, upload photos of the damage, communicate with the adjuster through a secure messaging system, and receive payment directly into their bank account. The speed and efficiency gains are substantial.

AI and Automation in the Insurance Claim Landscape

Artificial intelligence (AI) and automation are transforming the insurance claim landscape. AI-powered systems can analyze large datasets to identify patterns and predict potential fraud, allowing insurers to proactively address fraudulent claims. Automated systems can also assess the validity of claims based on predefined criteria, significantly speeding up the initial assessment process. For example, AI algorithms can analyze images of vehicle damage to estimate repair costs, reducing the need for manual assessments.

Furthermore, AI chatbots can provide immediate answers to policyholder queries, improving customer service and reducing the workload on human agents. These technologies are not just speeding up the process; they’re also improving accuracy and reducing costs.

Protecting Your Rights During the Claim Process

Navigating the insurance claim process can feel overwhelming, but understanding your rights is crucial for a fair and timely resolution. Knowing your consumer protections and potential pitfalls can significantly improve your chances of a successful claim. This section will Artikel key rights, common problems, and resources available to help you.

Consumer Rights and Protections

Your rights as a policyholder are generally Artikeld in your insurance policy and by state regulations. These rights often include the right to a prompt and fair investigation of your claim, access to your claim file, and the opportunity to appeal a denial. You also have the right to be treated respectfully and professionally by the insurance company and its adjusters.

Failure to uphold these rights can lead to legal recourse. Specific protections vary by state and policy type, so reviewing your policy and contacting your state’s insurance department is recommended.

Potential Pitfalls to Avoid

Several common mistakes can jeopardize your claim. Failing to report the claim promptly according to your policy’s terms is a significant issue. Insufficient documentation or providing inaccurate information can also lead to delays or denials. Unnecessarily agreeing to a settlement before fully understanding its implications is another frequent pitfall. Finally, neglecting to follow up on your claim’s progress can leave you vulnerable to delays and potential loss.

Examples of Unethical Insurance Company Practices

Unfortunately, some insurance companies engage in unethical practices. Examples include lowball settlement offers designed to pressure policyholders into accepting less than they deserve, unreasonable delays in processing claims, and attempts to deny legitimate claims based on technicalities or misinterpretations of policy language. In some cases, insurance companies may use aggressive tactics or intimidation to discourage policyholders from pursuing their claims.

These actions are often violations of state insurance regulations and can be challenged legally. One example could be an adjuster consistently downplaying the severity of damages in a car accident to justify a lower settlement. Another could involve an insurance company delaying a homeowner’s claim for extensive wind damage until after the policy’s renewal date, hoping to avoid paying out.

Resources for Consumers Facing Claim Disputes

If you encounter difficulties with your insurance claim, several resources can assist you.

- Your state’s insurance department: These departments regulate insurance companies and can investigate complaints and help resolve disputes.

- Consumer protection agencies: Federal and state consumer protection agencies offer resources and assistance with insurance claim issues.

- Legal aid organizations: Legal aid societies and other non-profit organizations may provide free or low-cost legal assistance to consumers facing insurance claim disputes.

- Private attorneys specializing in insurance law: If your dispute is complex or involves significant financial losses, you may consider hiring an attorney experienced in insurance law.

- Mediation or arbitration services: These services can help facilitate a resolution between you and the insurance company without resorting to litigation.

Illustrative Case Studies

Understanding the insurance claim process is greatly enhanced by examining real-world examples. These case studies illustrate both successful and unsuccessful claims, highlighting key factors that contribute to positive or negative outcomes. Analyzing these scenarios provides valuable insights for navigating the complexities of insurance claims.

Successful Homeowners Insurance Claim After a Fire

Sarah and Mark experienced a devastating house fire caused by a faulty electrical appliance. Their home suffered significant structural damage, along with the loss of many personal belongings. They immediately contacted their homeowners insurance provider, reporting the incident and cooperating fully with the investigation. They meticulously documented the damage with photographs and videos, creating a detailed inventory of lost possessions with receipts or appraisals where possible.

They worked closely with their insurance adjuster, providing all requested documentation promptly and professionally. The adjuster conducted a thorough assessment of the damage, and the insurance company approved their claim within a reasonable timeframe. The claim covered the cost of repairs to their home, replacement of damaged belongings, and temporary living expenses while repairs were underway. The claim was settled fairly and efficiently due to Sarah and Mark’s proactive approach, thorough documentation, and excellent communication with the insurance company.

Their prompt action in securing the property and preserving evidence also significantly contributed to the positive outcome.

Unsuccessful Auto Insurance Claim Due to Lack of Evidence

John was involved in a minor car accident. While he believed the other driver was at fault, he failed to obtain the other driver’s contact information or insurance details at the scene. He also didn’t take photos of the damage to either vehicle or the accident scene itself. When he filed a claim with his auto insurance provider, he only had his own account of the events.

The insurance company investigated the claim but, lacking independent corroboration, determined they could not verify John’s account of the accident. Furthermore, John did not have any witnesses to support his claim. Consequently, the insurance company denied his claim, citing insufficient evidence to determine liability. The lack of photographic evidence, witness statements, and contact information from the other driver proved detrimental to John’s case, highlighting the importance of gathering comprehensive evidence immediately following an accident.

This situation emphasizes the crucial role of documentation in successfully resolving an insurance claim.

End of Discussion

Successfully navigating an insurance claim requires preparation, clear communication, and a thorough understanding of the process. While frustrating delays and denials can occur, armed with the right knowledge and strategies, you can significantly increase your chances of a fair and timely settlement. Remember to meticulously document everything, communicate proactively with your insurer, and don’t hesitate to seek professional assistance if needed.

Ultimately, understanding your rights and responsibilities is key to a positive outcome.

Frequently Asked Questions

What happens if I disagree with the adjuster’s assessment?

You have the right to appeal the adjuster’s decision. Carefully review their reasoning, gather additional supporting evidence, and follow your insurer’s appeals process Artikeld in your policy.

How long does it typically take to get a claim settled?

Processing times vary greatly depending on the claim type, complexity, and the insurer’s workload. Simple claims might be settled within weeks, while more complex ones could take months.

Can I choose my own repair shop after an auto accident?

Often, yes, but check your policy. Some insurers have preferred networks, and choosing outside those networks might affect your reimbursement.

What if I don’t have all the required documentation immediately?

Contact your insurer as soon as possible to explain the situation. They may allow you some time to gather the missing documents, but prompt communication is essential.

Are there any time limits for filing a claim?

Yes, there are deadlines. Your policy will specify the time frame for reporting a claim. Contact your insurer immediately after an incident to avoid delays or potential claim denials.