Insurance CRM software is revolutionizing the insurance industry, transforming how companies manage customer relationships, process claims, and drive sales. It’s no longer enough to simply sell policies; today’s competitive landscape demands efficient operations and personalized customer experiences. This powerful software integrates various aspects of insurance management into a single, streamlined platform, offering significant advantages over traditional methods.

From automating tedious tasks like data entry to providing insightful analytics for better decision-making, Insurance CRM software empowers insurance providers to improve efficiency, boost customer satisfaction, and ultimately, increase profitability. This exploration will delve into the core functionalities, benefits, and future trends shaping this crucial technology.

Defining Insurance CRM Software

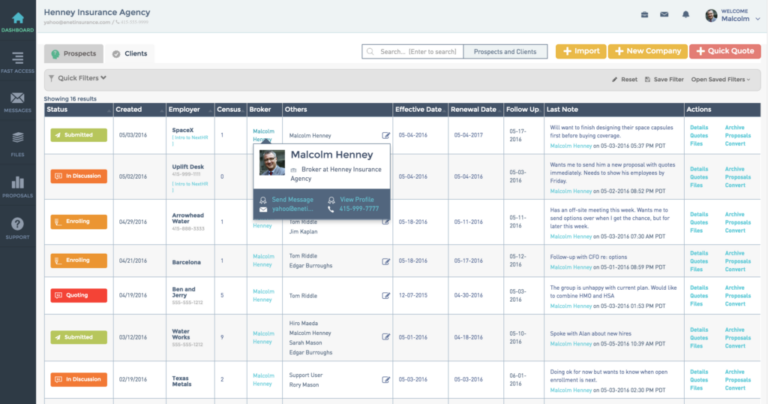

Insurance CRM software is a specialized type of customer relationship management (CRM) system designed specifically for the insurance industry. Unlike generic CRM solutions, it’s built to handle the unique complexities and regulatory requirements of insurance sales, underwriting, claims processing, and policy management. Its core purpose is to streamline operations, improve customer service, and ultimately boost profitability by centralizing all customer and policy information in one accessible location.Insurance CRM software goes beyond simply tracking contacts and interactions.

It integrates with other crucial insurance systems, providing a holistic view of each customer’s relationship with the insurance company. This allows for more efficient workflows, personalized customer experiences, and better risk management.

Key Features Differentiating Insurance CRM Software

The key features that set insurance CRM apart are its specialized functionalities designed to address the specific needs of the insurance sector. These features often include automated workflows for policy renewals, claims processing, and compliance reporting. Advanced analytics tools provide insights into customer behavior, allowing for targeted marketing and proactive risk management. Seamless integration with policy administration systems (PAS) and other core insurance applications is also crucial.

Finally, robust security features are essential to protect sensitive customer and policy data, meeting industry regulations like GDPR and CCPA.

Types of Insurance Businesses Benefiting from Insurance CRM Software

A wide range of insurance businesses can leverage the benefits of a dedicated CRM. Life insurance companies can use it to manage complex policy details, track client interactions throughout the policy lifecycle, and personalize communication strategies for better customer retention. Health insurance providers can utilize the software to streamline claims processing, manage member information, and enhance communication with healthcare providers.

Property and casualty insurers can benefit from features that facilitate risk assessment, claims management, and efficient communication with policyholders and adjusters. Essentially, any insurance business dealing with a significant volume of customer interactions and policy data can significantly improve efficiency and customer satisfaction through the implementation of a specialized insurance CRM.

Benefits of Implementing Insurance CRM Software

Implementing Insurance CRM software offers a significant leap forward in efficiency, customer satisfaction, and ultimately, profitability for insurance companies. It streamlines processes, improves data management, and empowers agents to focus on building relationships rather than getting bogged down in administrative tasks. The overall result is a more responsive, efficient, and successful insurance operation.

Improved Efficiency in Insurance Operations

Insurance CRM software automates many time-consuming tasks, freeing up valuable employee time. For example, automated email campaigns for policy renewals reduce the manual effort required for sending reminders. Lead management features automatically route inquiries to the appropriate agents based on specialization and location, ensuring quicker response times and improved customer experience. Policy management tools provide quick access to all policy information, eliminating the need to search through multiple files or databases.

The integration of various systems, such as claims processing and underwriting, streamlines workflows and reduces data entry duplication. Imagine the time saved by having all client information readily available at your fingertips, rather than searching through physical files or disparate systems.

Impact on Customer Relationship Management

Insurance CRM software dramatically improves customer relationship management. It centralizes all customer interactions, providing a complete 360-degree view of each client’s history, preferences, and needs. This allows for personalized communication and tailored service. For example, targeted marketing campaigns can be created based on customer demographics and policy types, leading to increased engagement and loyalty. The ability to track customer interactions and identify potential problems early allows for proactive customer service, preventing dissatisfaction and potential churn.

Imagine the improved customer experience when an agent can immediately access a client’s full history and preferences during a phone call, allowing for a more informed and personalized conversation.

Increased Sales and Revenue Generation

By improving efficiency and customer relationships, CRM software directly contributes to increased sales and revenue. Automated lead nurturing campaigns can effectively guide prospects through the sales funnel, increasing conversion rates. Detailed sales analytics provide insights into sales performance, allowing companies to identify areas for improvement and optimize their sales strategies. The ability to track customer interactions and identify upselling and cross-selling opportunities leads to increased revenue from existing customers.

For example, a CRM system might identify clients who are nearing the end of their auto insurance policy and automatically suggest a bundled home and auto insurance package. This proactive approach increases sales without requiring significant additional effort.

Comparison of CRM Software vs. Traditional Methods

| Feature | Insurance CRM Software | Traditional Methods |

|---|---|---|

| Data Management | Centralized, easily accessible data; automated data entry | Scattered data across multiple systems; manual data entry; prone to errors |

| Customer Interaction | Personalized communication; automated follow-ups; detailed interaction history | Generic communication; manual follow-ups; fragmented interaction history |

| Efficiency | Automated workflows; reduced manual tasks; improved response times | Manual processes; time-consuming tasks; slow response times |

| Sales & Revenue | Automated lead nurturing; targeted marketing; increased upselling/cross-selling opportunities | Manual sales processes; limited targeting; fewer upselling/cross-selling opportunities |

Key Features of Insurance CRM Software

A robust Insurance CRM system is more than just a contact list; it’s the central nervous system of your insurance business, streamlining operations and improving customer relationships. Choosing the right system means selecting one packed with features designed to manage the complexities of insurance while enhancing efficiency and profitability. The features Artikeld below represent a blend of essential and desirable functionalities for optimal performance.

Effective Insurance CRM software should seamlessly integrate various aspects of the insurance lifecycle, from initial contact to policy renewal and claims resolution. This integration reduces manual data entry, minimizes errors, and creates a unified view of each customer’s interaction with your business. The following sections detail key features categorized for clarity.

Essential Features of Insurance CRM Software

These features form the bedrock of any successful Insurance CRM implementation. Without them, the system would lack the core functionality needed to manage insurance operations effectively. These features are non-negotiable for any serious insurance provider looking to leverage technology for improved efficiency and customer service.

- Policy Management: This includes comprehensive tools for policy creation, renewal, modification, and cancellation. The system should allow for easy access to all policy details, including coverage, premiums, and payment history. Automated reminders for renewals and upcoming payments are also crucial.

- Claims Processing: Streamlined claim submission, tracking, and management are essential. The system should facilitate communication between agents, adjusters, and clients throughout the claims process, minimizing delays and improving transparency.

- Communication Tools: Integrated communication channels like email, SMS, and phone are critical for efficient client interaction. The system should allow for personalized communication and track all communication history with each client.

- Reporting and Analytics: Comprehensive reporting capabilities provide valuable insights into sales performance, customer behavior, and claims trends. These analytics inform strategic decision-making and identify areas for improvement.

Desirable Features Enhancing Customer Service and Agent Productivity

Beyond the essentials, certain features significantly enhance customer service and boost agent productivity, leading to improved overall business performance. These features represent a step beyond the basic requirements and are highly recommended for a competitive advantage.

- Automated Workflows: Automating repetitive tasks such as policy renewals and follow-up emails frees up agents to focus on higher-value activities, such as building client relationships.

- Customer Self-Service Portal: A client portal allows customers to access their policy information, submit claims, and communicate with agents independently, improving satisfaction and reducing agent workload.

- Lead Management: Tools for tracking leads, managing follow-ups, and converting leads into clients are crucial for sales growth.

- Document Management: Centralized storage and easy access to all policy documents, claims forms, and communication records improve efficiency and reduce the risk of lost information.

Integration Capabilities with Other Business Systems

The true power of an Insurance CRM system lies in its ability to seamlessly integrate with other business systems. This integration eliminates data silos, improves data accuracy, and creates a more efficient workflow. Examples of crucial integrations are detailed below.

- Accounting Software Integration: Direct integration with accounting software automates premium payments and expense tracking, reducing manual data entry and minimizing errors.

- Telephony System Integration: Integrating the CRM with the phone system allows for automatic call logging, pop-up customer information during calls, and click-to-dial functionality, significantly improving agent efficiency.

- Third-Party API Integrations: Support for third-party APIs allows for integration with other relevant tools, such as mapping software for claims adjusters or credit scoring services for underwriting.

Selecting and Implementing Insurance CRM Software

Choosing the right Insurance CRM and implementing it successfully is crucial for boosting efficiency and improving customer relationships. A poorly chosen or badly implemented system can lead to wasted resources and frustration. This section Artikels the steps involved in selecting and implementing a CRM solution tailored to your specific insurance business needs.

Steps in Selecting Insurance CRM Software

Selecting the right Insurance CRM involves a systematic approach. First, you need to define your requirements clearly, understanding your existing workflows and future goals. This will guide your evaluation of different software options. Next, you’ll research and compare various CRM solutions, considering factors like functionality, scalability, and integration capabilities. Finally, you’ll need to thoroughly test the chosen software before committing to a full-scale implementation.

This ensures a smooth transition and minimizes disruption to your business operations.

Factors to Consider When Evaluating Insurance CRM Solutions

A comprehensive evaluation checklist is essential. Consider the software’s ability to manage customer data effectively, including policy details, claims information, and communication history. Assess its reporting and analytics capabilities to track key performance indicators (KPIs) and gain valuable insights into your business performance. Examine the user interface and ease of use to ensure seamless adoption by your team.

Finally, investigate the vendor’s reputation, support services, and security measures. A reliable vendor with responsive support is critical for long-term success.

- Data Management Capabilities: The CRM should effectively store and manage all relevant customer and policy data, ensuring data integrity and accessibility.

- Reporting and Analytics: Robust reporting tools are crucial for monitoring key metrics like customer retention, sales conversion rates, and claim processing times.

- User-Friendliness: The software should be intuitive and easy to navigate, minimizing training time and maximizing user adoption.

- Integration Capabilities: The CRM should seamlessly integrate with existing systems like your policy administration system and accounting software.

- Scalability: Choose a solution that can grow with your business, accommodating increasing data volumes and user numbers.

- Security and Compliance: The software must adhere to relevant data privacy regulations and offer robust security features to protect sensitive customer information.

- Vendor Support and Reputation: Select a reputable vendor with a proven track record and excellent customer support.

Best Practices for Successful Implementation and Integration

Successful implementation requires careful planning and execution. Start by forming a dedicated implementation team with representatives from various departments. Develop a comprehensive implementation plan outlining timelines, responsibilities, and training schedules. Thorough data migration is crucial, ensuring accurate and complete transfer of existing customer data. Provide adequate training to your staff, ensuring they understand the new system’s functionalities and workflows.

Finally, monitor the system’s performance post-implementation, addressing any issues promptly and making necessary adjustments.

Potential Challenges During Implementation and Mitigation Strategies

Several challenges can arise during implementation. Data migration issues, resistance to change from staff, and integration complexities are common hurdles. To mitigate these challenges, conduct thorough data cleansing before migration, providing clear communication and training to address staff concerns. Invest in robust integration solutions and engage experienced consultants to manage the technical aspects of implementation. Regular monitoring and proactive problem-solving are key to ensuring a smooth transition.

| Challenge | Mitigation Strategy |

|---|---|

| Data Migration Issues | Thorough data cleansing and validation; phased migration approach |

| Resistance to Change | Effective communication and training; user involvement in the implementation process |

| Integration Complexities | Engage experienced consultants; utilize pre-built integrations where possible |

| Lack of User Adoption | Comprehensive training; ongoing support and feedback mechanisms |

The Role of Data and Analytics in Insurance CRM

Insurance CRM software isn’t just about managing customer interactions; it’s a powerful engine for collecting, analyzing, and leveraging data to drive better business outcomes. By centralizing customer information and automating data capture, it provides a holistic view of your policyholders, enabling more informed decisions across all aspects of your insurance operations.Data collected through an insurance CRM system offers a wealth of opportunities for improving efficiency and profitability.

This data fuels analytics that uncover valuable insights, leading to more personalized services, improved risk assessment, and ultimately, a stronger competitive advantage in the market.

Data Collection and Analysis for Improved Decision-Making

Insurance CRM systems streamline data collection from various sources, including policy applications, claims submissions, customer interactions (phone calls, emails, online chats), and even social media. This consolidated data is then analyzed using built-in reporting tools and dashboards, providing key performance indicators (KPIs) such as customer churn rate, average claim cost, and sales conversion rates. This allows insurance companies to identify areas for improvement, optimize processes, and make data-driven decisions regarding resource allocation and strategic planning.

For example, a high churn rate among a specific demographic might indicate a need for revised product offerings or improved customer service strategies.

Identifying Customer Trends and Personalizing Insurance Offerings

Analyzing customer data reveals valuable trends and patterns in purchasing behavior, risk profiles, and preferences. This information allows insurers to personalize their offerings. For instance, CRM analytics might reveal that customers in a certain geographic area are more prone to specific types of claims. This insight enables the insurer to tailor insurance packages to those customers, offering relevant coverage at competitive prices, potentially including bundled services or discounts based on their specific needs and risk profiles.

This level of personalization fosters stronger customer relationships and boosts customer loyalty.

Data-Driven Insights for Better Risk Assessment and Underwriting, Insurance CRM software

By integrating data from various sources – CRM, policy administration systems, and external data providers – insurance companies can create more accurate risk profiles for individual customers. This leads to improved underwriting decisions, resulting in more competitive premiums and reduced losses. For example, analyzing telematics data from connected car devices, integrated into the CRM, can help insurers assess driving behavior and offer customized rates based on individual risk assessments, rewarding safer drivers with lower premiums.

This data-driven approach minimizes the chance of accepting high-risk policies while allowing for more accurate pricing of lower-risk ones.

Data Flow and Applications within an Insurance CRM System

Imagine a visual representation: Data flows into the CRM from various sources – policy applications, claims, customer interactions, and external data. This data is then processed and cleaned, ensuring accuracy and consistency. The cleaned data populates different sections of the CRM, providing a 360-degree view of each customer. From this central repository, reports and dashboards are generated, offering insights into key metrics.

These insights inform various business functions, including sales, marketing, underwriting, and claims management. For instance, sales teams can use customer profiles to target specific segments with personalized offers, while the underwriting team can use risk assessment data to price policies more accurately. Claims adjusters can access complete customer histories to expedite claim processing, improving customer satisfaction. The entire cycle—data collection, analysis, and application—is iterative, constantly refining processes and improving outcomes.

Future Trends in Insurance CRM Software

The insurance industry is undergoing a rapid digital transformation, and Insurance CRM software is evolving to meet the challenges and opportunities of this new landscape. Emerging technologies are significantly reshaping how insurers interact with customers and manage their operations, leading to more efficient processes and enhanced customer experiences. This section explores these key trends and their implications.

The integration of advanced technologies is driving the evolution of Insurance CRM systems, pushing them beyond simple contact management tools. This shift is fueled by the need for insurers to improve customer engagement, personalize offerings, and optimize operational efficiency in an increasingly competitive and data-driven market.

Artificial Intelligence and Machine Learning in Insurance CRM

AI and machine learning are poised to revolutionize Insurance CRM. These technologies enable predictive analytics, allowing insurers to anticipate customer needs and proactively address potential issues. For example, AI-powered CRM systems can analyze customer data to identify individuals at high risk of churning and trigger targeted retention campaigns. Machine learning algorithms can also automate tasks such as claims processing and fraud detection, freeing up human agents to focus on more complex and relationship-building tasks.

The impact is a significant improvement in both customer satisfaction and operational efficiency. Consider a scenario where an AI system flags a potential fraud claim, saving the company significant financial losses and allowing quicker processing of legitimate claims. This results in faster claim payouts and happier customers.

Enhanced Customer Experience Through Personalized Interactions

Future-oriented Insurance CRM systems will leverage AI to personalize customer interactions at every touchpoint. This includes tailored communication, customized product recommendations, and proactive support. Imagine a scenario where a CRM system analyzes a customer’s driving history and offers them a personalized discount on their auto insurance. Or, consider a system that automatically sends a relevant policy document or reminder based on the customer’s specific needs and preferences.

This level of personalization enhances customer loyalty and satisfaction, leading to improved retention rates. This contrasts sharply with traditional CRM systems that often relied on generic, mass-market approaches.

Automation and Streamlined Operations

The integration of robotic process automation (RPA) and other automation technologies into Insurance CRM significantly streamlines operational processes. Tasks like data entry, policy administration, and claim processing can be automated, reducing manual effort and improving accuracy. This frees up human employees to focus on higher-value activities such as customer relationship management and strategic planning. For instance, RPA can automatically extract data from various sources and populate the CRM system, reducing the risk of human error and saving significant time and resources.

The difference between traditional manual processes and automated systems is a stark improvement in efficiency and cost reduction.

The Evolving Role of Data and Analytics

Data and analytics will play an increasingly crucial role in the future of Insurance CRM. Advanced analytics tools will allow insurers to gain deeper insights into customer behavior, preferences, and risk profiles. This data-driven approach enables more effective marketing campaigns, improved product development, and better risk management. Traditional CRM systems often lacked the sophisticated analytics capabilities needed to derive actionable insights from large datasets.

Future systems will be built on robust data platforms, allowing insurers to leverage the full potential of their data. This allows for better risk assessment and more accurate pricing models, ultimately leading to a more profitable and sustainable business model.

Traditional vs. Future-Oriented Insurance CRM Systems

Traditional Insurance CRM systems primarily focused on contact management and basic reporting. They lacked the advanced analytics and AI capabilities found in future-oriented systems. Future-oriented systems leverage AI, machine learning, and automation to deliver personalized experiences, streamline operations, and enhance decision-making. This shift from reactive to proactive customer management represents a fundamental change in how insurers operate. The contrast is significant: traditional systems were largely reactive, responding to customer inquiries and managing existing policies, while future systems anticipate customer needs and proactively engage them, leading to stronger relationships and improved business outcomes.

Closure

Ultimately, Insurance CRM software represents a critical investment for any insurance business aiming for growth and sustainability in today’s dynamic market. By embracing the power of data-driven insights, automated workflows, and personalized customer interactions, insurance companies can significantly enhance their operational efficiency, strengthen customer relationships, and achieve a competitive edge. The future of insurance is undoubtedly intertwined with the ongoing evolution of this transformative technology.

Detailed FAQs

What is the cost of Insurance CRM software?

Costs vary widely depending on the features, scalability, and vendor. Expect a range from affordable cloud-based solutions to more expensive enterprise-level systems with extensive customization options.

How long does it take to implement Insurance CRM software?

Implementation timelines depend on the complexity of the system and the size of the insurance business. Smaller implementations might take weeks, while larger ones could take several months.

What kind of training is needed for employees?

Most vendors provide training resources, including online tutorials, webinars, and in-person sessions. The extent of training required depends on the software’s complexity and the employees’ technical skills.

Can Insurance CRM software integrate with my existing systems?

Many Insurance CRM systems offer integration capabilities with various business systems, including accounting software, telephony systems, and policy administration systems. Check the vendor’s specifications to ensure compatibility.

What security measures are in place to protect customer data?

Reputable vendors prioritize data security and comply with relevant regulations (like GDPR or HIPAA). Look for features like data encryption, access controls, and regular security audits.