Insurance lead management software revolutionizes how insurance companies handle potential clients. It’s not just about storing contact information; it’s about optimizing the entire sales process, from initial lead capture to final conversion. This software empowers agents to focus on what matters most: building relationships and closing deals, all while boosting efficiency and maximizing ROI. This exploration dives into the core functionalities, benefits, and considerations surrounding this crucial technology.

We’ll cover everything from lead qualification and assignment strategies to the importance of integration with other business systems and the role of automation in streamlining workflows. We’ll also examine the critical aspects of data security and compliance. By the end, you’ll have a comprehensive understanding of how insurance lead management software can transform your sales process and drive significant growth.

Defining Insurance Lead Management Software

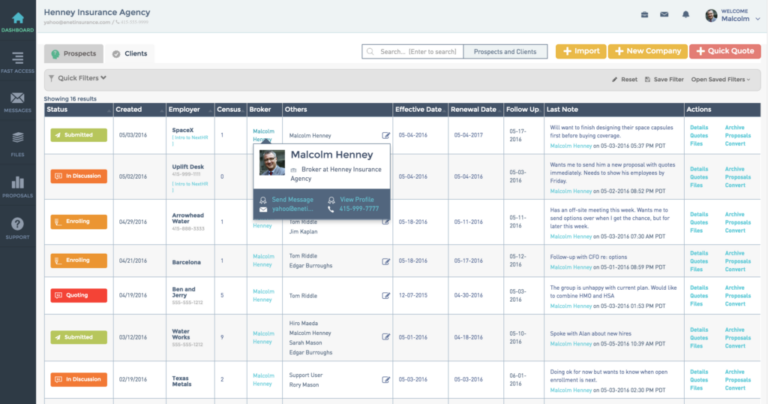

Insurance lead management software streamlines the entire process of acquiring, nurturing, and converting insurance leads into paying customers. It’s designed to boost efficiency and improve the overall sales process within the insurance industry, helping agents and brokers manage a high volume of leads effectively. This software acts as a central hub for all lead-related activities, from initial contact to policy issuance.

At its core, insurance lead management software offers functionalities designed to automate and optimize various stages of the sales cycle. This includes lead capture, qualification, assignment, tracking, communication, and reporting. It integrates various communication channels, allowing agents to interact with potential clients seamlessly across multiple platforms.

Core Functionalities of Insurance Lead Management Software

Insurance lead management software typically includes features such as lead capture forms, automated email sequences, lead scoring and qualification tools, CRM integration, reporting dashboards, and communication tracking. These features work together to provide a comprehensive solution for managing the entire lead lifecycle. For instance, lead scoring helps prioritize leads based on their potential to convert, while automated email sequences nurture leads and keep them engaged throughout the sales process.

The software also provides detailed reporting on key metrics such as conversion rates and sales performance, allowing agents to identify areas for improvement.

Types of Insurance Leads Handled

The software handles various types of insurance leads, including those generated from online advertising, referrals, inbound calls, trade shows, and direct mail campaigns. Each lead is typically tagged with relevant information such as contact details, insurance needs, and the source of the lead. This allows for targeted follow-up and personalized communication, enhancing the chances of conversion. For example, a lead generated from a website form might be different from a lead generated from a phone call, requiring different approaches and communication strategies.

The software enables agents to tailor their communication based on the specific characteristics of each lead.

Examples of Efficiency Improvements in Insurance Sales

Insurance lead management software significantly improves efficiency in several ways. It automates repetitive tasks such as data entry and email follow-ups, freeing up agents to focus on building relationships and closing deals. The software also provides a centralized system for managing leads, eliminating the risk of leads falling through the cracks. By tracking lead interactions and providing real-time insights, it enables agents to make data-driven decisions, leading to improved conversion rates and increased sales.

For example, an agent can quickly identify leads that haven’t been contacted in a while and prioritize them for follow-up, ensuring no potential customer is overlooked.

Comparison of Insurance Lead Management Software Categories

Different insurance lead management software solutions cater to varying needs and budgets. The following table highlights key features across different categories:

| Feature | Basic | Mid-Range | Enterprise |

|---|---|---|---|

| CRM Integration | Limited or None | Integration with popular CRMs | Seamless, customizable CRM integration |

| Automation Level | Basic email automation | Advanced automation workflows, lead scoring | Highly customizable automation, AI-powered features |

| Reporting Capabilities | Basic reports on lead volume | Detailed reports on conversion rates, sales performance | Advanced analytics, custom dashboards, predictive modeling |

| Pricing | Low monthly fee | Moderate monthly fee | High monthly fee, often customized contracts |

Lead Capture and Qualification

Effective lead capture and qualification are crucial for any insurance agency’s success. A robust lead management system streamlines this process, allowing agents to focus on converting qualified leads into paying customers rather than wasting time on unqualified prospects. This section details how insurance lead management software facilitates efficient lead capture and qualification.Lead Capture MethodsInsurance lead management software offers a variety of methods for capturing leads, maximizing reach and efficiency.

These methods are designed to integrate seamlessly with various marketing channels, creating a centralized hub for all incoming leads.

Lead Capture Methods Using Software

- Web Forms: The software typically integrates with website forms, automatically capturing lead data (name, email, phone number, insurance needs) and routing it directly into the system for processing. This eliminates manual data entry and ensures consistent data capture.

- Social Media Integration: Leads generated from social media campaigns (Facebook, LinkedIn, etc.) can be automatically imported into the software, providing a comprehensive view of all lead sources.

- API Integrations: The software may integrate with other marketing and sales tools (CRM, email marketing platforms) via APIs, allowing for seamless lead transfer and automated workflows. This avoids data silos and ensures a unified view of the customer journey.

- Phone Integrations: Call tracking and recording features can automatically log call details and identify potential leads, enriching the lead profile with valuable conversation data.

- Email Marketing Campaigns: Leads generated through email marketing campaigns are automatically logged, allowing for tracking of campaign effectiveness and identification of high-potential leads.

Lead Qualification Process

Lead qualification involves assessing the potential of each lead to convert into a paying customer. The software facilitates this by providing tools for scoring leads based on predefined criteria and automating the routing of leads to the appropriate sales representatives.

Lead Qualification Criteria and Scoring

The software allows users to define specific criteria for qualifying leads. This might include factors such as:

- Budget: Leads with a clearly defined budget for insurance are more likely to convert.

- Insurance Needs: Leads expressing a clear need for specific insurance coverage (e.g., life insurance, auto insurance) are prioritized.

- Engagement Level: Leads who actively engage with marketing materials or respond to sales outreach are considered higher quality.

- Demographics: Certain demographic factors might correlate with higher conversion rates.

The software then assigns a score to each lead based on these criteria, enabling agents to prioritize high-potential leads. For example, a lead with a high budget and clear insurance needs might receive a higher score than a lead with limited budget and unclear needs.

Best Practices for Maximizing Lead Capture Effectiveness

To maximize lead capture effectiveness, consider these best practices:

- Optimize Web Forms: Keep web forms short and simple, requesting only essential information. Use clear and concise language, and offer incentives for completion.

- Targeted Marketing Campaigns: Focus marketing efforts on specific demographics and insurance needs to attract qualified leads.

- Regularly Review and Update Lead Qualification Criteria: Adjust qualification criteria based on performance data to optimize lead scoring accuracy.

- Integrate with CRM: Integrate the lead management software with a CRM system to maintain a complete customer profile and track interactions throughout the sales cycle.

- Monitor and Analyze Lead Sources: Track lead sources to identify the most effective channels and allocate resources accordingly.

Lead Capture and Qualification Workflow Diagram

Imagine a flowchart. It begins with a “Lead Source” box (Website, Social Media, Phone, Email, etc.), leading to a “Lead Capture” box (Data captured automatically into the software). This then flows to a “Lead Qualification” box (Scoring based on predefined criteria). High-scoring leads are routed to a “Sales Representative” box for immediate follow-up, while low-scoring leads might go to a “Nurture” box (automated email sequences or other follow-up strategies).

Finally, all leads, regardless of qualification, are tracked in a “Lead Management System” box, providing a comprehensive overview of the lead pipeline.

Lead Assignment and Distribution

Getting leads to the right agents quickly and efficiently is crucial for maximizing sales. Effective lead assignment and distribution directly impacts your team’s productivity and ultimately, your bottom line. A well-designed system ensures leads are handled promptly, preventing them from going cold and improving overall conversion rates.Lead assignment and distribution methods vary widely depending on the size and structure of your sales team and the complexity of your leads.

The goal is to match leads with the agents best suited to convert them, considering factors like agent specialization, location, and lead characteristics.

Lead Assignment Methods, Insurance lead management software

Several methods exist for assigning leads, each with its own strengths and weaknesses. Choosing the right method requires careful consideration of your specific needs and resources.

- Round Robin: This is a simple, automated system that assigns leads sequentially to agents. It ensures fair distribution and is easy to implement, but it doesn’t account for agent expertise or lead characteristics.

- Priority-Based Assignment: This method prioritizes leads based on pre-defined criteria, such as lead score, value, or urgency. High-value leads might be assigned to your top performers, while less valuable leads go to agents with more capacity. This approach optimizes for conversion rates by focusing high-potential leads on your most effective agents.

- Skill-Based Routing: This approach assigns leads based on agent skills and experience. For example, a lead interested in commercial insurance might be routed to an agent specializing in that area. This method requires a robust system for tracking agent skills and lead attributes.

- Geographic Assignment: This method is particularly useful for businesses with a geographically dispersed customer base. Leads are assigned to agents based on proximity, minimizing travel time and improving response times.

Optimizing Lead Distribution for Maximum Conversion Rates

Optimizing lead distribution involves more than just assigning leads; it requires a holistic approach. Analyzing historical data to identify patterns in lead conversion rates is critical. This allows you to refine your assignment strategies and improve overall efficiency.For example, analyzing data might reveal that a particular agent consistently converts a higher percentage of leads from a specific source or demographic.

This information can then be used to prioritize assigning similar leads to that agent. Furthermore, regularly reviewing your lead scoring system and adjusting it based on performance data is vital for maintaining optimal lead distribution. A well-tuned lead scoring system ensures that your highest-potential leads are always prioritized.

Round-Robin and Priority-Based Assignment Examples

Let’s illustrate with a simplified example. Imagine a team of three agents: Agent A, Agent B, and Agent C. Round Robin: Leads 1, 2, 3, 4, 5, and 6 would be assigned to A, B, C, A, B, C respectively. Priority-Based Assignment: Assume leads are scored 1-10 based on their potential value. Lead 1 (score 9), Lead 2 (score 3), and Lead 3 (score 7) arrive.

A priority-based system might assign Lead 1 to Agent A (your top performer), Lead 3 to Agent B (your second-best), and Lead 2 to Agent C.

Factors to Consider When Designing a Lead Assignment Strategy

Before implementing a lead assignment strategy, several crucial factors require careful consideration:

- Agent Capacity and Performance: Consider each agent’s current workload, historical conversion rates, and areas of expertise.

- Lead Source and Quality: Leads from different sources may have varying conversion rates, requiring different assignment strategies.

- Lead Scoring and Qualification: A robust lead scoring system is essential for prioritizing high-potential leads.

- Automation and Integration: Integrate your lead assignment system with your CRM and other sales tools for seamless workflow.

- Reporting and Analytics: Regularly track key metrics to monitor performance and identify areas for improvement.

- Team Structure and Specialization: Tailor your assignment strategy to match your team’s structure and individual agent skills.

Lead Tracking and Reporting

Effective lead tracking and reporting are crucial for optimizing your insurance sales process. By monitoring key metrics and analyzing performance trends, you gain valuable insights into what’s working and what needs improvement, ultimately leading to increased efficiency and higher conversion rates. Insurance lead management software provides the tools to do just that, automating data collection and providing powerful reporting features.Lead tracking and reporting in insurance lead management software goes beyond simply logging leads.

It provides a comprehensive overview of the entire lead lifecycle, from initial capture to final conversion or disqualification. This allows for data-driven decision-making, enabling you to refine your strategies and maximize your return on investment.

Key Metrics Tracked by Insurance Lead Management Software

Insurance lead management software typically tracks a range of key performance indicators (KPIs) to provide a holistic view of lead performance. These metrics offer insights into various aspects of the sales process, allowing for targeted improvements.

- Lead Source: Identifying where your most productive leads originate (e.g., website, social media, referrals).

- Lead Conversion Rate: The percentage of leads that convert into paying customers.

- Lead Response Time: The average time taken to respond to a new lead. Faster response times generally lead to higher conversion rates.

- Average Deal Size: The average value of policies sold to leads generated through the system.

- Lead Qualification Rate: The percentage of leads deemed qualified and worth pursuing.

- Sales Cycle Length: The average time it takes to close a deal, from initial contact to policy issuance.

- Customer Acquisition Cost (CAC): The cost associated with acquiring a new customer through a specific lead source.

Reporting Features and Lead Performance Analysis

Reporting features within the software transform raw data into actionable insights. These reports help identify bottlenecks, areas for improvement, and successful strategies. For instance, analyzing response times can reveal if delays are hindering conversions, prompting adjustments to workflow processes. Similarly, examining lead sources highlights the most effective channels for generating high-quality leads, allowing for optimized marketing budget allocation.

The software often allows for customized reports, filtering data by various parameters to answer specific business questions.

Examples of Insightful Reports

The software generates a variety of reports, offering different perspectives on lead performance. Examples include:

- Lead Source Performance Report: Shows the number of leads generated, conversion rates, and cost per acquisition for each lead source.

- Sales Rep Performance Report: Tracks individual sales representative performance based on metrics like conversion rates, response times, and deal size.

- Lead Response Time Report: Highlights average response times and their correlation with conversion rates.

- Lead Qualification Report: Shows the percentage of leads qualified versus disqualified, identifying potential improvements in lead qualification processes.

Sample Lead Performance Report

This table illustrates a sample report showing key lead metrics for different lead sources over a specific period.

| Lead Source | Leads Generated | Conversion Rate | Average Response Time (hours) |

|---|---|---|---|

| Website | 150 | 15% | 2.5 |

| Social Media | 80 | 10% | 4.0 |

| Referrals | 50 | 25% | 1.5 |

| Email Marketing | 120 | 12% | 3.0 |

Integration with Other Systems

Seamless integration is crucial for any modern insurance lead management software. It’s not just about having the software; it’s about how effectively it works with your existing infrastructure to streamline operations and boost efficiency. A well-integrated system minimizes manual data entry, reduces errors, and ultimately saves time and money.Effective integration enhances workflow and data accuracy by creating a centralized hub for all lead-related information.

This eliminates the need to switch between different applications, reducing the risk of data discrepancies and ensuring everyone is working with the most up-to-date information. The result is a more efficient and informed sales process, leading to improved conversion rates.

Examples of Successful Integrations and Their Benefits

Successful integrations significantly improve operational efficiency. For example, integrating a lead management system with a CRM (Customer Relationship Management) system provides a complete view of each lead, from initial contact to policy sale. This unified view allows agents to personalize their interactions and tailor their approach, improving customer engagement and sales conversion rates. Integrating with a phone system allows for automatic lead routing and call tracking, providing valuable insights into agent performance and call effectiveness.

Imagine a scenario where a lead calls in, the system automatically identifies them, pulls up their history from the CRM, and routes the call to the most appropriate agent – all without manual intervention. This level of automation drastically reduces response times and enhances the customer experience. Another powerful integration is with marketing automation platforms. This allows for targeted lead nurturing campaigns, based on lead behavior and scoring, ensuring that the right message reaches the right prospect at the right time.

This targeted approach increases engagement and conversion rates.

Technical Aspects of Integrating Different Systems

The technical side of integration involves various methods, each with its own advantages and complexities. Common approaches include API (Application Programming Interface) integrations, which allow different systems to communicate and exchange data directly. This offers flexibility and real-time data synchronization. Another method involves using middleware, a software layer that acts as a bridge between disparate systems, translating data formats and ensuring seamless communication.

This approach is particularly useful when integrating older or less compatible systems. The choice of integration method depends on several factors, including the technical capabilities of the systems involved, the desired level of integration, and the budget. Security is paramount; secure protocols like HTTPS and robust authentication mechanisms must be implemented to protect sensitive data during transmission and storage.

Data mapping and transformation are also crucial, ensuring that data is correctly interpreted and transferred between systems. Consider a scenario where an insurance lead management system needs to integrate with a CRM. The lead’s name, contact information, and policy preferences must be accurately mapped and transformed to ensure consistency across both systems. Failure to do so can lead to data inconsistencies and errors.

Automation and Workflow Optimization

Automating your insurance lead management process is crucial for maximizing efficiency and minimizing wasted time and resources. By leveraging automation features, you can significantly improve response times, boost agent productivity, and ultimately increase your conversion rates. This section explores key automation areas and demonstrates how they streamline the entire lead lifecycle.Automation significantly improves efficiency in several key areas of insurance lead management.

It reduces manual data entry, minimizes human error, ensures consistent follow-up, and allows for quicker responses to potential clients. This ultimately translates to a better customer experience and a more profitable business.

Key Automation Areas

The software offers a suite of automation features designed to address various stages of the lead management process. These features work together to create a seamless and efficient workflow.

- Automated Lead Routing: Leads are automatically assigned to the most appropriate agent based on pre-defined criteria such as location, product expertise, or availability.

- Automated Email and SMS Campaigns: Pre-written email and SMS messages are automatically sent to leads at pre-determined intervals, nurturing them through the sales funnel and providing timely updates.

- Automated Lead Scoring: Leads are automatically scored based on various factors like demographics, engagement level, and past interactions, allowing agents to prioritize high-potential leads.

- Automated Data Entry: Information from various sources, such as online forms or CRM systems, is automatically imported and entered into the lead management system, eliminating manual data entry.

- Automated Reporting and Analytics: The system automatically generates reports and analytics on key metrics, providing insights into lead performance and overall process efficiency.

Workflow Automation Example

Consider a typical lead lifecycle. Automation can drastically reduce manual effort and improve response times. Here’s a streamlined workflow:

A potential client fills out an online form on your website.

The system automatically captures the lead information and assigns a unique ID.

Based on pre-defined criteria (e.g., location, product interest), the lead is automatically routed to the most suitable agent.

An automated email is sent to the lead acknowledging their inquiry and providing preliminary information.

A follow-up email is automatically sent after 24 hours, containing more relevant information and offering a call.

The agent receives a notification about the new lead and can access all relevant information within the system.

The agent follows up with the lead and updates the system with the outcome of the interaction.

The system automatically generates reports tracking key metrics like lead conversion rates and response times.

This automated workflow significantly reduces manual tasks, ensures timely follow-up, and provides valuable data-driven insights to optimize the overall lead management process. For instance, a company using a similar automated system saw a 30% increase in lead conversion rates within three months of implementation, directly attributable to faster response times and more consistent follow-up. This illustrates the significant impact automation can have on a company’s bottom line.

Cost and ROI of Insurance Lead Management Software

Investing in insurance lead management software represents a significant decision for any insurance agency. The initial cost is only one piece of the puzzle; understanding the potential return on investment (ROI) is crucial for justifying the expense and ensuring a successful implementation. This section will explore various pricing models, methods for calculating ROI, and the long-term cost savings associated with using this type of software.Pricing models for insurance lead management software vary considerably.

Some vendors offer tiered pricing based on features, the number of users, or the volume of leads processed. Others utilize a subscription model with monthly or annual fees. A few may even offer a one-time purchase option, though this is less common for comprehensive software solutions requiring ongoing updates and support. It’s essential to carefully review all pricing details, including any hidden costs or additional fees for implementation, training, or customization.

Pricing Models of Insurance Lead Management Software

Insurance lead management software pricing can be categorized into several models: Tiered pricing structures typically offer different packages with varying features and user limits. For example, a basic package might handle a limited number of leads and users, while a premium package provides advanced analytics and unlimited users. Subscription-based models are common, charging a recurring monthly or annual fee for access to the software.

This usually includes software updates, technical support, and ongoing maintenance. Finally, while less prevalent, some vendors might offer a one-time purchase option, but this often lacks ongoing support and updates. The optimal model depends heavily on the size and needs of the insurance agency.

Calculating the ROI of Insurance Lead Management Software

Calculating the ROI of insurance lead management software involves comparing the costs of implementation and ongoing maintenance against the benefits derived from improved lead management. A typical approach involves quantifying the increase in conversion rates, the reduction in processing time for leads, and the improvement in sales efficiency. For example, if the software increases the conversion rate of leads by 10%, and the average value of a closed deal is $5,000, the increased revenue can be directly attributed to the software.

Subtracting the cost of the software from this increased revenue provides a clear picture of the ROI. Furthermore, the reduction in manual labor costs due to automation can significantly contribute to the positive ROI.

Long-Term Cost Savings

The long-term cost savings associated with insurance lead management software stem from several factors. Automation of tasks like lead assignment, follow-up, and reporting reduces the need for manual labor, leading to significant cost reductions in personnel expenses. Improved lead qualification minimizes wasted time and resources on unqualified leads, resulting in higher conversion rates and increased efficiency. Furthermore, better lead tracking and reporting provide valuable insights into sales performance, allowing for data-driven decisions that optimize sales strategies and reduce marketing expenses.

Finally, integration with other systems streamlines workflows and eliminates redundancies, further contributing to long-term cost savings.

Cost and Benefit Comparison of Different Software Options

| Software Option | Pricing Model | Initial Costs | Long-Term Benefits |

|---|---|---|---|

| Software A | Tiered Subscription ($500-$2000/month) | Implementation fees ($1000), Training ($500) | Increased conversion rate (15%), Reduced processing time (50%), Improved sales efficiency (20%) |

| Software B | One-time purchase ($10,000) | High initial cost, No ongoing subscription fees | Requires internal IT support, Limited features compared to subscription models, May require additional upgrades/maintenance costs |

| Software C | Monthly Subscription ($1000/month) | Low implementation costs, User-friendly interface | Basic features, Limited scalability for growing businesses, No advanced analytics |

| Software D | Custom Solution (Quote-based) | High initial cost, Significant customization possibilities | Tailored to specific business needs, potentially higher ROI, but also higher risk and potential for cost overruns |

Security and Data Privacy

In the insurance industry, handling sensitive customer data is paramount. A robust security infrastructure within your lead management software is not just a good idea; it’s a necessity for maintaining client trust and complying with regulations. Choosing a system with inadequate security measures can lead to significant financial and reputational damage.Data breaches can expose personally identifiable information (PII), such as social security numbers, addresses, and financial details, leading to identity theft, financial losses for clients, and hefty fines for the insurance company.

Furthermore, a breach can severely damage your company’s reputation, making it difficult to attract and retain both clients and employees.

Security Measures Implemented by Reputable Software Providers

Reputable insurance lead management software providers employ a multi-layered approach to security. This typically includes robust encryption protocols (both in transit and at rest) to protect data from unauthorized access. They also implement strict access control measures, using role-based permissions to limit access to sensitive data based on an individual’s job function. Regular security audits and penetration testing are conducted to identify and address vulnerabilities before they can be exploited.

Furthermore, providers often utilize advanced threat detection systems, such as intrusion detection and prevention systems (IDPS), to monitor network traffic for suspicious activity and automatically block malicious attempts. Data backups and disaster recovery plans are also crucial components of a comprehensive security strategy, ensuring business continuity in the event of a system failure or cyberattack. Multi-factor authentication (MFA) adds another layer of security, requiring users to provide multiple forms of authentication before gaining access to the system.

Best Practices for Protecting Sensitive Customer Data

Beyond the security features provided by the software itself, organizations must adopt best practices to further enhance data protection. This includes regularly updating the software and its security components to patch vulnerabilities. Employee training programs are crucial to educate staff about security threats and best practices, such as strong password management and phishing awareness. Data minimization is also key; only collect and store the data absolutely necessary for business operations.

Regularly reviewing and updating data retention policies ensures that sensitive data is not kept longer than required. Finally, implementing a comprehensive incident response plan helps to minimize the impact of a potential breach by outlining clear steps to take in the event of a security incident.

Compliance with Data Privacy Regulations

Adherence to relevant data privacy regulations, such as GDPR (General Data Protection Regulation) in Europe and CCPA (California Consumer Privacy Act) in California, is mandatory. Reputable software providers design their systems with these regulations in mind, incorporating features to support compliance. This includes providing tools for data subject access requests (DSARs), allowing individuals to access, correct, or delete their personal data.

Consent management features ensure that data is only collected and processed with explicit consent. Data mapping and impact assessments help organizations understand the data they hold and the potential risks associated with it. Regular audits and documentation are crucial for demonstrating compliance to regulatory bodies. Providers often offer detailed documentation and support to help clients navigate these complexities and ensure their operations remain compliant.

Last Recap

Ultimately, effective insurance lead management software isn’t just a tool; it’s a strategic investment. By streamlining processes, improving efficiency, and providing valuable data-driven insights, it empowers insurance businesses to convert more leads, increase revenue, and gain a competitive edge. Choosing the right software requires careful consideration of your specific needs and resources, but the potential rewards are undeniable.

This guide has provided a solid foundation for understanding the key elements, and now it’s time to explore the options available and begin building a more efficient and profitable sales pipeline.

Detailed FAQs: Insurance Lead Management Software

What are the common pricing models for insurance lead management software?

Common models include subscription-based pricing (monthly or annual fees), tiered pricing based on features and user numbers, and sometimes one-time license fees for perpetual use. Some providers offer custom pricing based on specific business needs.

How do I measure the ROI of insurance lead management software?

Track key metrics like lead conversion rates, sales cycle length, cost per acquisition (CPA), and agent productivity before and after implementation. Compare these metrics to determine the increase in revenue and efficiency gained, allowing for a clear ROI calculation.

What are the potential security risks associated with insurance lead management software, and how can they be mitigated?

Risks include data breaches, unauthorized access, and non-compliance with data privacy regulations. Mitigation involves choosing software with robust security features (encryption, access controls, regular security audits), implementing strong internal security policies, and ensuring compliance with regulations like GDPR and CCPA.

Can I integrate my existing CRM with insurance lead management software?

Many insurance lead management software solutions offer seamless integration with popular CRM platforms like Salesforce and HubSpot. Check the software’s compatibility before purchasing to ensure a smooth transition and avoid data silos.