Compare health insurance plans? It sounds daunting, but it’s crucial for securing your well-being and financial future. Navigating the world of HMOs, PPOs, EPOs, and POS plans can feel like deciphering a secret code, but understanding the differences in cost structures, provider networks, and out-of-pocket expenses is key to finding a plan that truly fits your needs. This guide cuts through the jargon, helping you compare plans effectively and make an informed decision.

We’ll explore the various types of plans, highlighting the key factors to consider like deductibles, copayments, and coinsurance. We’ll also delve into the often-overlooked aspects, such as pre-existing conditions and how they impact your choices. Ultimately, we aim to empower you to confidently compare health insurance options and choose the best coverage for you and your family.

Types of Health Insurance Plans

Choosing the right health insurance plan can feel overwhelming, but understanding the key differences between the main types can simplify the process. This section breaks down the common plan types, highlighting their cost structures, provider networks, and out-of-pocket expenses. We’ll also explore the distinctions between individual and family plans, and delve into the specifics of Medicare and Medicaid.

HMO, PPO, EPO, and POS Plans Compared

Selecting the right plan depends heavily on your healthcare needs and preferences. Here’s a comparison of four common types: HMO (Health Maintenance Organization), PPO (Preferred Provider Organization), EPO (Exclusive Provider Organization), and POS (Point of Service) plans.

| Plan Type | Provider Network | Cost Structure | Out-of-Pocket Expenses |

|---|---|---|---|

| HMO | Narrow network of doctors and hospitals; usually requires a primary care physician (PCP) referral for specialists. | Generally lower premiums; typically requires co-pays for visits. | Lower overall costs if you stay in-network; high out-of-pocket costs for out-of-network care. |

| PPO | Broad network of doctors and hospitals; typically doesn’t require a PCP referral. | Higher premiums than HMOs; typically requires co-pays or coinsurance. | Higher premiums, but generally lower out-of-pocket costs even for out-of-network care (though usually at a higher cost-sharing rate). |

| EPO | Narrow network of doctors and hospitals; usually doesn’t require a PCP referral. | Premiums are generally between HMOs and PPOs. | No coverage for out-of-network care except in emergencies. |

| POS | Combines features of HMOs and PPOs; usually requires a PCP referral for specialists, but offers out-of-network options. | Premiums are generally between HMOs and PPOs. | Lower costs for in-network care; higher costs for out-of-network care, often requiring higher co-pays or coinsurance. |

Individual vs. Family Health Insurance Plans

Individual plans cover only the policyholder, while family plans extend coverage to the policyholder and their dependents (spouse and children). Family plans typically have higher premiums than individual plans but offer broader coverage. Premium costs for family plans vary significantly depending on the number of dependents and their ages. For example, a family of four will generally pay significantly more than an individual, but the cost per person might be lower than purchasing four separate individual plans.

Medicare and Medicaid

Medicare and Medicaid are government-sponsored health insurance programs. Medicare primarily covers individuals aged 65 and older or those with certain disabilities, while Medicaid primarily covers low-income individuals and families.Medicare has several parts: Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage), and Part D (prescription drug insurance). Eligibility for Medicare is based on age, disability status, or end-stage renal disease.

Benefits include coverage for hospital stays, doctor visits, and prescription drugs (depending on the part).Medicaid eligibility requirements vary by state, but generally include factors like income, assets, and family size. Benefits under Medicaid vary by state but typically include coverage for doctor visits, hospital stays, prescription drugs, and other healthcare services. For example, some states may offer broader dental or vision coverage than others.

Key Factors to Consider When Choosing a Plan

Picking the right health insurance plan can feel overwhelming, but understanding a few key factors simplifies the process. This section will break down crucial aspects to consider, ensuring you choose a plan that best fits your needs and budget. We’ll look at cost-sharing, essential benefits, and the impact of pre-existing conditions.

Deductibles, Copayments, and Coinsurance

Understanding how deductibles, copayments, and coinsurance work is vital for comparing plans. These are the amounts you pay out-of-pocket before your insurance kicks in more substantially. Different plan types handle these differently, significantly affecting your overall costs.

- Deductible: The amount you pay for covered healthcare services before your insurance company starts paying. Once you meet your deductible, your insurance coverage begins.

- Copayment (Copay): A fixed amount you pay for a covered healthcare service, like a doctor’s visit. Copays are usually due at the time of service.

- Coinsurance: Your share of the costs of a covered healthcare service, calculated as a percentage (e.g., 20%) after you’ve met your deductible. You pay the percentage; your insurance company pays the rest.

Here’s a comparison across plan types (note that these are examples and can vary widely):

| Plan Type | Deductible | Copay (Doctor Visit) | Coinsurance |

|---|---|---|---|

| High Deductible Health Plan (HDHP) | $5,000 – $10,000+ | $25-$50 | 20% |

| Preferred Provider Organization (PPO) | $1,000 – $5,000 | $50-$100 | 20-30% |

| Health Maintenance Organization (HMO) | $0-$2,000 | $25-$50 | 0-20% |

High Deductible Plans vs. Low Deductible Plans:

- High Deductible Plans:

- Advantages: Lower monthly premiums.

- Disadvantages: Higher out-of-pocket costs if you need significant medical care before meeting the deductible. May not be suitable for those with frequent or costly healthcare needs.

- Low Deductible Plans:

- Advantages: Lower out-of-pocket costs for covered services. Better for individuals with anticipated higher healthcare expenses.

- Disadvantages: Higher monthly premiums.

Essential Health Benefits

Most health insurance plans in the United States are required to cover essential health benefits (EHBs). These are a set of ten categories of services designed to provide comprehensive coverage. Understanding what’s included is crucial for evaluating a plan’s value. These benefits typically include: hospitalization, surgery, doctor visits, prescription drugs, mental health services, maternity care, and more. The specific services and limitations can vary slightly between plans, so reviewing the details of each plan’s coverage is important.

Pre-existing Conditions

The Affordable Care Act (ACA) prohibits health insurance companies from denying coverage or charging higher premiums based on pre-existing conditions. However, it’s still crucial to understand how your pre-existing conditions might impact your plan choice. Some plans might have higher out-of-pocket costs or specific requirements for managing your condition. For example, a plan might require you to see specific specialists within their network for managing a chronic condition.

Always review the plan details to ensure it adequately addresses your specific health needs.

Cost Comparison and Savings Strategies

Choosing the right health insurance plan isn’t just about coverage; it’s about finding the best balance between cost and protection. Understanding how to compare plans and implement cost-saving strategies is crucial for managing your healthcare expenses effectively. This section will Artikel methods for comparing plans and highlight strategies to minimize your out-of-pocket costs.

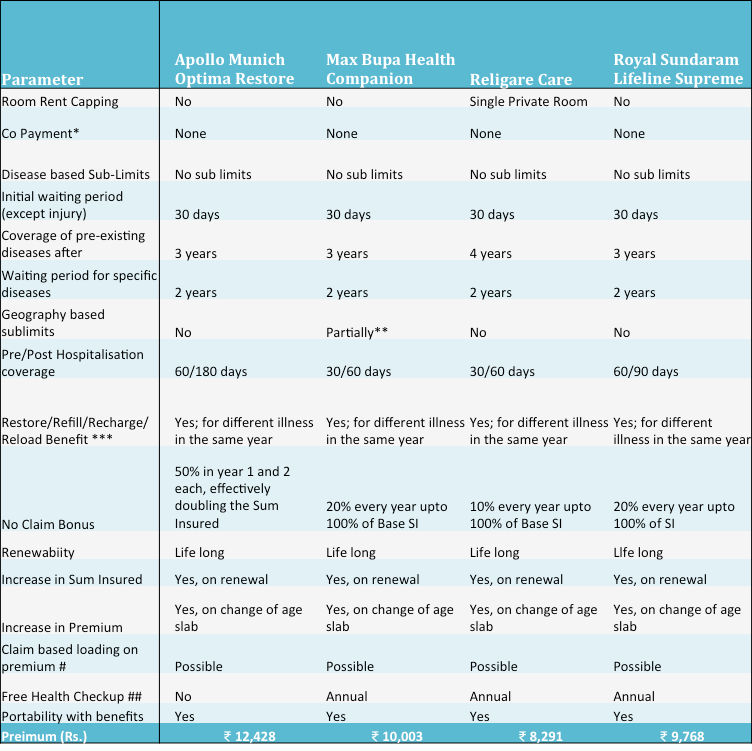

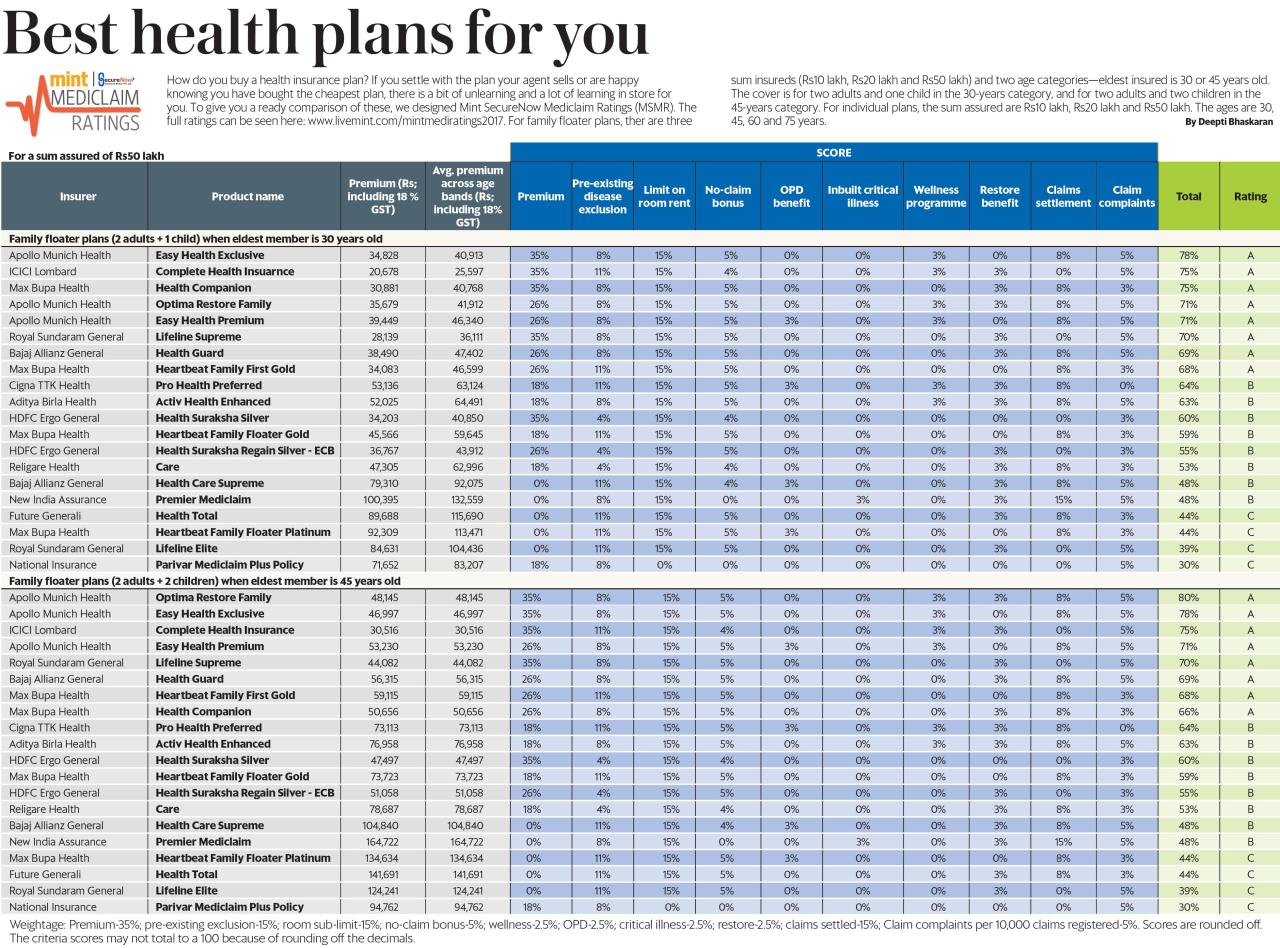

Comparing Health Insurance Plan Costs

Accurately comparing health insurance plans requires a detailed look beyond just the monthly premium. You need to consider several key factors to get a complete picture of your potential costs. Failing to consider all these elements can lead to unexpected expenses down the line.

| Plan Name | Monthly Premium | Annual Deductible | Out-of-Pocket Maximum | Copay (Doctor Visit) | Coinsurance |

|---|---|---|---|---|---|

| Plan A | $300 | $5,000 | $10,000 | $30 | 20% |

| Plan B | $450 | $1,000 | $6,000 | $50 | 10% |

| Plan C | $200 | $7,500 | $12,000 | $25 | 25% |

This simple table illustrates how different plans can vary significantly. While Plan A has a lower premium, its higher deductible and out-of-pocket maximum could lead to substantially higher costs if you need significant medical care. Plan B offers a lower deductible and out-of-pocket maximum but at a higher premium. Plan C demonstrates a low premium but a high deductible. Always carefully compare these figures to determine which plan best suits your needs and budget.

Remember to factor in your expected healthcare utilization.

Cost-Saving Strategies

Several strategies can help reduce your overall healthcare costs. These strategies are not mutually exclusive; you can combine them for maximum savings.Using a Health Savings Account (HSA) or Flexible Spending Account (FSA) can significantly reduce your out-of-pocket medical expenses. HSAs are tax-advantaged savings accounts for individuals with high-deductible health plans, allowing pre-tax contributions to be used for qualified medical expenses.

FSAs, offered through employers, also allow pre-tax contributions but typically have a “use it or lose it” provision.

HSAs offer significant tax advantages and can grow tax-free, making them a powerful tool for long-term healthcare savings.

Factors Influencing Health Insurance Premiums

Several factors influence the cost of your health insurance premiums. Understanding these factors can help you anticipate and potentially manage your costs.Age, location, and health status are among the most significant factors. Older individuals generally pay higher premiums due to increased healthcare utilization. Geographic location plays a role due to variations in healthcare costs across different regions. Pre-existing conditions or a history of significant healthcare needs can also lead to higher premiums.

Additionally, the type of plan chosen (e.g., HMO, PPO) also directly impacts the premium cost. For example, a family plan will typically cost more than an individual plan. Smoking habits are often considered in premium calculations, with smokers typically facing higher premiums than non-smokers.

Finding and Enrolling in a Health Insurance Plan

Choosing a health insurance plan can feel overwhelming, but breaking the process down into manageable steps makes it much easier. Whether you’re getting coverage through your employer or navigating the marketplace, understanding the process and available resources is key to finding a plan that fits your needs and budget. This section will guide you through the essential steps involved in finding and enrolling in a health insurance plan.

The enrollment process varies depending on whether you obtain coverage through your employer or the Health Insurance Marketplace. Employer-sponsored plans typically involve a limited selection of plans offered by your employer, while the Marketplace offers a wider range of plans from different insurance companies. Regardless of your enrollment method, carefully reviewing the details of each plan is crucial before making a decision.

Navigating the Health Insurance Marketplace or Employer-Sponsored Plans

Finding a health insurance plan involves several key steps. These steps apply generally to both Marketplace and employer-sponsored plans, though the specific websites and resources will differ.

- Determine your eligibility: Understand the eligibility requirements for the Marketplace or your employer’s plan. This might involve verifying your income, residency, and citizenship status. Employer plans will have specific eligibility criteria based on employment status and length of service.

- Create an account: If using the Marketplace, create an account on the Healthcare.gov website (or your state’s equivalent). For employer-sponsored plans, you’ll likely use a portal or system provided by your employer’s human resources department.

- Explore plan options: Carefully review the available plans. The Marketplace will allow you to filter plans based on factors like cost, coverage, and network of doctors. Employer plans usually offer a smaller selection. Pay close attention to the details of each plan’s coverage, including deductibles, co-pays, and out-of-pocket maximums.

- Compare plans: Use the comparison tools provided by the Marketplace or your employer. These tools allow you to compare plans side-by-side, highlighting key differences in costs and benefits. Pay close attention to the cost-sharing details, such as deductibles, co-pays, and out-of-pocket maximums.

- Select and enroll: Once you’ve chosen a plan, complete the enrollment process. This will usually involve providing personal information and confirming your selection. There are often open enrollment periods, so be aware of deadlines.

Reviewing the Summary of Benefits and Coverage (SBC)

Before enrolling in any health insurance plan, it’s absolutely vital to thoroughly review the Summary of Benefits and Coverage (SBC). The SBC is a standardized document that provides a clear and concise summary of your plan’s benefits and coverage. Understanding this document is crucial for making an informed decision.

The SBC Artikels key information such as your plan’s deductible, copayments, coinsurance, and out-of-pocket maximum. It also details which services are covered and which are not. Taking the time to read and understand the SBC will help you avoid unexpected costs and ensure that the plan meets your healthcare needs.

The SBC is your best friend when comparing plans. Don’t skip this step!

Using Online Comparison Tools

Many online tools are available to help compare health insurance plans. These tools typically allow you to input your personal information (age, location, income, etc.) and then display a range of plans that meet your needs. The information presented usually includes:

| Information Provided | Relevance |

|---|---|

| Monthly Premium | The amount you pay each month for coverage. |

| Deductible | The amount you pay out-of-pocket before your insurance starts to cover expenses. |

| Copay | The fixed amount you pay for a doctor’s visit or other service. |

| Coinsurance | The percentage of costs you pay after meeting your deductible. |

| Out-of-Pocket Maximum | The most you’ll pay out-of-pocket in a year. |

| Network of Doctors and Hospitals | The healthcare providers covered by your plan. |

| Prescription Drug Coverage | Details on how your plan covers prescription medications. |

By carefully reviewing this information across different plans, you can identify the plan that best balances cost and coverage for your specific circumstances. Remember to consider your individual healthcare needs and spending habits when comparing plans.

Understanding Health Insurance Coverage

Choosing a health insurance plan is only half the battle; understanding what that plan actually covers is crucial. This section will clarify the specifics of coverage for various medical services and Artikel the claims process. Knowing this information empowers you to make informed decisions and avoid unexpected medical bills.

Different health insurance plans offer varying levels of coverage for medical services. Understanding these differences is key to selecting a plan that best suits your individual needs and budget. Generally, plans cover a core set of essential health benefits, but the specifics and extent of coverage can differ significantly. This variation stems from factors such as the plan’s network of providers, the plan type (e.g., HMO, PPO), and your chosen deductible and out-of-pocket maximum.

Coverage for Different Medical Services, Compare health insurance

The coverage provided by health insurance plans varies greatly depending on the specific plan and the type of service. Below are some examples of commonly covered and not covered services. Remember to always check your plan’s specific benefits document for complete details, as coverage can change.

- Covered Services: Doctor visits (primary care and specialist), hospital stays (in-network facilities), emergency room visits, certain prescription drugs (those on the formulary), preventive care (like annual checkups and vaccinations), maternity care, mental health services.

- Not Covered Services (or may require significant out-of-pocket costs): Cosmetic surgery, elective procedures (unless medically necessary), experimental treatments, services from out-of-network providers (without prior authorization), some prescription drugs (those not on the formulary), long-term care.

The Claims Process and Appeals

Filing a claim typically involves submitting a form to your insurance company, along with supporting documentation like receipts and medical bills. The process can vary slightly depending on your insurer, but generally follows a similar pattern. If your claim is denied, you have the right to appeal the decision.

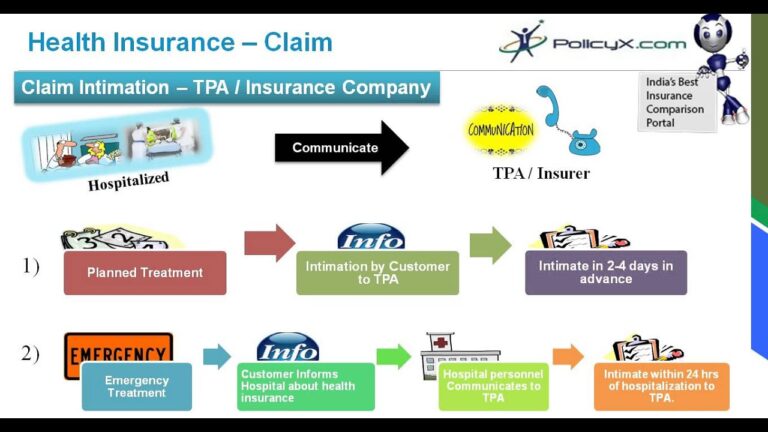

A Visual Representation of the Insurance Claim Process

Imagine a flowchart. It starts with a “Medical Service Received” box. An arrow points to a “Submit Claim” box, which requires gathering necessary documents (medical bills, explanation of benefits, etc.). From there, an arrow leads to the “Insurance Company Review” box, where the claim is processed and verified. Two arrows branch out from this box: one leads to a “Claim Approved” box, followed by a “Payment to Provider” box.

The other arrow goes to a “Claim Denied” box, leading to an “Appeal Process” box where you can provide additional information or documentation to support your claim. Finally, the appeal process leads back to an “Insurance Company Review” box, which again branches into “Claim Approved” or “Claim Denied” based on the appeal outcome. The final outcome for both paths is either payment to the provider or notification of the final decision.

Conclusive Thoughts

Choosing a health insurance plan is a significant decision, impacting both your health and your finances. By understanding the different plan types, key factors to consider, and cost-saving strategies, you can navigate the complexities of the health insurance market with confidence. Remember to carefully review the Summary of Benefits and Coverage (SBC) and utilize online comparison tools to find the plan that best aligns with your individual needs and budget.

Don’t hesitate to ask questions and seek professional advice if needed – your health is worth it!

FAQ Compilation: Compare Health Insurance

What’s the difference between a deductible and a copay?

A deductible is the amount you pay out-of-pocket before your insurance kicks in. A copay is a fixed fee you pay for a doctor’s visit or other service.

Can I change my health insurance plan during the year?

Generally, you can only change plans during open enrollment periods, unless you experience a qualifying life event (like marriage, job loss, or having a baby).

What if I have a pre-existing condition?

The Affordable Care Act (ACA) prevents insurers from denying coverage or charging higher premiums based solely on pre-existing conditions. However, some plans may have waiting periods before covering certain conditions.

How do I file a claim?

The process varies by insurer, but generally involves submitting forms and documentation detailing your medical services. Your insurance provider’s website or member handbook will Artikel the specific steps.

What does “out-of-pocket maximum” mean?

This is the most you’ll pay out-of-pocket in a year for covered services. Once you reach this limit, your insurance will typically cover 100% of eligible expenses.