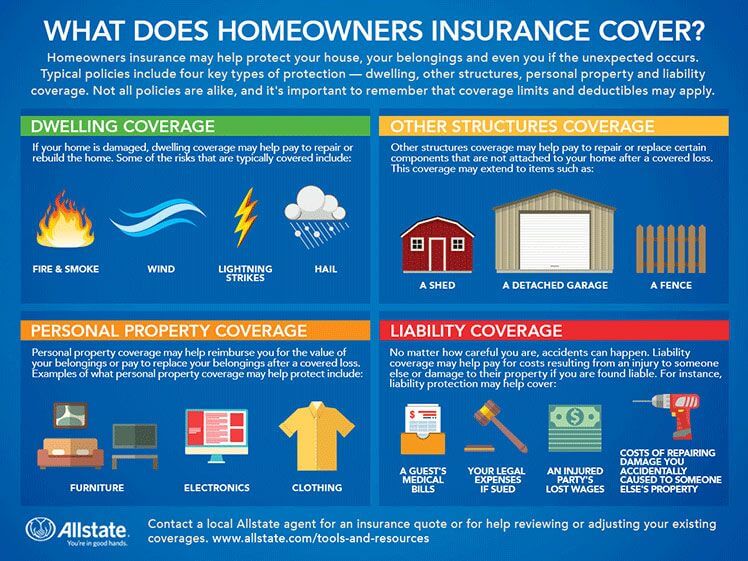

What does homeowners insurance cover? That’s a crucial question for every property owner. Understanding your policy is vital, not just for peace of mind, but also for financial protection in case of unexpected events. This guide breaks down the essentials of homeowners insurance, explaining what’s typically covered, what’s usually excluded, and how to make sure you have the right coverage for your needs.

We’ll delve into the different types of policies, liability protection, and the importance of understanding your policy’s limitations.

Homeowners insurance is designed to protect your biggest investment – your home. It’s a complex topic, but understanding the basics can save you significant stress and financial hardship down the line. This guide will cover property damage coverage, liability coverage, additional living expenses, and common exclusions, equipping you with the knowledge to choose a policy that best suits your individual circumstances.

What is Homeowners Insurance?

Homeowners insurance is a crucial financial safety net protecting your most valuable asset: your home. It safeguards you from unexpected costs associated with damage or loss to your property and potential liability for accidents occurring on your premises. Understanding the different types of coverage and their specifics is essential for securing adequate protection.

Homeowners Insurance Policy Types

Several types of homeowners insurance policies cater to different needs and situations. The most common are HO-3, HO-4, and HO-6. Choosing the right policy depends largely on whether you own your home outright, rent, or own a condominium. Each policy type offers a unique blend of coverage.

Components of a Homeowners Insurance Policy

A typical homeowners insurance policy encompasses several key components designed to cover various potential losses. These components work together to provide comprehensive protection. Understanding these components allows you to assess the adequacy of your coverage.

Comparison of Homeowners Insurance Policy Types

The table below compares the coverage offered by the three most common types of homeowners insurance policies. Note that specific coverages and limits can vary based on your insurer, location, and the specifics of your policy.

| Policy Type | Dwelling Coverage | Other Structures Coverage | Personal Property Coverage |

|---|---|---|---|

| HO-3 (Special Form) | Covers damage to your dwelling caused by most perils, except those specifically excluded (e.g., flood, earthquake). | Covers damage to other structures on your property (e.g., detached garage, shed), usually at a lower percentage of your dwelling coverage. | Covers personal belongings inside your home and sometimes temporarily outside (e.g., while traveling). Coverage is typically based on actual cash value (ACV) or replacement cost. |

| HO-4 (Renters Insurance) | Does not cover the dwelling itself, as you don’t own it. | Generally does not cover other structures. | Covers personal belongings inside your rented dwelling. Coverage is typically based on actual cash value (ACV) or replacement cost. |

| HO-6 (Condominium Insurance) | Covers your condo’s interior and personal property. It typically

|

May offer limited coverage for improvements or additions you’ve made to your unit. | Covers personal belongings inside your condo unit. Coverage is typically based on actual cash value (ACV) or replacement cost. |

Coverage for Property Damage

Homeowners insurance is designed to protect your most valuable asset – your home and its contents. Understanding what your policy covers in terms of property damage is crucial for financial security in the event of an unforeseen incident. This section details the various aspects of property damage coverage offered by a standard homeowners insurance policy.

Dwelling Coverage

This part of your policy covers damage to the physical structure of your house. This includes the walls, roof, foundation, plumbing, electrical systems, and built-in appliances. The amount of coverage is typically determined by the estimated replacement cost of your home, not its market value. This means the insurance company will pay to rebuild or repair your home to its pre-loss condition, even if the cost exceeds the home’s current market value.

Keep in mind that this coverage usually has a deductible, which is the amount you’ll pay out-of-pocket before your insurance kicks in.

Other Structures Coverage

Your policy also typically covers structures on your property that are detached from your main dwelling. This usually includes things like a detached garage, shed, fence, or even a gazebo. The coverage amount for these structures is usually a percentage (often 10% or more) of your dwelling coverage. So, if your dwelling coverage is $300,000, your other structures coverage might be $30,000.

Remember that this coverage also typically has a deductible.

Personal Property Coverage

This portion of your homeowners insurance protects your belongings inside your home. This includes furniture, clothing, electronics, jewelry, and other personal items. Coverage is usually calculated based on the actual cash value (ACV) or replacement cost of your possessions. ACV takes depreciation into account, while replacement cost covers the cost of replacing your items with new ones of like kind and quality.

Many policies offer replacement cost coverage for personal property.

Covered and Excluded Events

Many events are typically covered under a standard homeowners insurance policy. These include damage caused by fire, lightning, windstorms, hail, vandalism, and theft. However, certain events are usually excluded. The most common exclusions are flood damage, earthquake damage, and damage caused by normal wear and tear. Some policies offer optional coverage for these excluded perils, but at an additional cost.

Personal Property Loss Example

Let’s say you have $50,000 worth of personal property coverage with replacement cost value. A fire damages many of your belongings. After the fire, an insurance adjuster assesses the damage. They determine that $10,000 worth of items were destroyed. Assuming you meet your policy’s deductible requirements, your insurance company would pay up to $10,000 to replace those lost items.

The actual amount paid will depend on the specifics of your policy and the appraisal process. It’s important to keep detailed records of your belongings, including receipts or photos, to aid in the claims process.

Liability Coverage

Liability coverage in your homeowners insurance is a crucial safety net, protecting you financially if someone gets hurt or their property is damaged on your land, or if you accidentally cause harm to someone else or their property off your property. It essentially covers the costs associated with lawsuits and settlements resulting from such incidents. Without it, you could face potentially crippling debt.Liability coverage isn’t just about accidents on your property; it extends to situations where you’re legally responsible for someone else’s losses.

This could be anything from a dog bite to a slip and fall, even if it happens outside your home. The amount of coverage you have directly impacts your ability to manage these situations.

Examples of Liability Coverage Application

Liability coverage kicks in when you’re held legally responsible for someone’s injuries or property damage. For instance, imagine a friend slips on an icy patch on your walkway and breaks their arm. Your liability coverage would help pay for their medical bills and any legal fees if they sue you. Or, consider accidentally damaging your neighbor’s fence while mowing your lawn.

Your insurance would likely cover the cost of repairs. Another example would be if your child accidentally breaks a window at school; your liability coverage could assist in covering the cost of repairs. These scenarios highlight the broad reach of liability coverage.

Liability Coverage Limits and Payouts

Your homeowners insurance policy will specify a liability limit, usually expressed as a dollar amount (e.g., $300,000 or $500,000). This is the maximum amount your insurer will pay out for covered liability claims. If the total cost of settlements and legal fees exceeds this limit, you would be personally responsible for the difference. For example, if you face a $700,000 lawsuit after a serious accident on your property and your policy has a $300,000 liability limit, you would be responsible for the remaining $400,000.

Scenarios Where Liability Coverage Might Be Insufficient, What does homeowners insurance cover

High-value lawsuits, particularly those involving serious injuries or significant property damage, can quickly exhaust even substantial liability limits. Consider a situation where someone suffers a permanent disability due to an accident on your property. Medical expenses, lost wages, and pain and suffering claims could easily surpass a standard liability limit. Similarly, a lawsuit involving multiple plaintiffs or extensive property damage could quickly exceed the coverage.

In such cases, having an umbrella liability policy, which provides additional liability coverage beyond your homeowners policy, is highly recommended.

Common Exclusions Related to Liability Coverage

It’s important to understand that liability coverage doesn’t cover everything. Common exclusions include intentional acts (e.g., intentionally harming someone), business-related activities conducted from your home, and damage caused by specific hazards not covered by your policy (e.g., some types of water damage). Many policies also exclude liability for injuries caused by certain animals, such as those deemed inherently dangerous.

Carefully review your policy documents to understand the specific exclusions that apply to your coverage.

Additional Living Expenses Coverage

Homeowners insurance isn’t just about rebuilding your house; it’s about getting your life back to normal after a covered disaster. That’s where Additional Living Expenses (ALE) coverage comes in. It’s a crucial part of your policy that helps cover the costs of maintaining your usual standard of living while your home is uninhabitable due to a covered event like a fire, storm, or vandalism.ALE coverage helps bridge the gap between your disrupted life and a return to normalcy.

It’s designed to alleviate the financial burden of unexpected displacement, allowing you to focus on recovery rather than worrying about immediate living expenses. This coverage recognizes that simply rebuilding a house doesn’t account for the disruption to your daily routine and the additional costs that arise.

Examples of Covered Expenses

ALE coverage typically includes a range of expenses necessary to maintain your lifestyle during the displacement. These can vary slightly depending on your policy, but generally include costs for temporary housing (hotel, rental property), meals (eating out, groceries if you lack kitchen facilities), transportation to and from your temporary residence, and even pet boarding fees if applicable. Some policies might also cover additional expenses like storage fees for your belongings if they can’t be kept in your temporary accommodation.

Think of it as covering the essentials to maintain a reasonable level of comfort and functionality during the repair or rebuilding process.

ALE Coverage Limits Across Providers

ALE coverage limits vary significantly between insurance providers and even within different policies from the same provider. Some policies offer a fixed dollar amount as a limit, while others offer a percentage of your dwelling coverage. For instance, one provider might offer a $50,000 ALE limit, while another might provide 20% of your dwelling coverage. This means that if your dwelling coverage is $250,000, your ALE coverage would be $50,000.

It’s crucial to compare policies and understand the limitations of your ALE coverage before purchasing a policy. Higher limits provide greater financial security during a prolonged displacement period.

ALE Coverage Calculation: A Hypothetical Scenario

Let’s say John’s home suffered significant fire damage. His ALE coverage is $40,000. He needs temporary housing for six months at $2,000 per month ($12,000), spends $3,000 on groceries and meals, $1,000 on transportation, and $500 on pet boarding. His total expenses are $16,500. In this scenario, his insurance company would cover the full $16,500, well within his $40,000 ALE limit.

However, if his total expenses had exceeded the $40,000 limit, he would be responsible for the difference. Therefore, understanding your policy’s limits and budgeting accordingly during the displacement period is essential.

Understanding Policy Exclusions and Limitations

Homeowners insurance, while offering crucial protection, doesn’t cover everything. Understanding what’s excluded and the limitations of your policy is just as important as knowing what’s covered. This section will clarify common exclusions, the role of deductibles, the claims process, premium influencing factors, and tips for selecting the right policy.

Common Exclusions

Many events aren’t covered by standard homeowners insurance policies. These exclusions often relate to events considered high-risk or outside the typical scope of a homeowner’s responsibility. For instance, flood damage is almost always excluded, requiring separate flood insurance. Similarly, earthquake damage is typically not covered, necessitating a separate earthquake policy. Acts of war, nuclear accidents, and intentional acts by the policyholder are other common exclusions.

It’s vital to review your policy carefully to understand precisely what events are not covered. For example, while a standard policy might cover damage from a fire, it might exclude damage resulting from a fire intentionally set by the homeowner.

Deductibles and Their Impact on Claims

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. It’s a crucial part of your policy, influencing both your premium and your claim payout. A higher deductible typically translates to lower premiums because you’re accepting more financial responsibility for smaller claims. Conversely, a lower deductible means higher premiums but less out-of-pocket expense when you file a claim.

Let’s say your deductible is $1,000, and you have $5,000 in damage from a covered incident. Your insurance company would pay $4,000, while you’d cover the remaining $1,000.

Filing a Claim: The Process and Required Information

Filing a claim usually involves contacting your insurance company immediately after an incident. You’ll need to provide detailed information about the event, including the date, time, and circumstances. You’ll also need to document the damage with photos or videos. Providing accurate details about the extent of the damage is crucial for a smooth claims process. The insurance company will likely send an adjuster to assess the damage and determine the amount payable under your policy.

You will need to supply supporting documentation, such as receipts for repairs or replacement costs. Failure to promptly report a claim or provide accurate information can delay or even jeopardize your claim.

Factors Influencing Homeowners Insurance Premiums

Several factors determine your homeowners insurance premium. Your location plays a significant role, as areas prone to natural disasters like hurricanes or wildfires tend to have higher premiums. The age and condition of your home also matter; older homes with outdated systems may cost more to insure. The coverage amount you choose directly impacts your premium; higher coverage equates to higher premiums.

Your credit score can also be a factor, with better credit often leading to lower premiums. Finally, the type of dwelling (single-family home, condo, etc.) and the presence of security systems can influence your premium.

Tips for Choosing the Right Homeowners Insurance Policy

Choosing the right homeowners insurance policy requires careful consideration.

- Compare quotes from multiple insurers to find the best rates and coverage options.

- Understand your coverage needs based on your home’s value, location, and personal belongings.

- Consider the deductible carefully, balancing premium cost with your willingness to pay out-of-pocket.

- Read your policy thoroughly to understand what is and isn’t covered.

- Ask questions; don’t hesitate to contact insurers to clarify anything you don’t understand.

Conclusive Thoughts

Ultimately, knowing what your homeowners insurance covers is about more than just reading the fine print; it’s about securing your financial future. By understanding the nuances of your policy—from property damage coverage to liability protection and additional living expenses—you can rest assured that you’re adequately protected against unforeseen circumstances. Remember to regularly review your policy and adjust your coverage as needed to reflect changes in your life and the value of your property.

Don’t hesitate to contact your insurance provider if you have any questions or need clarification on specific aspects of your coverage.

Top FAQs: What Does Homeowners Insurance Cover

What if my claim is denied?

If your claim is denied, carefully review the denial letter and your policy. Contact your insurer to understand the reasons for the denial and explore your options for appeal or further clarification. Consider seeking legal advice if necessary.

How often should I review my homeowners insurance policy?

It’s a good idea to review your policy at least annually, or whenever there’s a significant change in your life (e.g., major renovations, additions to your property, increase in the value of your possessions).

What factors affect my insurance premium?

Several factors influence premiums, including your location, the age and condition of your home, the amount of coverage you choose, your claims history, and the type of policy you select.

Can I get homeowners insurance if I rent out part of my home?

Yes, but you’ll likely need a specialized policy that addresses the risks associated with having renters. Contact your insurer to discuss your specific situation.

What’s the difference between actual cash value and replacement cost coverage?

Actual cash value (ACV) covers the replacement cost minus depreciation, while replacement cost covers the full cost of replacing damaged items without deducting for depreciation.