How much is car insurance? That’s the million-dollar question, and the answer, unfortunately, isn’t a simple number. The cost of car insurance is a complex tapestry woven from many factors, from your age and driving history to the type of car you drive and where you live. This guide will unravel those complexities, giving you a clearer picture of what influences your premiums and how to find the best coverage at a price you can afford.

We’ll explore different coverage options, ways to save money, and what to expect when filing a claim.

Understanding car insurance is crucial for responsible driving. This guide aims to demystify the process, empowering you to make informed decisions about your coverage and your budget. We’ll cover everything from comparing quotes to understanding policy details, ensuring you’re equipped to navigate the world of car insurance with confidence.

Factors Influencing Car Insurance Costs: How Much Is Car Insurance

Car insurance premiums are influenced by a complex interplay of factors, making it crucial to understand these elements to secure the best possible rate. Several key aspects significantly impact the final cost, ranging from personal characteristics to the vehicle itself and your driving record. Let’s delve into the specifics.

Age and Car Insurance Premiums

Younger drivers typically pay significantly higher premiums than older drivers. This is because statistically, younger drivers are involved in more accidents. Insurance companies view them as higher risk. As drivers gain experience and reach their mid-twenties and beyond, their premiums generally decrease. This reflects a lower accident probability based on actuarial data.

The reduction in risk translates directly to lower costs for the insurance company, which they pass on to the consumer. However, even within the younger driver demographic, there’s variation. Those with clean driving records and safe driving habits may see better rates than their peers with accidents or violations. Conversely, senior drivers might face slightly higher premiums due to potential age-related health concerns that could impact driving ability, although this is often offset by their generally lower accident rates.

Car Type and Insurance Costs

The type of car you drive substantially affects your insurance premiums. Sports cars, for example, tend to be more expensive to insure than sedans or hatchbacks. This is due to several factors. Sports cars often have higher repair costs, are more likely to be stolen, and are statistically involved in more accidents due to their higher performance capabilities.

Insurance companies factor in the cost of parts, repair time, and the likelihood of claims when determining premiums. A luxury sedan will likely be more expensive to insure than a basic economy model, mainly due to higher repair costs and replacement value. The vehicle’s safety features also play a role; cars with advanced safety technologies might receive discounts due to their reduced accident risk.

Driving History’s Impact on Insurance Rates

Your driving history is arguably the most significant factor in determining your car insurance premiums. Accidents and traffic violations significantly increase your rates. A single at-fault accident can lead to a substantial premium increase for several years. Multiple accidents or serious violations, such as DUI, can result in even higher premiums or even policy cancellation. Conversely, maintaining a clean driving record with no accidents or tickets will earn you lower premiums and potential discounts.

Insurance companies use a points system to track violations, with more points resulting in higher premiums. The severity of the violation also influences the point value and the premium impact.

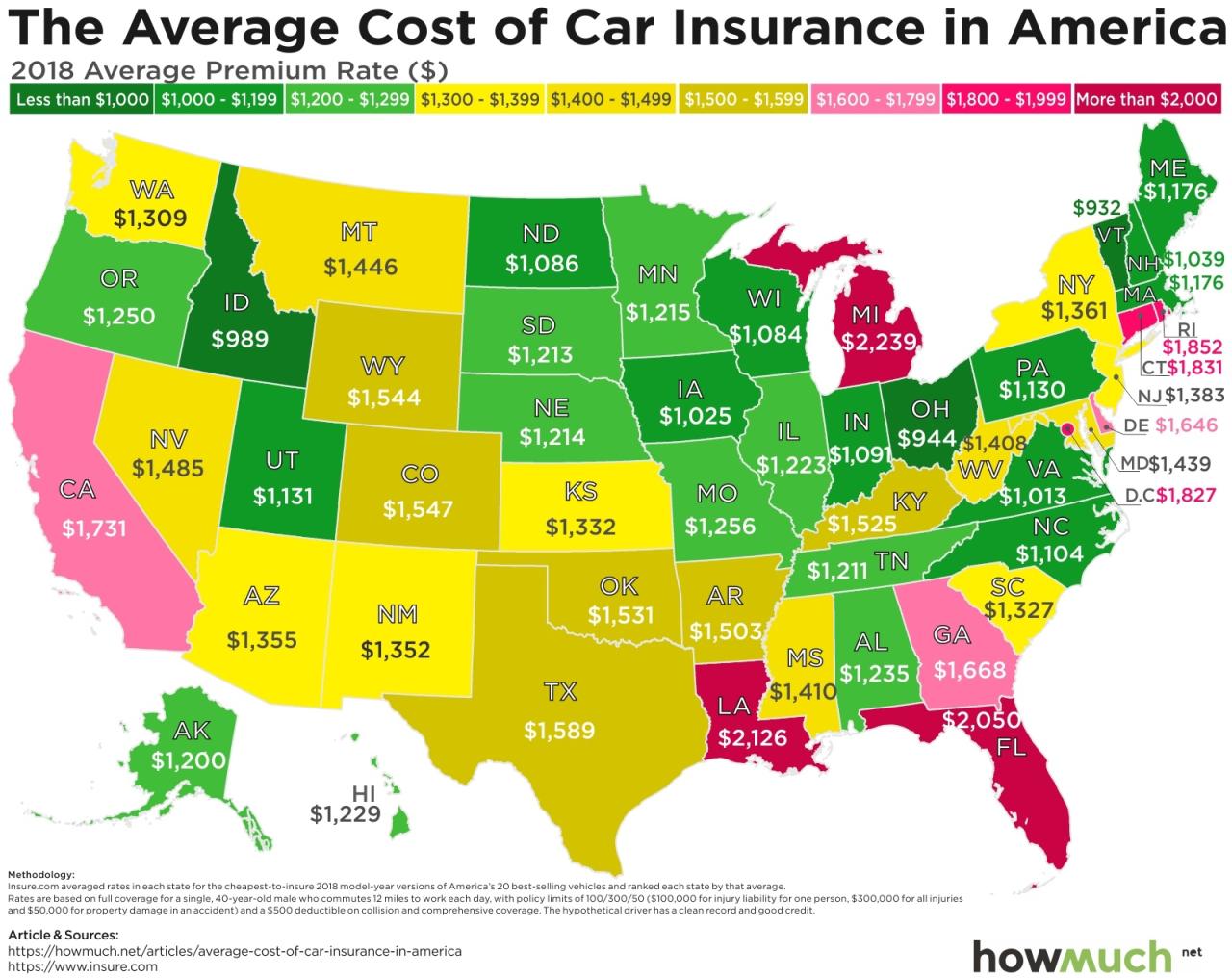

Location and Insurance Costs

The location where you live heavily influences your insurance premiums. Factors such as crime rates, accident frequency, and the cost of vehicle repairs in your area all contribute. Insurance companies analyze claims data for specific geographic regions, resulting in varied premiums across different cities and states.

| City | State | Average Annual Premium (Example) | Factors Contributing to Cost |

|---|---|---|---|

| New York City | NY | $2000 | High accident rates, high repair costs, theft |

| Los Angeles | CA | $1800 | High population density, traffic congestion |

| Chicago | IL | $1600 | Moderate accident rates, moderate repair costs |

| Omaha | NE | $1200 | Lower accident rates, lower repair costs |

Types of Car Insurance Coverage

Understanding the different types of car insurance coverage is crucial for protecting yourself financially in the event of an accident. Choosing the right coverage depends on your individual needs and risk tolerance. Let’s break down some key types.

Liability Coverage

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It’s usually divided into two parts: bodily injury liability and property damage liability. Bodily injury liability covers medical bills, lost wages, and pain and suffering for anyone injured in an accident you caused. Property damage liability covers the cost of repairing or replacing the other person’s vehicle or property.

For example, if you rear-end someone and cause $10,000 in damages to their car and $20,000 in medical bills for the injured driver, your liability coverage would help pay for these expenses, up to your policy limits. The limits are typically expressed as a three-number combination, such as 25/50/25, meaning $25,000 per person for bodily injury, $50,000 total for bodily injury per accident, and $25,000 for property damage.

Collision and Comprehensive Coverage

Collision coverage pays for damage to your car resulting from a collision with another vehicle or object, regardless of who is at fault. Comprehensive coverage protects against damage to your car caused by events other than collisions, such as theft, vandalism, fire, hail, or falling objects. While both offer valuable protection, collision coverage is usually mandatory if you have a loan on your car, as the lender requires it to protect their investment.

The main limitation is the deductible; you’ll pay this amount out-of-pocket before your insurance kicks in. For example, if you have a $500 deductible and your collision repair costs $2,000, you’ll pay $500 and your insurance will cover the remaining $1,500. Comprehensive coverage, on the other hand, often excludes wear and tear.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. Uninsured motorist bodily injury coverage will pay for your medical bills and other expenses if the at-fault driver doesn’t have insurance. Underinsured motorist coverage covers the difference between your medical bills and the at-fault driver’s liability coverage if it’s insufficient. For example, if you’re injured by an uninsured driver and your medical bills total $50,000, your uninsured motorist coverage will help pay for these expenses.

If you’re hit by an underinsured driver whose liability coverage is only $25,000, but your damages are $50,000, your underinsured motorist coverage will help pay the remaining $25,000.

Medical Payments Coverage

Medical payments coverage (Med-Pay) pays for your medical expenses and those of your passengers, regardless of fault. It’s a supplementary coverage that can help with medical bills, even if you’re at fault for the accident. The key difference between Med-Pay and uninsured/underinsured motorist coverage is that Med-Pay covers medical expenses regardless of fault, while uninsured/underinsured motorist coverage only applies when the other driver is at fault and lacks sufficient insurance.

It’s important to note that Med-Pay typically has lower limits than other coverages and is often considered secondary to other health insurance plans.

Typical Exclusions in Standard Car Insurance Policies

Standard car insurance policies usually exclude several situations. It’s vital to understand these exclusions to avoid unexpected costs.

- Damage caused intentionally by the policyholder.

- Damage resulting from racing or other illegal activities.

- Damage caused by wear and tear or mechanical breakdown (generally excluded from comprehensive coverage).

- Damage from nuclear events, war, or terrorism.

- Damage while driving a vehicle not listed on the policy.

- Loss due to depreciation.

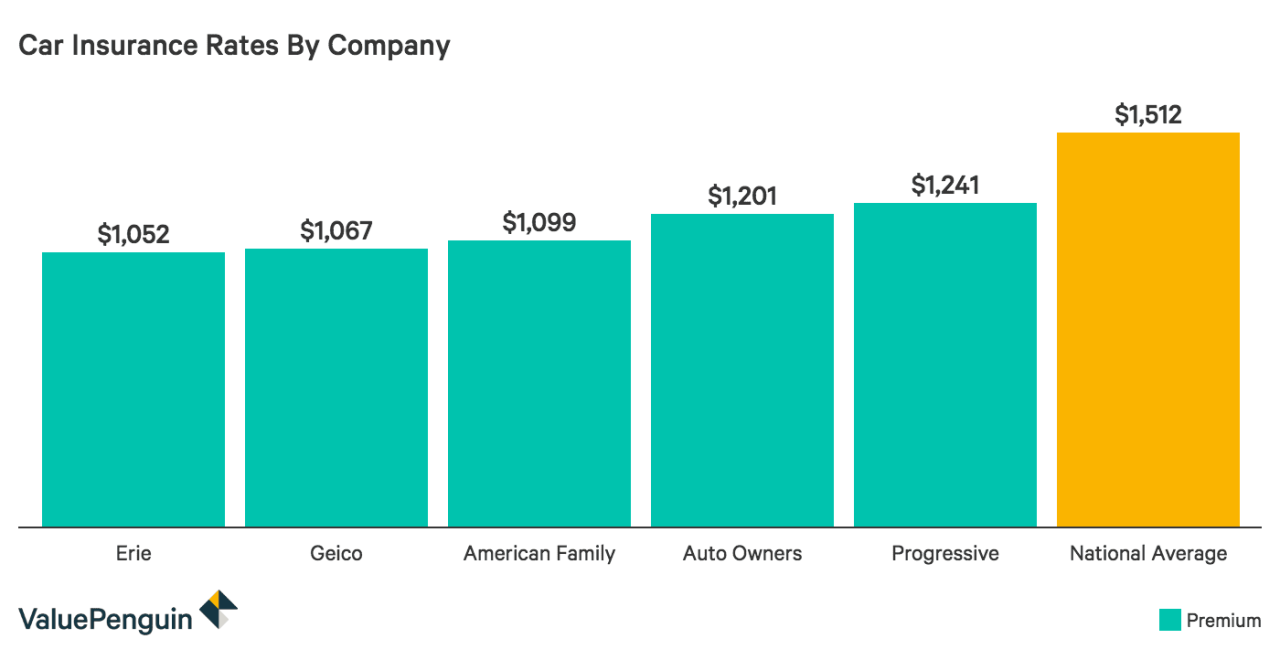

Obtaining Car Insurance Quotes

Getting the best car insurance deal involves more than just clicking the first link you see. It requires comparing quotes from multiple providers to ensure you’re getting the most competitive price for the coverage you need. This process can seem daunting, but with a systematic approach, you can find the perfect policy without breaking the bank.Shopping around for car insurance is like shopping for any other big purchase; you wouldn’t buy the first car you saw, would you?

The same principle applies to insurance. Taking the time to compare quotes will save you money in the long run.

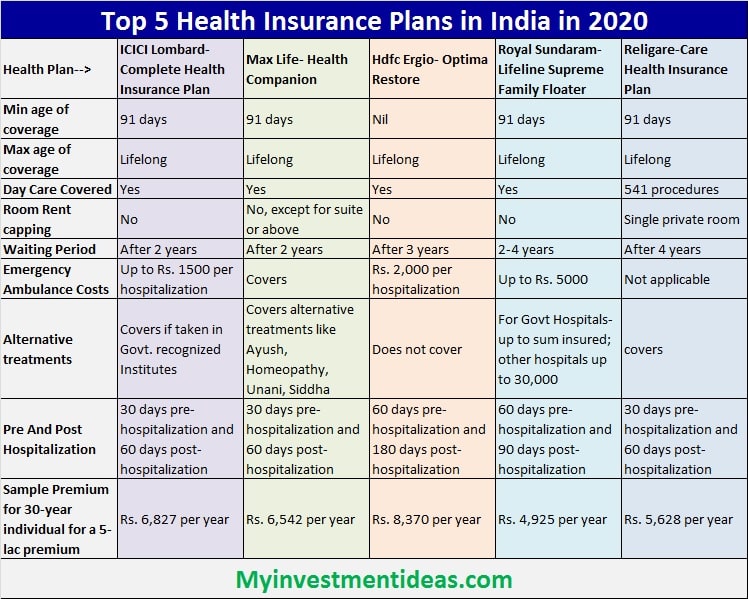

Comparing Insurance Quotes

When comparing car insurance quotes, it’s crucial to look beyond just the monthly premium. Several key factors significantly impact the overall cost and value of your policy. Failing to consider these elements could lead to choosing a policy that appears cheaper initially but proves inadequate or excessively expensive in the long run.

- Premiums: This is the amount you pay regularly (monthly, quarterly, or annually) for your insurance coverage. Lower premiums are obviously desirable, but don’t let this be the sole deciding factor.

- Deductibles: This is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, but you’ll pay more if you need to file a claim. Consider your financial situation and risk tolerance when choosing a deductible.

- Coverage Limits: This refers to the maximum amount your insurance company will pay for a specific type of claim (e.g., bodily injury liability, property damage liability). Adequate coverage limits are vital to protect your assets in case of an accident.

- Policy Exclusions: Understand what events or situations are not covered by the policy. Some policies might exclude certain types of damage or driving situations.

Online vs. Offline Quote Acquisition

Obtaining car insurance quotes can be done through various methods, each with its advantages and disadvantages. Choosing the right method depends on your preferences and comfort level with technology.

| Method | Advantages | Disadvantages |

|---|---|---|

| Online | Convenient, quick, allows for easy comparison of multiple quotes simultaneously, often provides instant quotes. | May lack personalized advice, potential for hidden fees or complexities not immediately apparent, reliance on accurate data entry. |

| Offline (Insurance Agent) | Personalized advice, opportunity to ask questions and clarify complexities, potential access to exclusive deals or discounts. | Can be time-consuming, may require multiple phone calls or visits, less convenient for comparing multiple providers simultaneously. |

Understanding Insurance Quotes

A typical car insurance quote will provide a detailed breakdown of the various costs associated with your policy. Understanding this breakdown is essential for making an informed decision. For example, a quote might itemize costs for liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and potentially others. Pay close attention to these individual components to ensure you are getting the coverage you need at a price you can afford.

Don’t hesitate to contact the insurance provider directly if any aspect of the quote is unclear. Many companies offer detailed explanations of their policy features and pricing structures. Remember, a lower premium isn’t always better if it comes with significantly reduced coverage. The best policy balances cost-effectiveness with adequate protection.

Discounts and Savings on Car Insurance

Saving money on car insurance is a smart financial move. Many insurance companies offer a wide variety of discounts, potentially significantly lowering your premiums. Understanding these discounts and how to qualify for them can save you hundreds of dollars annually. Let’s explore the common discounts available and how to maximize your savings.

Types of Car Insurance Discounts

Numerous discounts are available, often overlapping. Companies use different names for similar discounts, so check your insurer’s specific offerings. The key is to actively seek out and utilize every discount you qualify for.

Good Driver and Safe Driver Discounts

These are among the most common and valuable discounts. A good driving record, demonstrated by a lack of accidents and traffic violations, is usually the primary qualification. Insurance companies often use a points system; fewer points mean lower premiums. Some insurers offer discounts for completing defensive driving courses, proving your commitment to safe driving practices. Documentation usually involves providing your driving history report from your state’s Department of Motor Vehicles (DMV).

For example, a driver with a clean driving record for five years might receive a 20% discount, while a driver with one minor accident might only receive a 10% discount.

Bundling Discounts

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, is a very effective way to save. Insurers often reward loyalty and bundled policies by offering significant discounts. This discount can range from 5% to 25% or more depending on the insurer and the types of insurance bundled. You’ll need to provide proof of your other insurance policies to your car insurance provider to qualify.

For instance, bundling home and auto insurance could save a family $300 annually compared to purchasing policies separately.

Vehicle Safety Features Discounts

Modern vehicles often come equipped with advanced safety features like anti-lock brakes (ABS), airbags, electronic stability control (ESC), and even advanced driver-assistance systems (ADAS). These features reduce the risk of accidents, leading to discounts. The discount amount varies based on the specific features and the insurer. Your vehicle’s registration or insurance documents should list these features. A car with advanced safety features might get a 5-10% discount compared to a similar car lacking these features.

Payment Method Discounts

Some insurers offer discounts for paying your premiums in full annually or semi-annually rather than monthly. This eliminates the administrative overhead associated with monthly billing and is often rewarded with a discount, typically around 5-10%. Proof of payment is your payment confirmation from the insurance company. Paying annually could save $50 to $100 per year depending on your premium.

Other Potential Discounts

Other potential discounts include those for good students (typically for students with good grades), military personnel, and affiliations with certain organizations or employers. Specific requirements vary by insurer, so contact your insurance provider for details.

Example Discounts and Savings

| Discount Type | Discount Percentage | Example Premium (Annual) | Savings |

|---|---|---|---|

| Good Driver | 20% | $1200 | $240 |

| Bundling (Home & Auto) | 15% | $1200 | $180 |

| Vehicle Safety Features | 10% | $1200 | $120 |

| Payment in Full | 5% | $1200 | $60 |

Understanding Your Car Insurance Policy

Your car insurance policy is a legally binding contract. Understanding its terms and conditions is crucial to ensure you’re adequately protected and know what to expect in various situations. This section will guide you through the key aspects of your policy, empowering you to navigate any challenges that may arise.

Policy Document Review

Carefully read your entire policy document. Don’t just skim it; take your time to understand the specifics. Pay close attention to the declarations page, which summarizes your coverage, policy number, and other key information. The detailed sections Artikel the types of coverage you have, the limits of your liability, and any exclusions or limitations. Look for definitions of key terms; insurance policies often use specific terminology.

If anything is unclear, contact your insurance provider for clarification. Keeping a copy of your policy in a safe place, both physical and digital, is highly recommended.

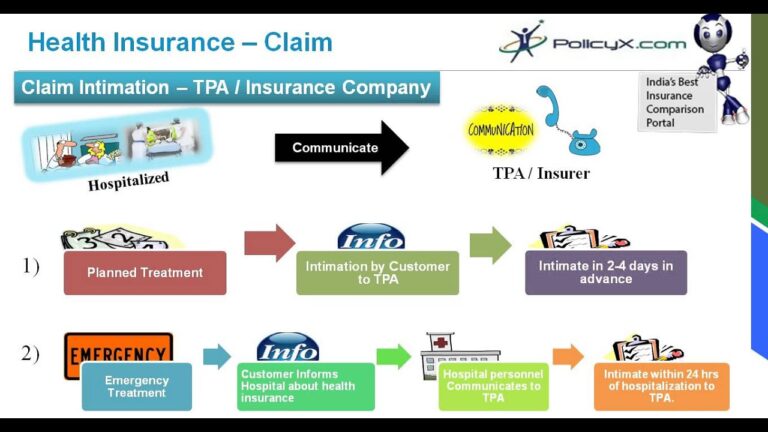

Filing a Claim After an Accident

Following an accident, immediately contact the police and obtain a copy of the accident report. Next, notify your insurance company as soon as possible, usually within 24-48 hours, as per your policy’s instructions. Provide them with all the necessary details, including the date, time, location, and circumstances of the accident, along with the contact information of all parties involved.

Gather any evidence you can, such as photos of the damage to your vehicle and the other vehicles involved, as well as witness contact information. Your insurer will guide you through the claims process, which may include providing a detailed statement, undergoing an inspection of your vehicle, and potentially negotiating with other insurance companies. Be prepared for a thorough investigation.

Remember to keep detailed records of all communications and documents related to your claim.

Updating Policy Information

Keeping your insurance company informed of any changes to your circumstances is vital to maintain accurate coverage. This includes notifying them of address changes, adding or removing drivers from your policy, purchasing a new vehicle, or making significant changes to your driving habits. Most insurers have online portals or phone lines for easy updates. Failure to update your information could lead to coverage gaps or claims denials.

For example, if you move and don’t update your address, your policy might be invalidated if an accident occurs at your new address. Similarly, failing to add a new driver could leave them uninsured if they’re involved in an accident.

Canceling or Changing Your Policy

You have the right to cancel or change your car insurance policy. However, there are usually procedures to follow. Typically, you need to notify your insurance company in writing, either by mail or through their online portal, stating your intention to cancel or modify your policy, specifying the effective date of the change. Depending on your policy and state regulations, there might be penalties for early cancellation, so carefully review your policy for any cancellation fees or other financial implications.

When changing your policy, you may need to provide updated information, such as changes to your vehicle or driving record. Always request confirmation of the cancellation or change in writing from your insurance company.

Illustrative Examples of Car Insurance Costs

Understanding car insurance costs can be tricky, as many factors influence the final price. Let’s look at some real-world scenarios to illustrate how different elements contribute to the overall expense. These examples are for illustrative purposes only and actual costs will vary depending on your specific circumstances and location.

Young Driver vs. Experienced Driver

Consider two drivers with the same car: a 2015 Honda Civic. Sarah, a 20-year-old with a clean driving record, is paying significantly more for her insurance than 45-year-old Mark, who also has a clean record. Sarah’s higher premiums reflect the statistically higher risk associated with younger drivers. Both have liability coverage, but Sarah’s premiums are approximately $1500 annually, while Mark’s are around $800.

This difference highlights the impact of age and experience on insurance rates. The increased cost for Sarah also reflects the fact that statistically, younger drivers are involved in more accidents.

Minimum Coverage vs. Comprehensive Coverage, How much is car insurance

Let’s examine Mark’s situation again. He currently has minimum liability coverage. If he upgraded to comprehensive coverage, including collision, comprehensive, and uninsured/underinsured motorist protection, his annual premium would jump to approximately $1200. This significant increase illustrates the added cost of more extensive protection. While minimum coverage fulfills legal requirements, comprehensive coverage provides much broader financial protection in case of accidents or damage to his vehicle.

The extra cost reflects the increased risk the insurance company assumes.

Impact of an Accident on Premiums

Imagine Mark, after several years of clean driving, gets into a minor accident. Even a seemingly small fender bender can significantly impact his insurance premiums. His insurer may raise his rates by 20-30% for the following year or even longer, depending on his policy and the details of the accident. Let’s say his premium was $800 before the accident.

After the accident, it could increase to $1040-$1040 (a 20-30% increase). This increase will likely stay in effect for several years, potentially three to five, before gradually decreasing if he maintains a clean driving record. This demonstrates how even a single accident can have lasting financial consequences.

Final Conclusion

Ultimately, finding the right car insurance hinges on balancing coverage needs with your budget. By carefully considering the factors we’ve discussed – your driving history, vehicle type, location, and desired coverage levels – you can make an informed decision that protects you financially while fitting your lifestyle. Remember to shop around, compare quotes, and don’t hesitate to ask questions. Your peace of mind is worth it.

Top FAQs

What’s the difference between liability and collision coverage?

Liability covers damage you cause to others; collision covers damage to your own vehicle, regardless of fault.

Can I get car insurance without a driving license?

Generally, no. Most insurers require a valid driver’s license to provide coverage.

How often can I change my car insurance policy?

Most policies renew annually, but you can usually make changes or cancel at any time, though there might be penalties.

What happens if I get into an accident and don’t have insurance?

Driving without insurance is illegal and can lead to hefty fines, license suspension, and legal trouble. You’ll be responsible for all damages.

Do all insurance companies offer the same discounts?

No, discounts vary widely between companies. It’s worth comparing offers to find the best deals.